Almost 10 years into an economic recovery, most of what is going on seems extremely pro-cyclical, meaning we are borrowing from our future to make the present look better. Many of these policies and trends cannot continue indefinitely, and when they stop, the world we are left with will look very different.

In early February the markets calm demeanor changed immediately and radically. The VIX index, which measures expected volatility, had its largest one-day gain ever. The Dow and S&P 500 all of sudden started gyrating, reminiscent of the days of the financial crisis. One of the obviously “turkey” investments of this cycle finally reached its “Thanksgiving” when short volatility funs (who had averaged returns north of 40% a year for several years) lost more than 90% of their value in one day! (Morningstar.com)

The truth is a steady zombie-like market that allows pro-cyclical forces to build to ever bigger extremes is not healthy. We are way past the point of healthiness; however, it’s anybody’s guess whether the big recessionary downturn that a lot of sober market watchers expect is here. Certainly, the recent market jitters are too recent and small to have had a significant impact on the real economy so far. In 2006, the cracks in mortgage-related funds appeared in July of 2007, the market hit its market top in October of 2007, and the financial crisis didn’t truly unfold until late 2008. (Creditbubblebulletin.blogspot.com)

Since the recession, I’ve heard people lament that if they would have known of warning signs pointing to a looming crisis, they would have behaved differently in the markets and in their spending and saving. With that in mind, and without pontificating or giving advice, here is a point-by-point review of some of the warning signs in today’s capital market environment.

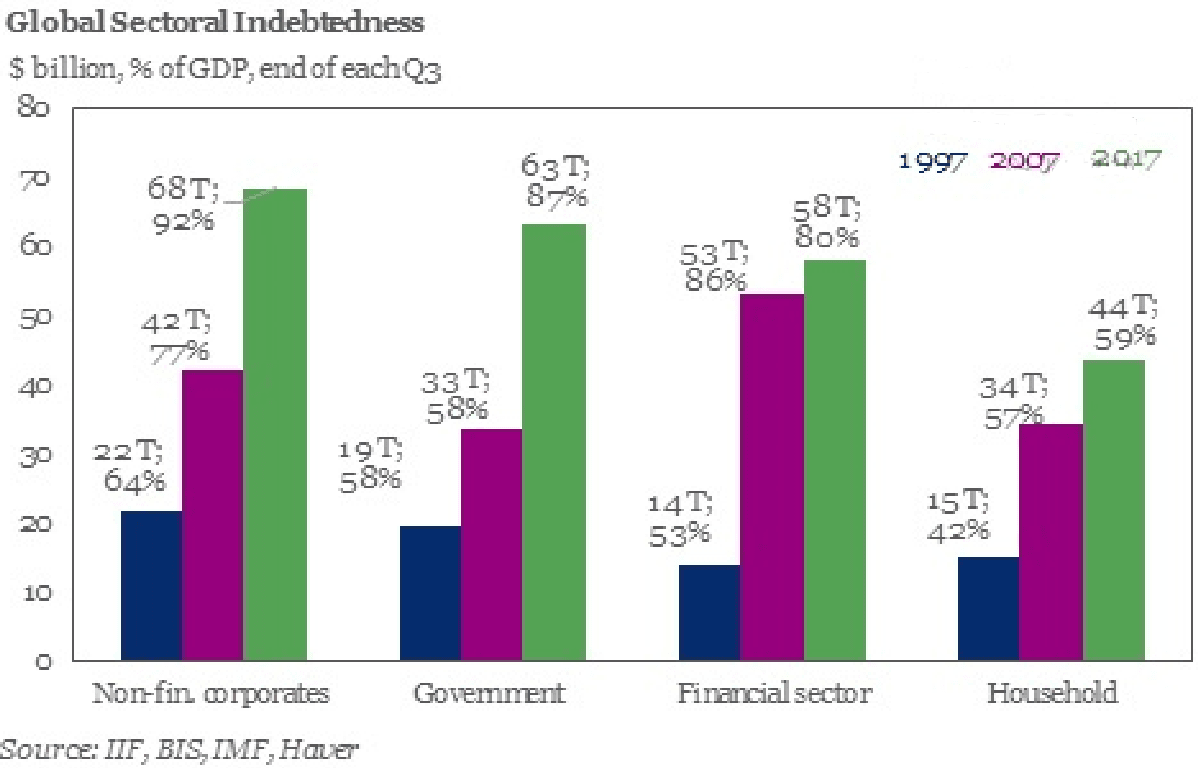

Debt is High and Increasing

The most basic way of thinking about debt is borrowing from the future. If you use it for good (as in to increase your ability to produce), it can be a fine thing. Often, however, people, companies and governments use debt in a way that has no hope of increasing what they produce. Keep that in mind as you read through the statistics below; a lot of this debt spending is being completely wasted.

For those who think we have been cured of our wicked ways of over-indebtedness that led us to the Great Financial Crisis (GFC), I’m sorry to say we have solved nothing. In fact, it has gotten significantly worse globally. Adding the numbers, there is currently $71 trillion more debt than in 2007. To put that in context, the size of the global economy is about $79 trillion. (data.worldbank.org)

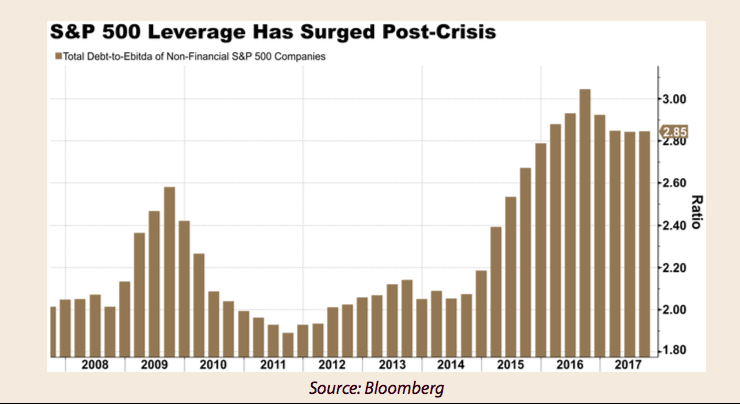

While U.S. banks, the epicenter of the last crisis, did decrease debt after the GFC, the rest of corporate America has been on a borrowing binge:

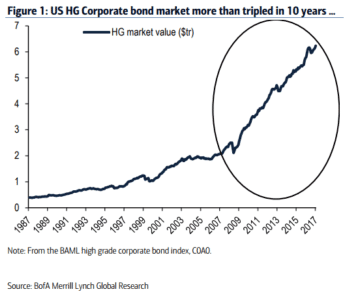

Also worrisome is the lowest quality part of the bond market (junk bonds) has tripled in the last decade:

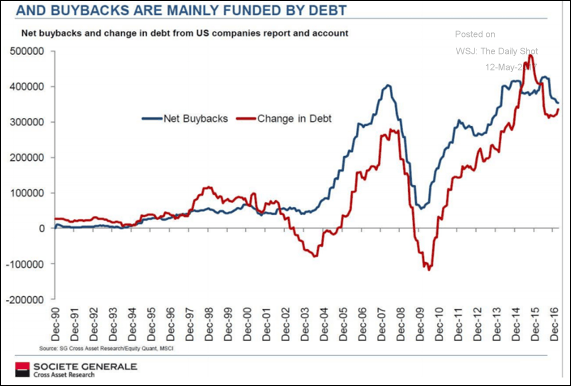

To add insult to injury, many corporations have not been using the debt on anything productive. As bond manager Dr. Lacy Hunt explains, “The composition of our debt is becoming increasingly inferior. We have the wrong type of debt. We’re taking on debt that is not going to generate an income stream, and that feeds financial speculation.”

A company buying back stock can be helpful to investors if they pay a cheap price for it, but at high prices of today, it’s yet another pro-cyclical strategy that juices up the market in the short term and leaves investors worse off in the long term.

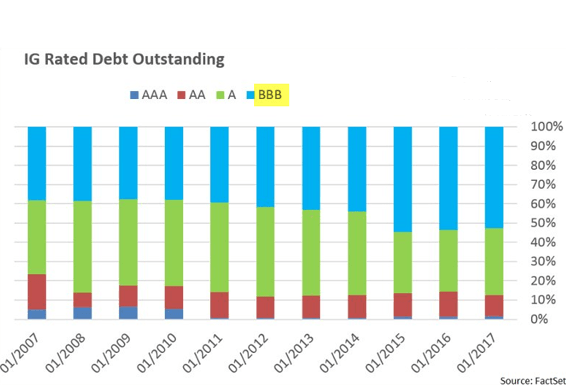

Because of all this borrowing, even among “Investment Grade” bonds, the quality is dropping. More than 50% of investment grade bonds are rated BBB, the last rating before you drop into junk status:

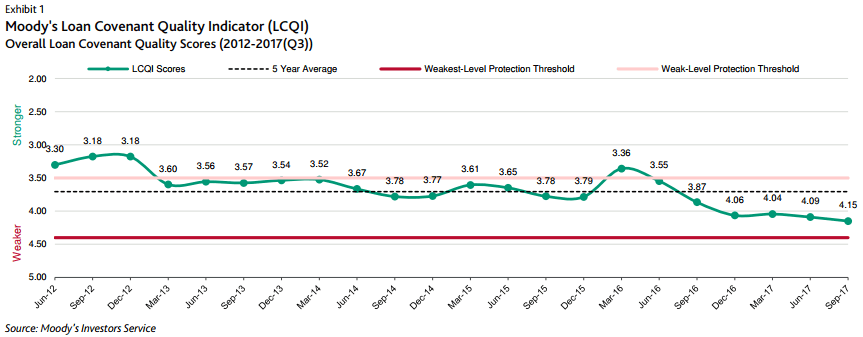

Another layer of “unhealthiness” to these credit markets is the growth of “covenants light” bonds. Covenants are the terms in a debt offering that protect investors; if they are “covenant light,” they have little recourse if a firm gets in trouble. In short, investor protection is the worst on record.

Source Moody’s via Valuewalk

These dynamics are so bad that the International Monetary Fund stated in mid-2017 that if interest rates rise, a full 22% of U.S. coporations are at risk of default (see 13D Research, Aug. 24, 2017).

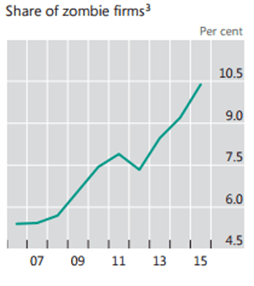

And if that isn’t scary enough, the Bank of International Settlements put out a chart showing the percentage of “zombie” firms in the developed world. They define zombie firms as those that are more than 10 years old and don’t earn enough money to pay their interest and taxes. Said another way, the only way they’re staying alive is by piling on more debt to pay off the interest on the old debt. This represents about 10.5% of public firms in the developed world. Think about that. When the credit markets tighten, a full 10% of companies will be in severe danger very quickly.

Souce: Bank of International Settlements

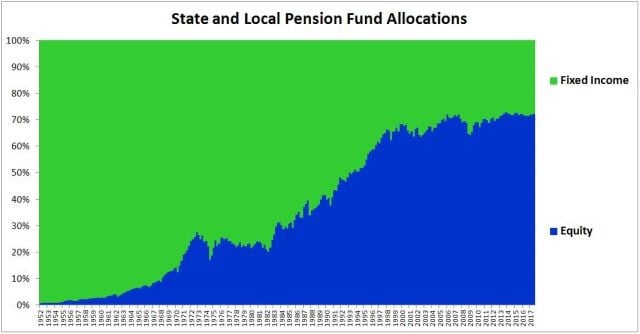

Unfunded Pensions Abound

You’ve heard of these in the news. Moody’s estimates that government unfunded liabilities are somewhere in the ballpark of $7 trillion. For just the 19 biggest unfunded plans in corporate America, Russell estimates the number at $189 billion. This is yet another pro-cyclical kick down the road. Why face the music and actually contribute what your pension needs when times are good? The logic seems to be, let’s wait until times are tougher than the recent correction and the numbers look truly awful before we worry about it and then maybe somebody will bail us out.

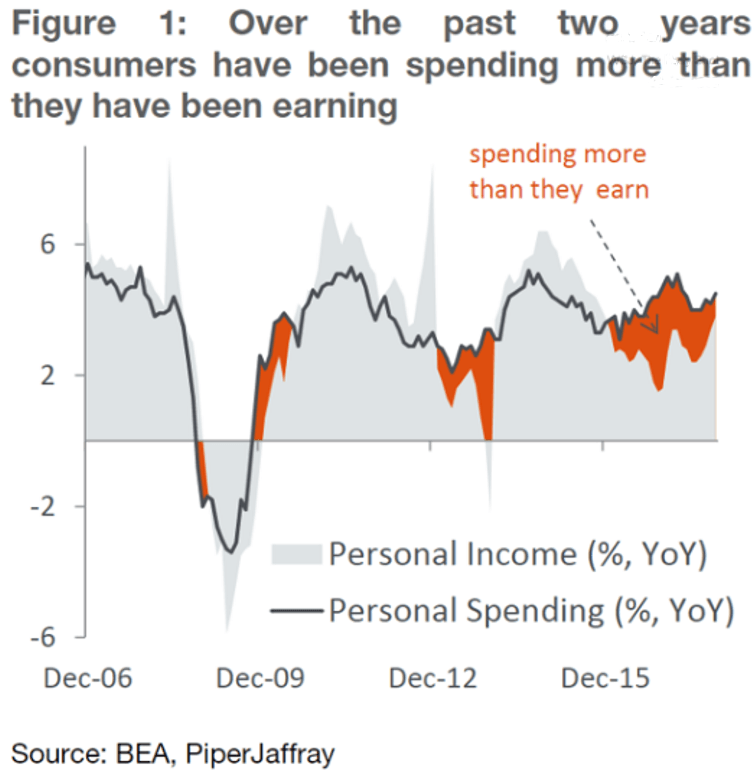

Consumers are Joining the Debt Party

After the GFC, the American public realized that an over-reliance on debt might be a bad thing. Unfortunately, memories fade. Today, the savings rate for consumers is negative. They seem to reason, who needs to save when a 401k is going up double-digits every year? This, like almost everything in this paper, making our current state of affairs look better as consumers spend more at the expense of consumers’ balance sheets in the future who will have less savings and more debt to deal with.

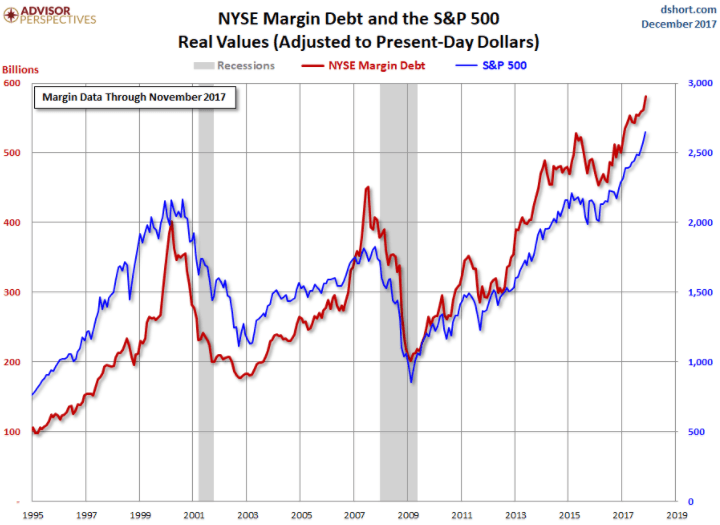

As corporations have increased their debt, investors have taken out almost $600 billion of margin (borrowing against equity in your investment account) to lever their investment accounts. Note that these numbers do not include securities-based loans for which the numbers are not publicly disclosed. However, Business Insider called securities-based loans “huge and booming.” What happens to all this debt if the U.S. stock market suffers even a normal recessionary downturn?

Chinese Debt – The Biggest Credit Bubble in History

The Chinese situation suffers from the boy-who-cried-wolf syndrome. People like Jim Chanos have been warning about China since 2010, when his firm famously calculated that the amount of commercial real estate the Chinese were building was enough to house a 5x5 square foot cube for every man, woman and child in the country. Now that the bubble has gotten much bigger, people are tired of listening to the warnings.

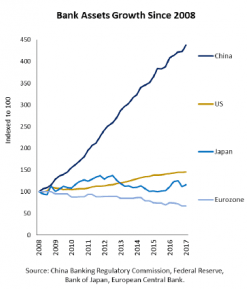

However, just because China continued to blow this bubble to proportions we have never seen in human history doesn’t mean that one day there won’t be a reckoning. That commercial real estate square footage figure that Chanos quoted in 2010 has been built twice over since then. The way they have done this is by mandating government-owned banks in China to keep lending. The chart below shows the growth of Chinese banking system since 2008:

Chinese bank assets (synonymous with loans) hit $33 trillion by the end of 2016 (Financial Times, March 5, 2017.) To put that in perspective, the size of the Chinese economy is about $12 trillion, and the size of the U.S. banking system is $16 trillion. That means Chinese banks have deployed more debt in the last 10 years than the entirety of the United States, which took more than 200 years to build up our banking system. How much bad debt has built up in this insane system?

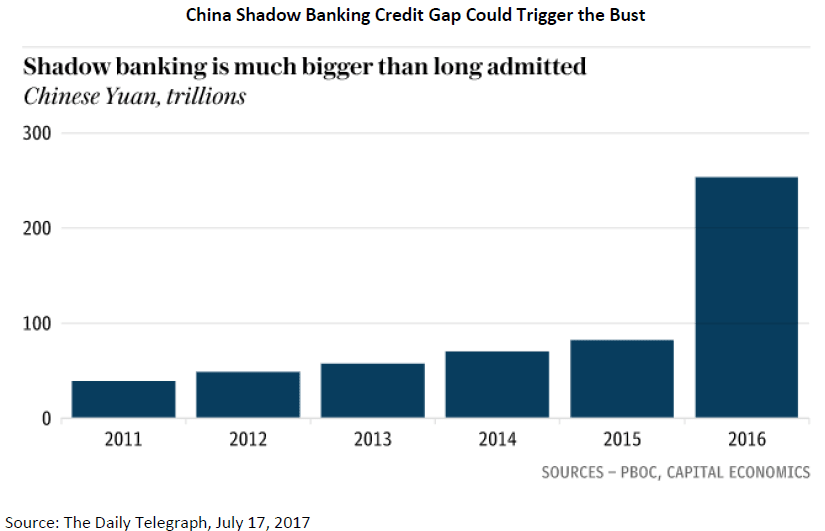

China’s shadow banking sector has bubbled to immense proportions as well. Shadow banks are lending companies that are not pure banks, so they play by rules and regulations that are often not as stringent as official banks. Previously, many people thought the Chinese shadow banking system was around $3 trillion to $7 trillion in assets. The People’s Bank of China shocked the world when in their 2017 Financial Stability Report, they estimated the country’s shadow banking system at $37 trillion! That’s bigger than their banking system. Consider that in 2006, sub-prime loans in the United States were about $1 trillion in assets. Whatever amount of bad loans are in the Chinese banking and shadow banking system, I think it’s safe to say it is multiples of that in the United States in 2006.

In short, China is probably the biggest credit bubble the world has ever seen. The country’s only advantage is that it uses an autocratic style of government, which allows the government to dictate its will to the banks. However, no matter one’s political authority, there is no escaping the laws of debt. China has wasted trillions of dollars, and at some point, it will have to suffer significant repercussions.

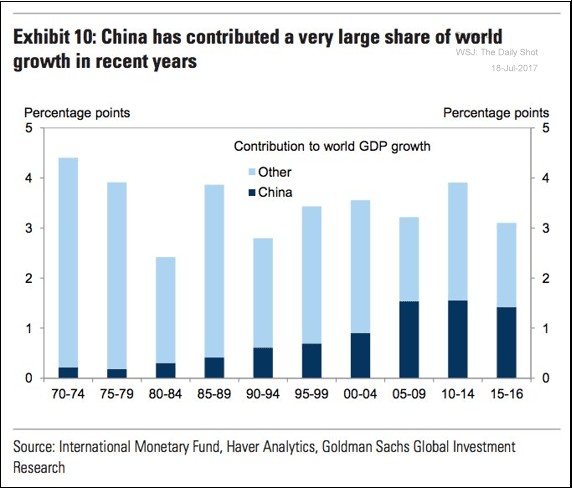

You may be wondering, what do I care about China? What does it matter to me? The reason you might want to care is that China is, through all its spending in the last decade, directly responsible for somewhere between 33% and 40% of global growth. It could even be as much as 50% if you include the second derivatives of their spending. If nearly half of global growth is predicated on completely unsustainable trends, would that change how you see the world? As one of my favorite China analysts Charlene Chu has said: “Everyone knows there’s a credit problem in China, but I find that people often forget about the scale. It’s important in global terms” (FT).

Demographics

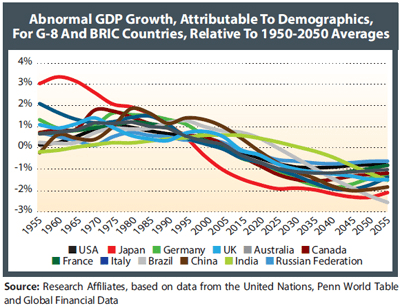

Demographics (and more specifically, the size of a workforce) matter a lot to an economy’s wellbeing. Indeed, an economy is simply the amount of workers multiplied by the amount they produce. If you have a workforce shrinking by 1% per year, the workers need to be 1% more productive every year just to tread water. In the United States, we’ve had about 3.3% GDP growth per year since 1900; 2% of that was from productivity growth and 1.3% was from workforce growth. The problem is that today or in the near future, the working age population in many countries is shrinking. (See Research Affiliate’s chart below)

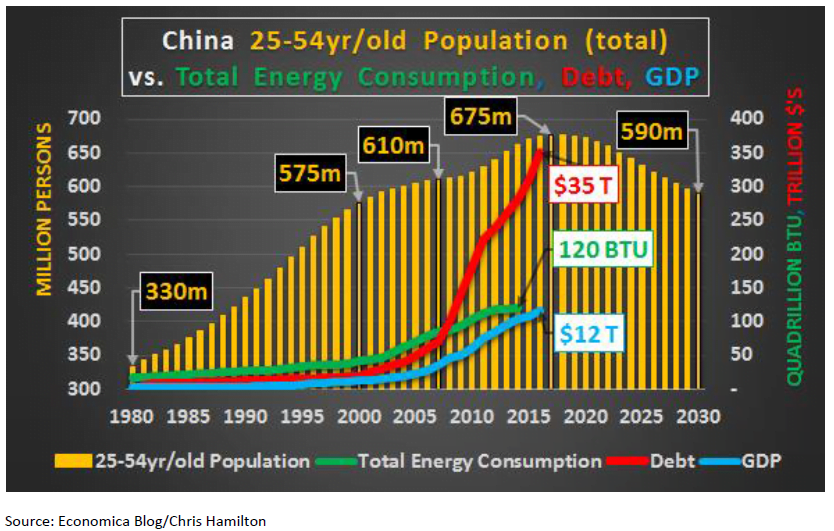

Take China. In reading about the country’s incredibly high debt burden, one might muse, “They have a lot of debt, but they also have 1.4 billion people to work that off.” The problem with that thinking is that China has already reached its peak workforce, which means the country is going to have to work off all that debt with a decreasing workforce!

China’s case is not a unique occurrence. Most major economies are facing demographic headwinds. The United States is actually one of the better positioned countries in this regard. J.P. Morgan estimates population growth of 0.3% over the next decade, but that means we’re losing 1% GDP growth relative to history on this metric alone.

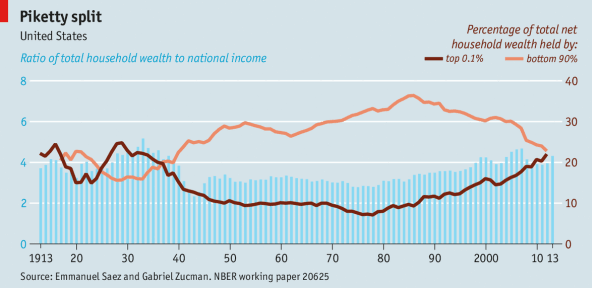

Dangerous Inequality

Similar to the years leading up to the Great Depression, the wealth in the United States has gotten more concentrated in the top 0.1%. When rich people get richer, they spend some of it, but mostly they save the excess earnings. This creates demand for financial assets at the expense of spending in the real economy.

Central Bank Policy

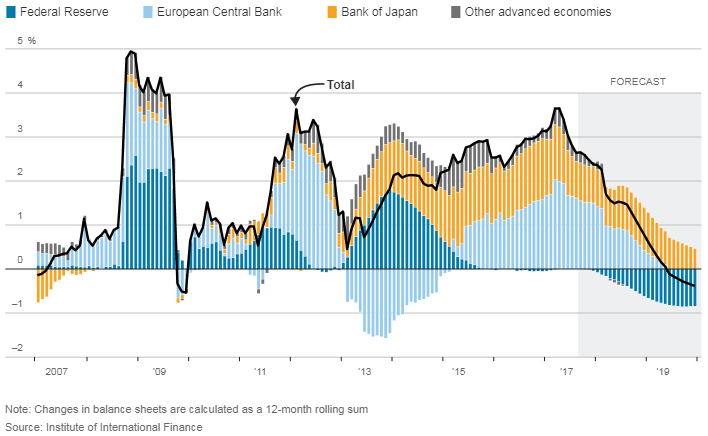

While no one can deny that money printing has had a significant impact on the financial markets, the healthiness of that impact is fiercely debated. The Central Banks of the world have printed about $14 trillion to $16 trillion since the GFC and more than $2 trillion for 2017. Now that global economic growth has increased, the Central Banks are forecast to slow down these tactics drmatically. Whatever the impact of money printing, its slowdown is virtually certain to significantly change the balance of liquidity in global financial markets.

As a side note, and this is purely my personal opinion, I believe that everything in the natural world eventually reaches a law of diminishing returns. Central Banks spent the better part of a decade chasing a completely arbitrary inflation number of 2%. If they can’t lower interest rates much and the impact of money printing is dulled, what will be the impact of money printing during the next recession? I don’t know, and I don’t think anybody else does either, but to bet that it will be as cost-free as the last 10 years is a dangerous bet.

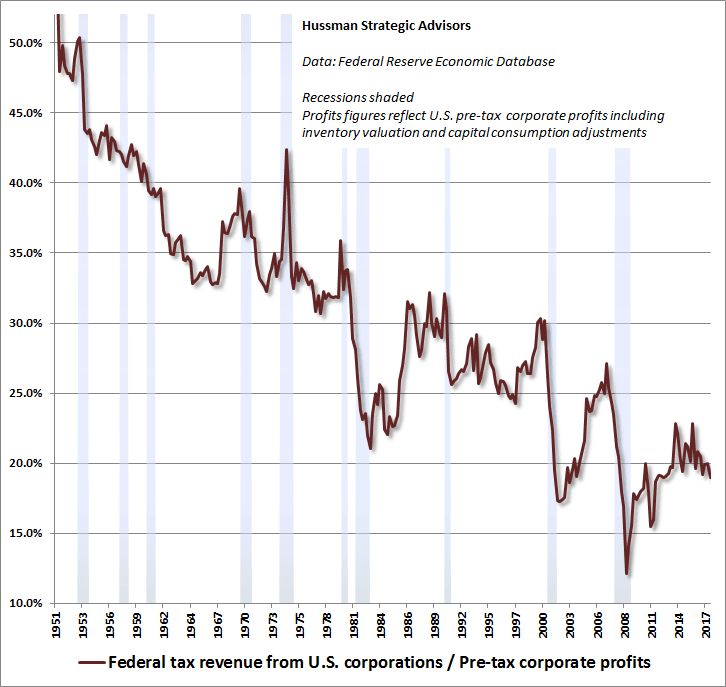

The Impact of Tax Cuts

There is little doubt that the recent tax cuts will juice earnings, but one important question is, “By how much?” It may surprise many that the effective Federal tax rate (which doesn’t include state taxes but those largely haven’t moved anyway) was below 20% before the recent tax cut. The second item to point out is this is yet another pro-cyclical policy. Government spending needs to be financed either now or later. Just like a person with a credit card, if you choose to use it, fine, but you have to at least pay your higher minimum balance going forward. It’s also highly unusual to have this kind of stimulus with the kind of economic growth we’ve had recently. Once again, we’ll have less room for error when the next downturn comes.

Conclusions

As Buffet noted in his Cinderella analogy, the market’s clocks have no hands. It is entirely possible that the points made above could linger without much obvious consequence for months and even years. But if that happens, the extremity of these trends continuing will be truly frightening.

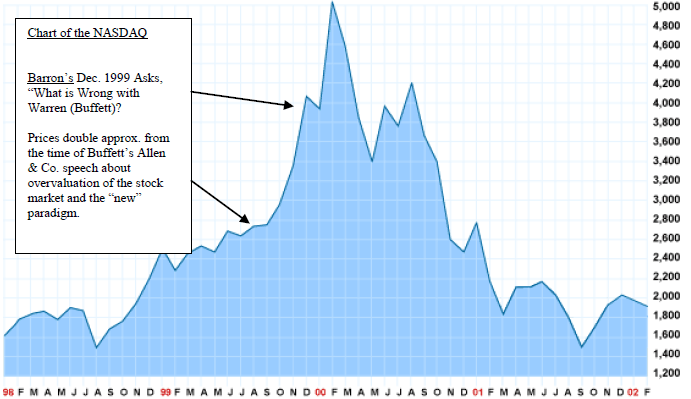

Directly due to the pro-cyclical policies described above, economic numbers have been accelerating globally. Some investors, including the highly respected value investor Jeremy Grantham, have postulated we could have a “blow off” top of as much as 50%. Chief Investment Officer of the world’s biggest hedge fund Ray Dalio recently opined that there could be another 18-24 months to this rally, during which investors will feel “pretty silly” holding cash. When Warren Buffett made his famous speech in 1999, basically saying that technology was in a bubble, prices doubled from there. Of course, by September 2001, investors had lost about 50% from the level of Buffett’s speech and more than 80% from the top. (See chart below)

Source: John Chew

Advisors often say, “invest for the long-term.” Today, just think of the next 5 years and it’s hard to imagine some of these items don’t come to fruition over that timeframe. For these reasons, I believe the next recessionary downturn (which may follow from the recent correction, although, it may not) will be at least as bad as average, which historically has been -37%. I also know that many of the points highlighted here were present during some of the worst downturns in history, like 1929, 2000 and 2007 in the United States, as well as Japan in 1989, when investors suffered losses between 50%-90%.

If you think all this is so horrible it’s depressing, remember that in investing, nothing is ever “bad” or “good.” Facts are only bad or good relative to how you’ve positioned yourself. If this turns into a bloodbath, and we get a severe recession or depression, the investor who was willing to be conservative now will have an opportunity of a lifetime when this bubble pops.

Loic LeMener, CFA®, MBA, CFP® is a registered representative of Lincoln Financial Advisors Corp.

Securities and investment advisory services offered through Lincoln Financial Advisors Corp., a broker-dealer (member SIPC) and registered investment advisor. Insurance offered through Lincoln affiliates and other fine companies CRN-2028751-021418

Opus Wealth Management is not an affiliate of Lincoln Financial Advisors Corp.

This information is designed for general use with the public and is for informational or educational purposes only. It is not intended or should be construed as investment advice and is not a recommendation for retirement savings.

Sources:

1 IIF, BIS, IMF, Haver: Global Sectoral Indebtedness

2 Bloomberg: S&P 500 leverage has surged post-crisis

3 BofA Merrill Lynch Global Research: HG Corporate bond market more than tripled in 10 years

4 Societe Generale: Buybacks are mainly funded debt

5 FactSet: IG Rated Debt Outstanding

6 Moody’s Investors Service: Moody’s Loan Covenant Quality Indicator (LCQI)

7 Bank of International Settlements: Share of zombie firms

8 Business Insider, AI-CIO: State and local Pension Fund Allocations

9 BEA, Piper Jaffray: Consumers spending more than they earn

10 dshort.com, December 2017: NYSE Margin Debt / S&P 500: Real Values

11 China Banking Regulatory, Federal Commission, Bank of Japan, European Central Bank: Bank Assets Growth since 2008

12 The Daily Telegraph, July 17, 2017: China Shadow Banking Credit Gap Trigger the Bust

13 International Monetary Fund, Haver Analytics, Goldman Sachs Global Investment Research: China contributed large share of world growth in recent years

14 Economica blog/Chris Hamilton: China 25-54yr/old population total vs. total energy consumption debt, GDP

15 Research Affiliates, based on data from the United Nations, Penn World Table and Global Financial Data: Abnormal DGP growth, Demographics, for G-8 and BRIC countries, relative to 1950-2050 averages

16 Emmanuel Saez and Gabriel Zucman, NBER working paper 20625: Piketty Split

17 Institute of International Finance: Changes in balance sheets are calculated as a 12-month rolling sum

18 Federal Reserve Economic Database, Hussman Strategic Advisors: Federal tax revenues from U.S. corporations / Pre-tax corporate profits

19 John Chew: NASDAQ, Barron’s Dec 1999 “What is wrong with Warren Buffett”?

20 Ray Dalio, American businessman and founder of the investment firm “Bridgewater Associates”

21 Warren Buffett: American business magnate, investor and philanthropist.

22 Dr. Lacy H. Hunt, Ph.D.: Executive Vice President of HIMCO, Internationally-known Economist

23 Charlene Chu: Influential China Analyst

About the Author

Loic received his Masters in Business Administration from Southern Methodist University, studying Finance, Accounting and Portfolio Management. He also earned the Certified Financial Planner™ certification and the prestigious Chartered Financial Analyst® designation. In addition, he has been quoted in national publications such as Barron’s.

In his free time, Loic is a devout reader, with his favorite topic being “value investing.” His favorite investors are Warren Buffett, Ben Graham, Charlie Munger, Seth Klarman, Howard Marks, and Jeremy Grantham.