Sui Generis Canada Partners LP Fund Commentary for the month of February 2018.

The Sui Generis Canada Partners LP fund was down 0.20% for the Class A Lead Series during February 2018, resulting in a year-to-date net return of -0.17% and since inception (March 1, 2015) cumulative net return of 9.21% (2.98% annualized).

Check out our H2 hedge fund letters here.

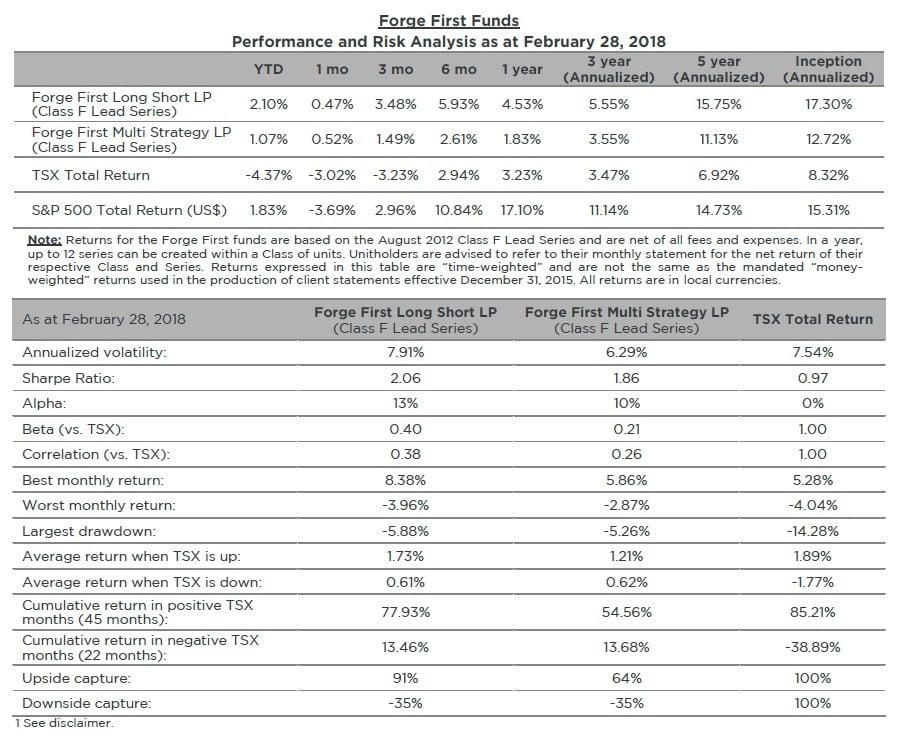

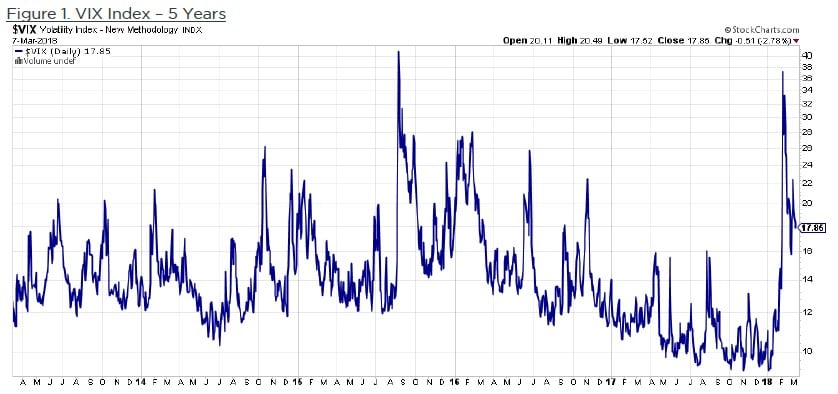

We have long suggested that should volatility return to equity markets, our style of long/short investing would begin to prove its mettle. This is exactly what we saw during the month of February, as the spike in US Treasury yields catalyzed volatility (as measured by the VIX index) to spike to levels last seen in 2015, resulting in a monthly loss of 3.0% for the TSX and 3.7% for the S&P 500 indices. Both Forge First Long Short LP (“FFLSLP”) and Forge First Multi Strategy LP (“FFMSLP”) generated positive net returns for the month.

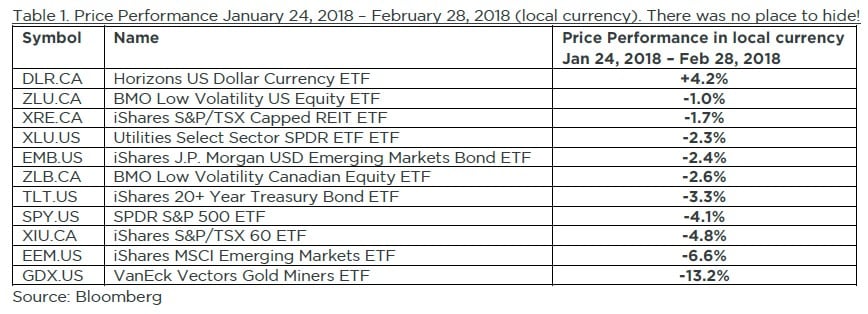

What is interesting to observe during this abrupt sell off was that outside of owning US cash, there was no place to hide in a diversified, long-only portfolio. As can be seen from the below table, the diversification benefits of owning US, Canadian and global equities, fixed income products, REITs, gold, and low beta defensive sectors such as utilities, telecom and consumer staples did not provide much in the way of a safe haven for investors. The long and short of this narrative (pun intended) is that in our view, in a rising interest rate environment characterized by higher levels of volatility and asset classes becoming more heavily correlated, bonds may not serve as reliably as they have in the past to reduce equity risk in your portfolio. As Gavekal Research points out, “the zeitgeist in the bond market has shifted”.

We certainly aren’t trying to imply that we are furiously trading what we honestly believe is an untradeable market, however we do believe that the newfound sense of volatility allows for some disparity to show up amongst the equities in our universe. We believe our acute focus on going long companies generating sustainable free cash flow and shorting companies with high cash burn gives us a leg up in markets where everything isn’t heading in the same direction. The rising tide of the last few years has hidden what we believe are fatal flaws at many companies we have been watching and waiting to short. Rising equity markets and willing investment bankers have allowed many companies to simply tap equity or debt markets to fund their operations and growth; businesses that we might characterize as unsustainable or over-levered become a hot deal on a sales desk.

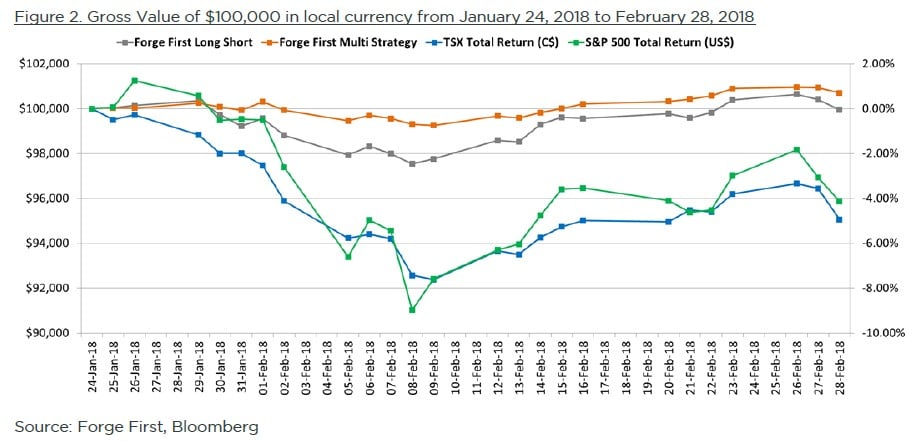

With the swift move higher in bond yields and subsequent volatility in equities (Figure 1), the companies we own, those with solid and growing free cash flow generation, have begun to steadily outperform those whose equity financing windows may be closing as we type. Throw in the prospect of disruption to international trade flows and you have a recipe for active managers, particularly those that can short stocks, to shine. You can see that FFLSLP and FFMSLP ended the month of February with positive net returns, but they also exhibited far less volatility during the month vs the S&P 500 and TSX indices (Figure 2).

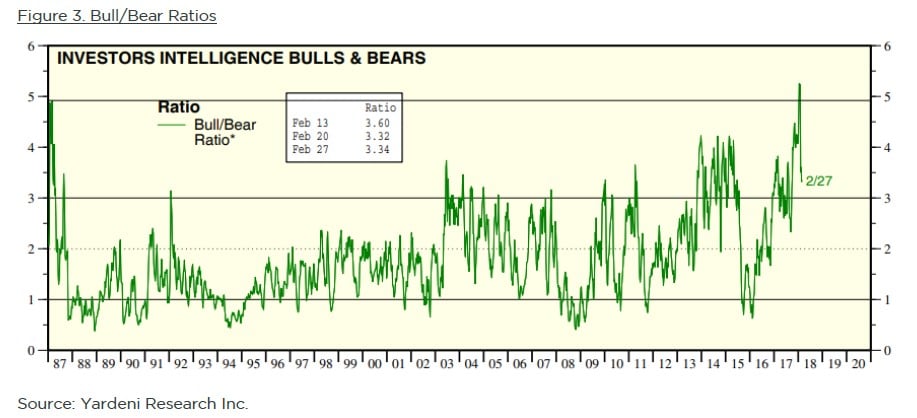

While it is perhaps too early to declare that a war on trade has begun, we believe prudence is the best path forward for the time being as, broadly speaking, valuations are still elevated and bullishness remains near all-time highs (Figure 3). All of this is to say, in spite of the choppiness we have experienced over the last month, investors appear not to have taken the opportunity to batten down the hatches and still appear to be all in.

Given the time of year, we think it would be worthwhile to highlight a few of our positions and how they have performed vis a vis our expectations through Q4/year end reporting season. Our energy book, which had been greatly reduced through January and early February, has begun to grow in importance again. We aren’t pounding the table by any means, but we are seeing continued evidence of producer discipline and a shift in strategy away from “growth at all costs” and cash flow outspend. This unsustainable path is slowly shifting to a model of sustainable free cash flow yielding share buy backs and dividend increases. Having met with dozens of energy companies over the past year we are actually starting to believe that many of them have found religion, and thus are very attractive businesses at $50+ crude while concurrently trading at historically low valuations. We believe that over time, our generally constructive view on crude pricing coupled with a more shareholder return focused attitude from management teams will translate into higher multiples. All this is to say, we think the ~12% pullback in crude prices in February was overdue and now with reset (lower) expectations from investors at large, we see the space as very attractive again.

Looking beyond energy, earnings season has been very kind to us with far more hits than misses across both the long and the short book. Important short positions like Enbridge (ENB.CA) or DHX Media (DHX.B.CA) are learning that you can’t borrow your way to success. Both companies, while reporting reasonably in-line Q4 earnings, have seen their stocks react negatively. We believe the realization that we’ve seen the bottom in interest rates combined with what can perhaps be best described as poor timing are conspiring against both companies, full of good people though they may be. Both Enbridge and DHX Media made enormous debt-financing acquisitions (Enbridge’s takeover of Spectra and DHX’s acquisition of “Peanuts”) over the last two years, significantly levering their already levered balance sheets without seeing a commensurate jump in free cash flow.

On the positive side of the equation and another endorsement for rolling your sleeves up and doing the work; newer positions like Superior Plus Corp (SPB.CA) and Enerflex Ltd. (EFX.CA) both had been punished badly after negative releases post Q3 results and both presented buying opportunities at a 10%+ free cash flow yield earlier this year. After gaining confidence that both had been experiencing transitory problems rather than structural ones, we began acquiring shares in both and were dually rewarded upon release of their Q4 numbers and 2018 guidance. In both instances, we believe there is far more upside to come.

In conclusion, our view is that 2018 will be a year of increased volatility. We received a taste of this in February where most asset classes declined in sync as the market tried to acclimatize to a new world order of (finally) higher interest rates. The Fed is committed to normalizing policy (bad for bonds) and we’ve had 9 strong years for equity markets without a recession. We think now more than ever is when investors need to be considering long/short strategies to participate if markets grind higher and protect capital should markets decline. Forge First offers solutions that have a history of generating positive returns in down markets, low correlations to equity indices, and index-beating performance since inception. Please do not hesitate to reach out to us if you wish to learn more about how our strategies can complement and lower volatility in your investment portfolio.

As always, we welcome any feedback, and for more information please visit our website at www.forgefirst.com.

Thank you,

Daniel Lloyd Portfolio Manager

D: 416-597-7934

Andrew McCreath, CFA President and CEO

D: 416-687-6771

See the full PDF below.