AlphaClone performance update for the month ended March 31, 2018.

Perception is beating reality conclusively so far this year. Investor perception around the consequences of a trade war with China has trumped the realities of strong economic growth, an interest rate trajectory that favors equities and a more business friendly tax environment. While broad investment themes haven't changed compared to last year, growth and momentum stocks continue to out perform, what the market is choosing to focus on certainly has. As we kick off what is expected to be a strong earnings season, whether this is a good buying opportunity or the beginning of something more ominous, one thing is widely expected - it's going to be a bumpy ride.

After nine consecutive quarters of positive returns, markets gave one back with the S&P 500 finishing -0.76% for the quarter. International market also sold off with the MSCI All Country World Index returning -1.34%. The DJIA finished the quarter down 2.49% and the Russell 2000 was down slightly by 0.08%. Market volatility remained elevated with VIX futures trading in the 20s, twice the levels they ended 2017, albeit down from the highs (>30) in February.

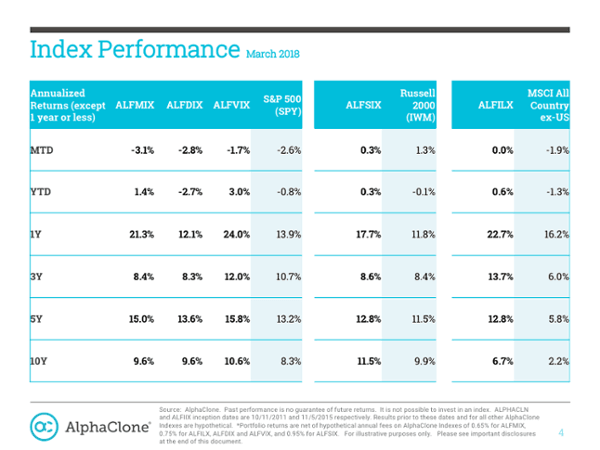

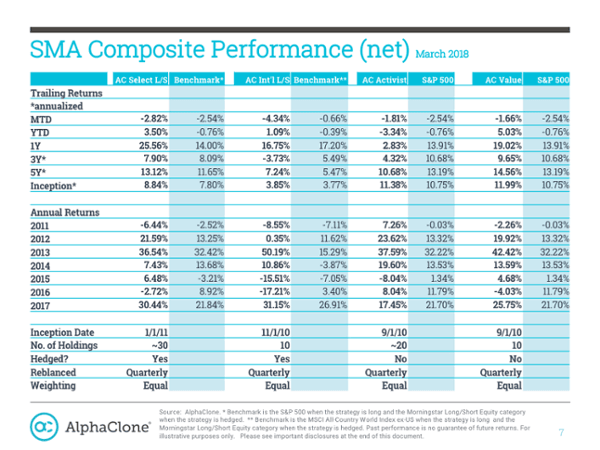

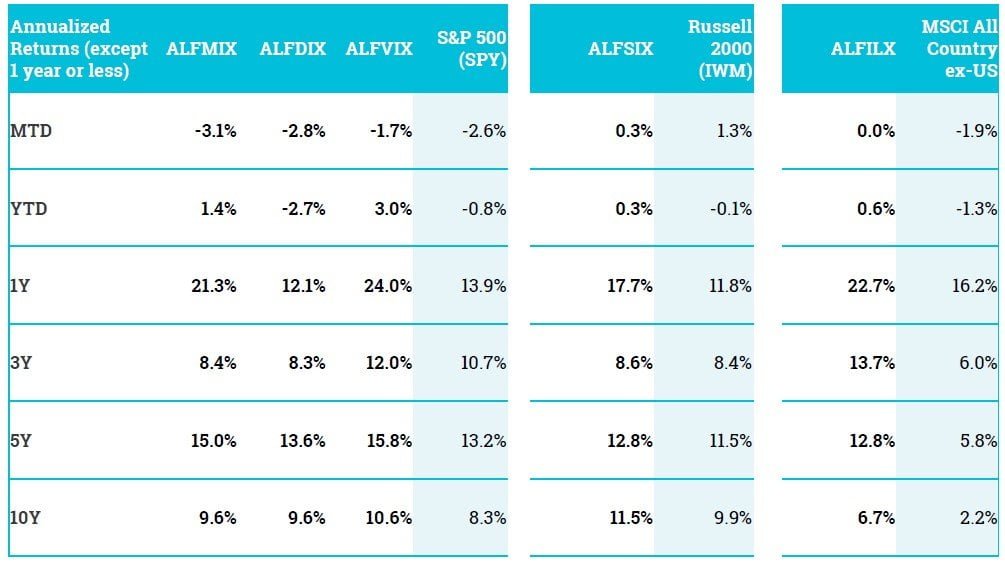

Despite the difficult quarter, all AlphaClone indexes and SMA strategies except our Activist strategies remain ahead of their benchmarks on a year to date and 12 month trailing return basis. March 2018 Performance Report.

AlphaClone Indexes - our index strategies underlie our ETFs and are intended for financial professionals and self-directed investors who want the flexibility of high active share strategies but with the advantages offered by ETFs.

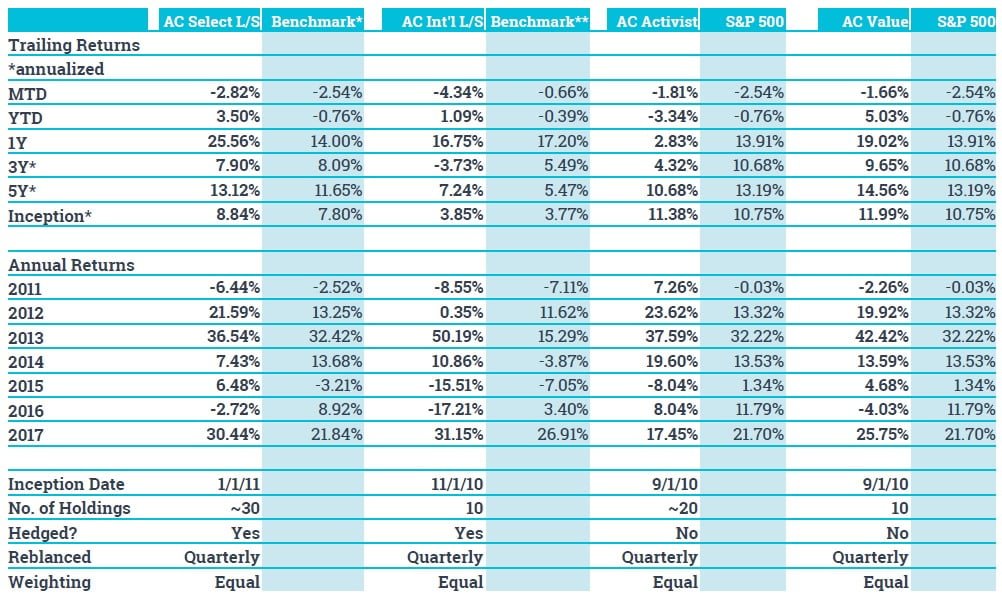

AlphaClone Separately Managed Account (SMA) Composites - our SMA composites are available to self-directed investors who are comfortable making their own asset allocation decisions and who prefer a separate account. Open an SMA account.

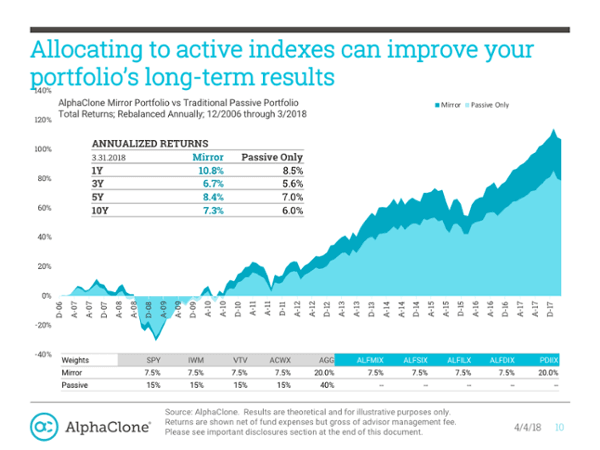

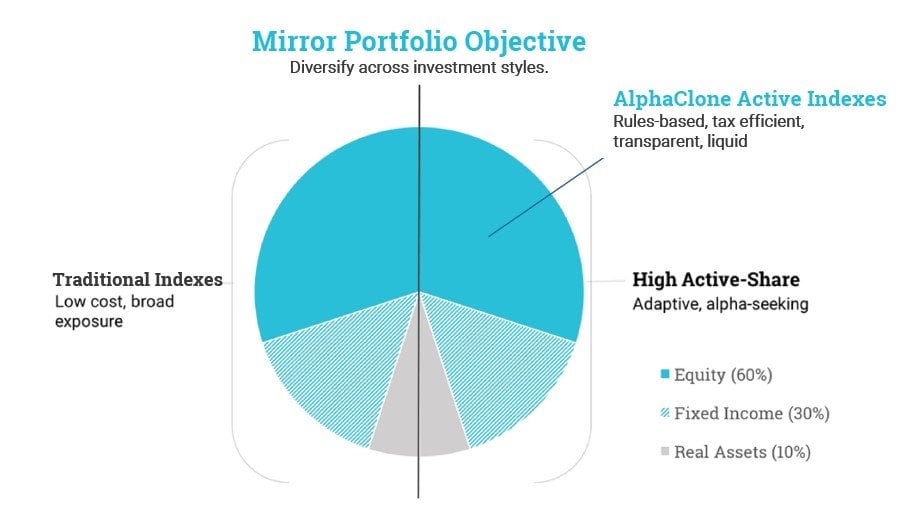

AlphaClone Mirror Portfolios - our mirror portfolio service is for individual investors planning for retirement. Designed to combine the advantages of AlphaClone’s active indexing approach with traditional passive investments, a mirror portfolio is an affordable and holistic investment solution, tailored to adjust to your investment objectives and risk tolerance as you approach your goals. Open a Mirror Portfolio Account.

AlphaClone Active Indexes

Index Performance March 2018

AlphaClone SMA Composites

SMA Composite Performance (net) March 2018

AlphaClone Mirror Portfolio

Mirror Portfolio Benefits

Use active indexes to diversify your investment style exposure while avoiding the inefficiency and high fees of traditional active funds.

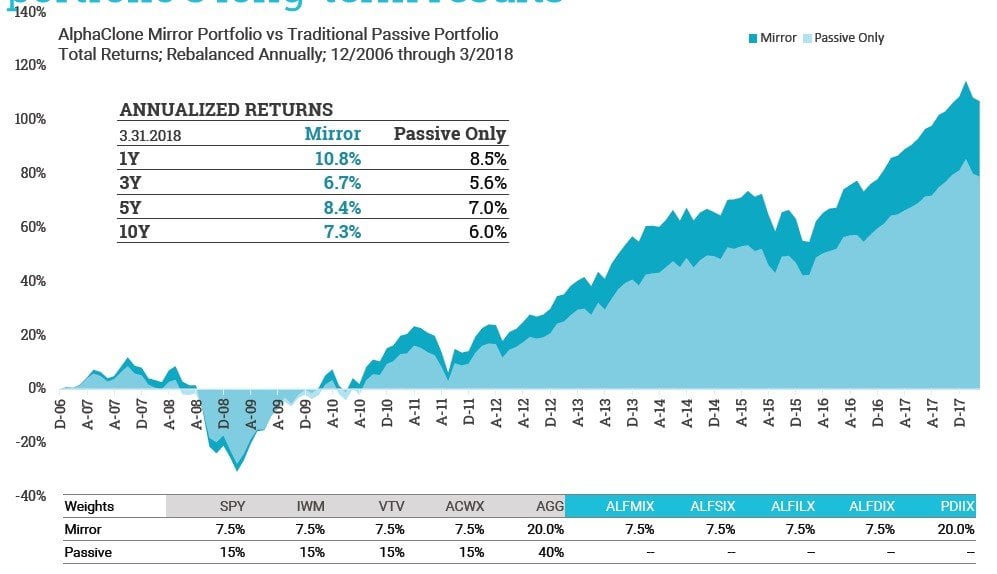

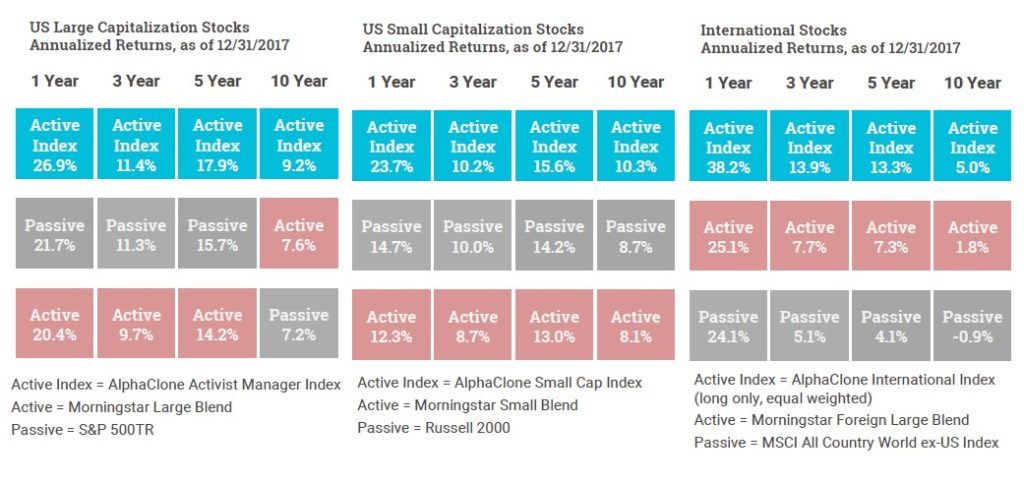

Allocating to active indexes can improve your portfolio’s long-term results

Controlling costs is one of the most important determinants of investment success

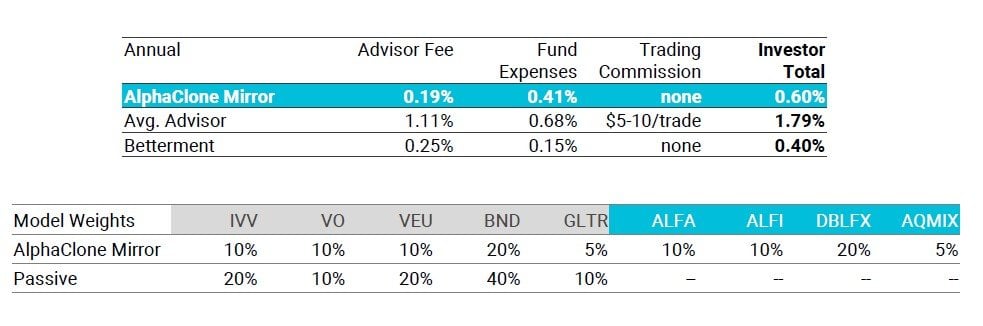

The table below summarizes the average fees for a model moderate risk portfolio that invests $500,000. Fees for the average traditional advisor and fund expenses comes from the 2016 InvestmentNews Financial Study of Advisory Firms, a survey of 500+ RIAs. Fees for Betterment come from an analysis conducted by Investor Junkie.

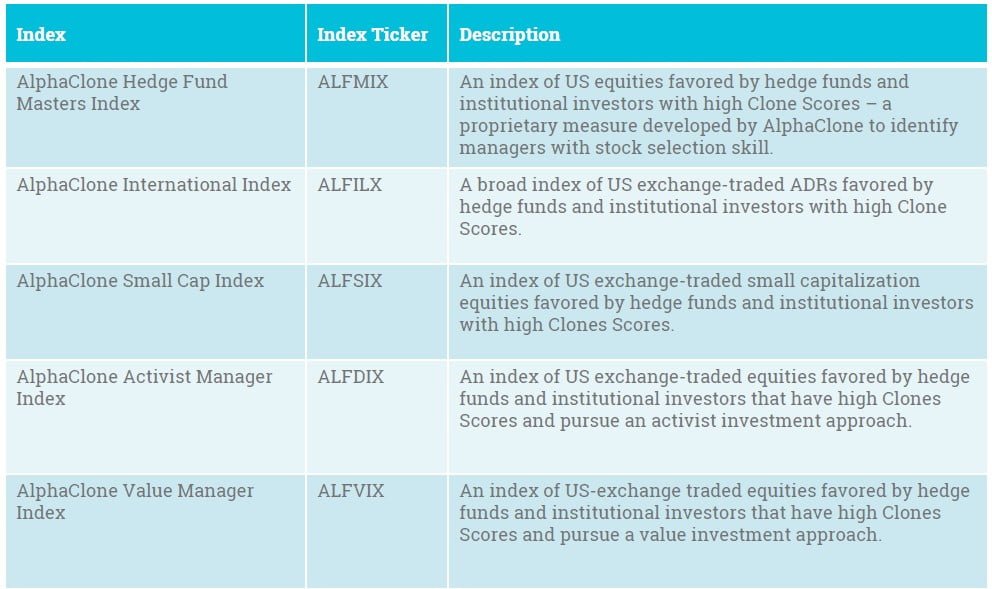

Why Active Indexing?

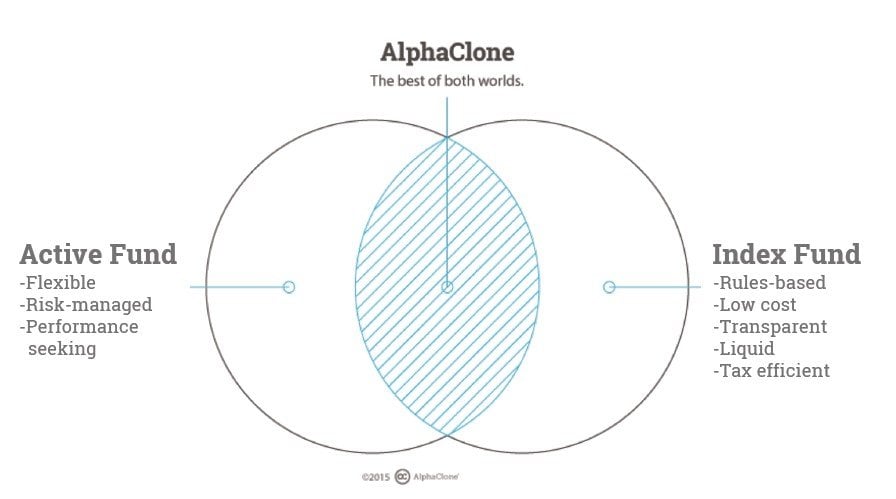

What is an active index?

Active indexes offer the benefits of index funds while still seeking to outperform the overall market

Active indexing has outperformed both the market and traditional active funds

See the full PDF below.