Cryptocurrency booms and busts continue to dominate headlines, as do the scams that once appeared to be booms. Most people are undeterred by the bad news in the cryptocurrency sphere, choosing instead to retain a futuristic view of the emerging technology that is going to democratize the worldwide currency system and take power out of the hands of the few and redistribute it to the many. So how do you go about getting started investing in this brand new futuristic technology, anyway?

Check out our H2 hedge fund letters here.

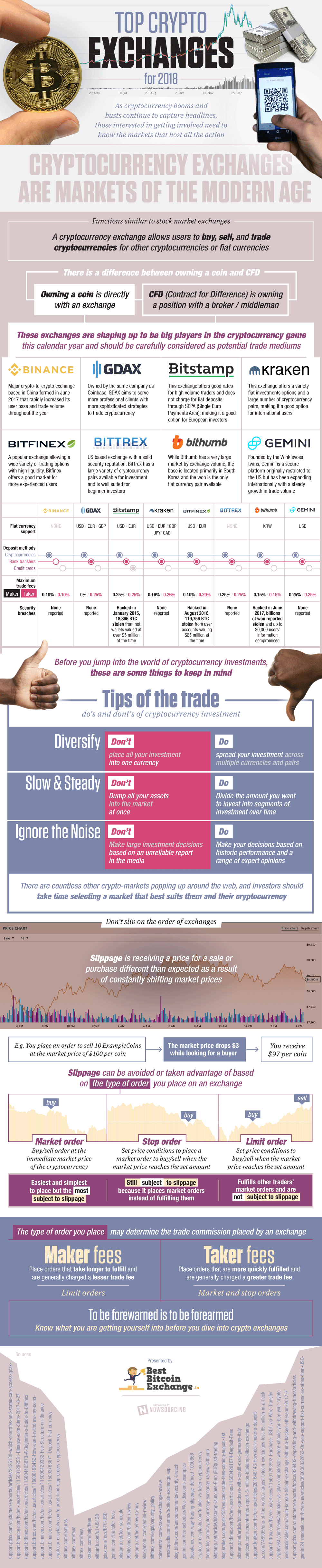

Crypto exchanges are a lot like stock exchanges. They have the same basic parts - you have a broker, you can choose to buy positions or tokens, and you input fiat currency in order to buy what is available on the market.

Each market caters to a different group or serves a different purpose. There are markets that are set up to work really great with Europeans and their preferred currency system, while others serve Chinese citizens and still others serve Korean citizens. When choosing the right exchange for you, look for things like fees, type of fiat currency accepted, deposit methods, and any security breaches reported.

As with all types of investments, there are some rules you should follow. Diversification is the biggest one of these rules - you don’t want to invest all your money into one cryptocurrency or even all into cryptocurrency. Diversify your portfolio to include a wide variety of securities so you can hedge against any potential bubbles or market downfalls. This is what we saw when people were losing everything in Bitconnect - they had put their entire life’s savings into an obvious ponzi scheme and many lost it all.

It’s also important to enter the market slowly and incrementally in order to hedge against market fluctuations. Additionally, when those market fluctuations do occur it’s important not to be reactionary - hold tight and make sound and safe decisions. The biggest mistakes people make in investing is to go all in on one investment and then panic when normal market fluctuations start to occur and lose everything cashing out in a down market.

Cryptocurrency investing is a lot like regular investing. You just need to take the time to learn more about the markets and how to get into them. But once you realize this is all stuff you already know it takes the intimidating factor right out of it. Learn more about investing in cryptocurrency markets from this infographic!