Can investors truly buy and hold?

Vanguard’s Jack Bogle changed the investment landscape by pioneering a suite of inexpensive mutual funds that strictly tracked their representative index. He argued that investors are better off simply owning everything rather than trying to pick winning and losing stocks each year. By simply buying the representative index and holding it in the portfolio, Bogle reasoned the investor would realize positive returns over the long-term.

[REITs]Odds don’t favor picking winners

Longboard is inclined to agree with Mr. Bogle. Our research has found that 3 out of every 5 stocks underperforms the index and 1 in 5 stocks go to zero. Said another way: the odds are stacked against those trying to actively pick winning stocks with any consistency.

The ‘hold’ part of ‘buy and hold’ is the hard part. Investors are humans and humans can get emotional and make bad decisions when they do. Headline grabbing stories will only exacerbate this emotional process and make investors even more tempted to act against their own best interest. This up and down ride is less ‘buy and hold’ and more like ‘buy and hold on.’

Volatile days create opportunities to change

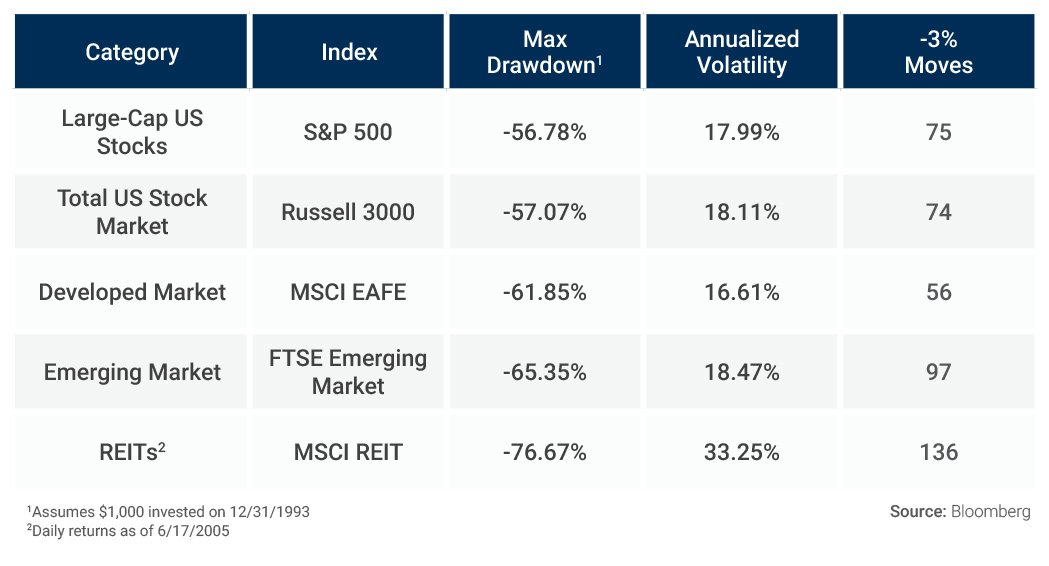

The table below reflects the underlying index tracked by the most popular exchange traded funds (by assets under management). We measured the worst drawdown, the volatility, and the number of times an index lost -3% in a single day to get a sense of how exposed investors are to volatile days, going back to January 1994.

-3% days are important because these are the days that tempt investors to sell. String enough of these days together and investors can start to lose confidence.

Source: Bloomberg

Daily returns, as of 12/31/1993 unless otherwise noted

As you can see, each market offers investors plenty of opportunities to deviate from the ‘buy and hold’ discipline.

Visualizing drawdowns

-3% days can be dangerous in the short term. For most investors, the most dangerous time is during a prolonged drawdown. As a reminder, a drawdown is when an investment is no longer at its peak value.

Drawdowns are important for two reasons. First, drawdowns are mathematically disadvantageous because the investment has to make up lost ground before it can resume compounding. If you lose -50%, you need to make 100% to get back to even.

Secondly, and more importantly, major drawdowns (over 15%) rarely happen overnight. Instead, the stock market will steadily grind down as your gains turn into losses. It can be excruciating to live through and is one of the most painful parts of investing. Throughout this stressful period, investors will be tempted to sell out to stop the pain.

The products that seek to track these indexes are helpful for diversifying returns, however, investors should be aware they lack any explicit protection from drawdowns. Part of being a disciplined, long-term investor means choosing a portfolio with the smallest emotional cost, not necessarily the cheapest headline price.

If you found yourself selling your ‘passive’ investments at any time over the last 20+ years – whether in the midst of a drawdown or not – consider an investment strategy that employs active risk management to control this exposure and lower the emotional cost of being a long-term investor.

Scroll down to see the drawdowns for the S&P 500, Russell 3000, MSCI EAFE, FTSE Emerging Market, and MSCI REIT Indexes.

[1] Assumes $1,000 invested on 12/31/1993 [2] Daily returns as of 6/17/2005

Article by Alex Clark, Longboard Funds