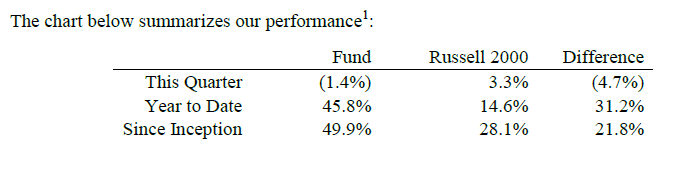

When Jeremy and Michael Kahan consider the notion of diversification, the wince. With a return of 45.8% to end 2017, their stock-picking fund, North Peak Capital, successfully scours the small-cap landscape to find value where that the market masses have missed. In the young fund’s year-end letter reviewed by ValueWalk, the Kahan’s sharply question the notion of diversification by assembling a broad portfolio of stocks. They do this while pointing to new, overlooked picks, some of whom have been widely written off.

Don’t expect the Kahans to discuss standard deviation, volatility, monthly or even yearly returns. While investors in the fund have asked about the sometimes wild swings in performance. Their objective is absolute returns and to achieve this they don’t buy into the well-worn philosophy that there is any “right” number of stocks to own in a portfolio.

Their portfolio is driven by suitable investments they happen to find. If there are a high number of investments that meet their criteria for being undervalued, they have a more significant number of stocks in the portfolio. Conversely, if the number of ideas is thin, but there is a firm belief in the underlying security selection, their portfolio might contain only a handful of names.

“We question the very premise that there is a ‘correct’ number of stocks in a portfolio without regard for the type of investments in a portfolio,” they said.

Their work contrasts that of legendary investor Benjamin Graham who, in the book Intelligent Investor, recommended 10 to 30 issues. Economist Stephen Archer, for instance, suggests 10 to 20 stocks. H0wver, Buffett, and Munger would agree with the concentration in cases, and even Graham made his fortune off a big bet on GEICO.

A key point at which the Kahans differ with the likes of Graham comes in their core belief that markets are not efficient. “We are seeking the very idiosyncratic risk that these analyses are trying to diversify away,” they wrote. With a portfolio, concentration comes the potential for outsized returns, but this also means that, as undervalued stocks can swing wildly in price, volatility comes hand in hand with delivering significant absolute returns.

Their portfolio management process is not just about stock selection, but also stock weighting. “The academic approach typically analyzes portfolios constructed from randomly selected securities and perform their computations either on an equal-weighted basis or a value-weighted basis,” they wrote. They look at their analysis and weight a portfolio based on how they perceive the risk-reward characteristics. “We believe that if you are going to select securities, you should also exert the intellectual effort to weight them optimally.”

The hedge fund also is not a fan of Kelly's Formula, noting:

If you fiddle with the formula, you will discover that it is hard to justify position sizes less than 10%. Here’s why, if an investment has 25% upside, 25% downside, and the upside is 55% likely, Kelly still suggests a 40% position, and Half Kelly a 20% position. Most investors would consider this nearly uninvestable, and highly unworthy of a 20% position. Thus, according to the Kelly Criterion, it’s nearly impossible to have a situation where an investor has enough confidence to invest, but should only take a 3%-5% position. Some practitioners work in the concept of excess return (over a hurdle) to frame sizing in the context of excess return, rather than absolute returns as discussed here.

Putting their principles into action, they see a stock widely ignored that is in the early stages of a turnaround. “You may have forgotten that Groupon existed since you 6 blocked their overly aggressive email campaigns circa 2012, but 32 million Americans and close to 50 million global consumers transacted on the platform over the last twelve months,” they noted, pointing to $2.9 billion in revenue and $225 million of EBITDA.

Groupon just emerged from a streamlining, cutting employees from 10,500 to 6,600 worldwide and the $300 million they saved is getting poured back into marketing. They have developed a credit card application surrounding their Groupon+ offering that makes redeeming offers easier.

Other stocks the firm sees value in is Boston-based Hubspot and website building company WIX.

With Hubspot, they like the expansion of the target market:

For the majority of the Company’s history, Hubspot offered a single product (marketing automation) that had a relatively high cost ($13,000 ARPU) and maintained a low R&D budget. In 2017, the Company transitioned to offer a multi-product growth stack (sales, marketing automation, CRM, and eventually customer service) with a freemium pricing architecture and significantly expanded their investment in innovation. We are encouraged by initial green shoots from the Company’s transformation and believe shareholders will benefit from an expanded total addressable market, reduced customer acquisition costs, improved customer retention, higher customer life time values, and more diversified cash flows.

With WIX they see pros and cons, but ultimately like the customer acquisition model:

the Company added an incremental ~200,000 paying customers in line with net adds over the past six quarters. Additionally, WIX continued to increase ARPU, improved conversion (churn went negative in the quarter), maintained a rapid payback on marketing investments, and launched important new products and feature sets, including WIX Code which could prove to be a needle moving product. On the negative side, WIX announced an incremental $20 million expansion of their R&D budget in 2018 -- a result of the appreciation of the shekel vs. the dollar and incremental investment in their acquired Deviant Art platform. We were surprised by the magnitude of market capitalization destroyed by this change but remain confident that the business will continue to enjoy operating leverage across their primary expense centers.

The hedge fund currently manages $25M AUM