Portfolio Manager Chuck Royce and Co-CIO Francis Gannon look at what’s most interesting about the current small-cap market cycle.

Francis Gannon: So Chuck, where do you think we are in the small-cap cycle?

Chuck Royce: Well, for some time, I think we've been closer to a peak. As you know, a favorite way for us to measure market performance, our own performance, is over a cycle, so it's an important question. Part of me thinks we've had a peak for four, five, six months. I probably still feel that way, that we're more likely to have a downturn of some...maybe not a full correction. I'm not sure we'll have that necessarily right now, but, you know, I think the market is sort of looking towards some form of a correction.

FG: Since the market bottomed in February of 2016, the steepest decline we've seen is about 6.4 percent going into September of last year. So you're actually coming up on a two-year anniversary for that, in February of this year.

2017 vs. Median Intra-Year-Decline

Largest Russell 2000 Intra-Year Declines Through 12/31/17

CR: It's amazing, the volatility has come down, the month-to-month down-periods have been very minimal. It's, you know, unsettling, at some point, measuring, using that, peak in '15, I'm very pleased with overall performance.

FG: One of the big things that we talked about coming out of the bottom in the market in 2016 was the rotation back to value. Obviously, in 2017, that did not occur. Growth outperformed by a wide margin over value. What are your thoughts on value at the moment, and do you think that value will reassert itself here?

CR: My sort of guiding principle is that, as rates go up, it'll be clearer to the world that the value end of the spectrum is the more attractive end. In the lower-return periods, duration of course is almost infinite, in how you measure a growth stock. So I think we had some of that kind of at a pause for '17. Health did well, technology did very well, certainly, growth was leading.

FG: The normalization process you've talked about, we've talked about quantitative easing ending, you've seen rates kind of back up a little bit here. What are you looking for in terms of normalization?

CR: I'd prefer not a flat yield curve. I would prefer the market to continue to look forward to increasing activity, GDP growth, maybe some...a little more inflation. It's happening even more so on a worldwide basis. Rates are, you know, not following us exactly abroad. There's still some QE activity abroad. I think our rates would be higher now, if world rates were higher.

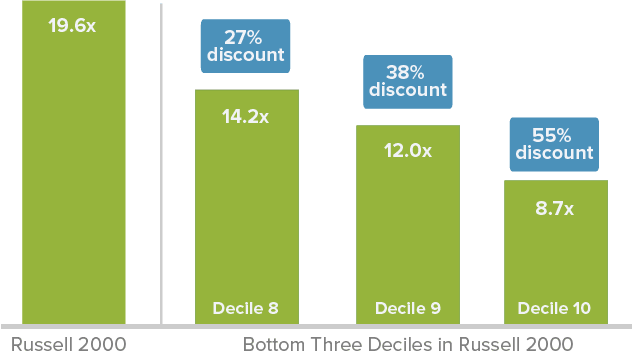

FG: So the Russell 2000 is expensive. Where are you finding opportunities in the market today?

Even in a High-Priced Market, There Are Opportunities

Many Small-Caps Sell at a Significant Discount

Bottom Three Deciles in Russell 2000 Median LTM EV/EBIT1 ex negative EBIT as of 12/31/17

1Last Twelve Months Enterprise Value/Earnings Before Interest and Taxes.

CR: We are continuing to hunt for interesting stocks in the financial sector. We are doing more banks than we've done in a long time. I do believe they're entering an excellent period of prosperity, so we are adding to our banking area, we're continuing with industrial companies, you know, the slightly more cyclical companies that have a global outlook.

FG: The cyclical story is a powerful one, at least it was last year, in terms of the overall market, in terms of those companies and their ability to generate revenue outside of the United States. Is that what you've been focused on?

Go Global

2017 Russell 2000 Returns by % of Foreign Sales

CR: I just love, you know, extremely strong small-cap securities that have a global penetration. Typically they have niche products, they don't have monster products, they have niche products, and I love the diversity of their revenue streams, I love the fact that they can be global leaders, and these are the stocks that are very good compounders.

FG: What do you think about small-caps, given the tax cut we just saw from a corporate standpoint?

CR: Theoretically the tax cut does benefit small-cap more than large-cap. You know, certainly it was probably the major provision of this tax change and changing the ability to not have to leave money off shore was a long overdue, outcome.

FG: So where do you think investors are spending too much time focusing on in the market today?

CR: The headlines of the last three or four months have been about taxes, and that's been okay, but I think it's kind of missed some key features. To me, this can very well be a stimulant for Capex, the long-awaited missing element of this particular cycle. There are significant, accelerated depreciation advantages in this tax code adjustment that potentially could be extremely positive. So I am optimistic about Capex really for the first time in a long time.

FG: It's so logical that small-caps would benefit from tax reform, because...

CR: Yes.

FG: ...they are domestic businesses, and they generate most of their revenue here. But it does seem that the market is focused too much and is forgetting this underlying profitability and earnings story that we should be focusing on.

CR: I couldn't agree more. And I do think, and I do hope that the next big thing will be infrastructure, which, you know, will tie into Capex also.

FG: When you think about 2018, what do you think the biggest surprise for investors is going to be this year?

CR: I think the issue about the political, machinations, I think will less and less be a market factor. I think that, what is going to be a positive surprise is continued global growth. There's a lot of catch-up going on, and that is extremely important to our better companies.

Article by The Royce Funds