Key Takeaways

- Yield curve positioning and proper diversification remain prudent strategies to manage interest rate risk.

- Small allocations to lower-quality fixed income can also be additive for suitable investors.

- Long-term investing allows total return to potentially work in the investor’s favor: focus less on short-term price volatility and more on long-term total return.

As 2017 ended, fixed income investors were searching for income, after several years of 10-year Treasuries yielding less than 2.5%. When 2018 began, this changed quickly as tax reform and signs of inflationary pressures pushed market interest rates higher. The 10-year Treasury yield rose 0.87%, from a starting yield of 2.04% on September 7, 2017 to 2.91% on February 15, 2018. Investors have grown concerned that improving economic data and rising inflationary pressures may cause the Federal Reserve (Fed) to raise interest rates in 2018 at a more aggressive pace than originally anticipated. Given this backdrop, investors are naturally reassessing their interest rate risk.

What Works Well When Rates Are Rising

As outlined in our Outlook 2018: Return of the Business Cycle, we expect yields to grind gradually higher during the year, but not in a straight line. As such, we continue to recommend portfolio positioning with a duration (a measure of interest rate sensitivity) lower than the Bloomberg Barclays U.S. Aggregate Index, along with additional diversification across sectors, maturities, and credit ratings (for suitable investors), which may potentially help mitigate the impact of rising interest rates on investors’ portfolios.

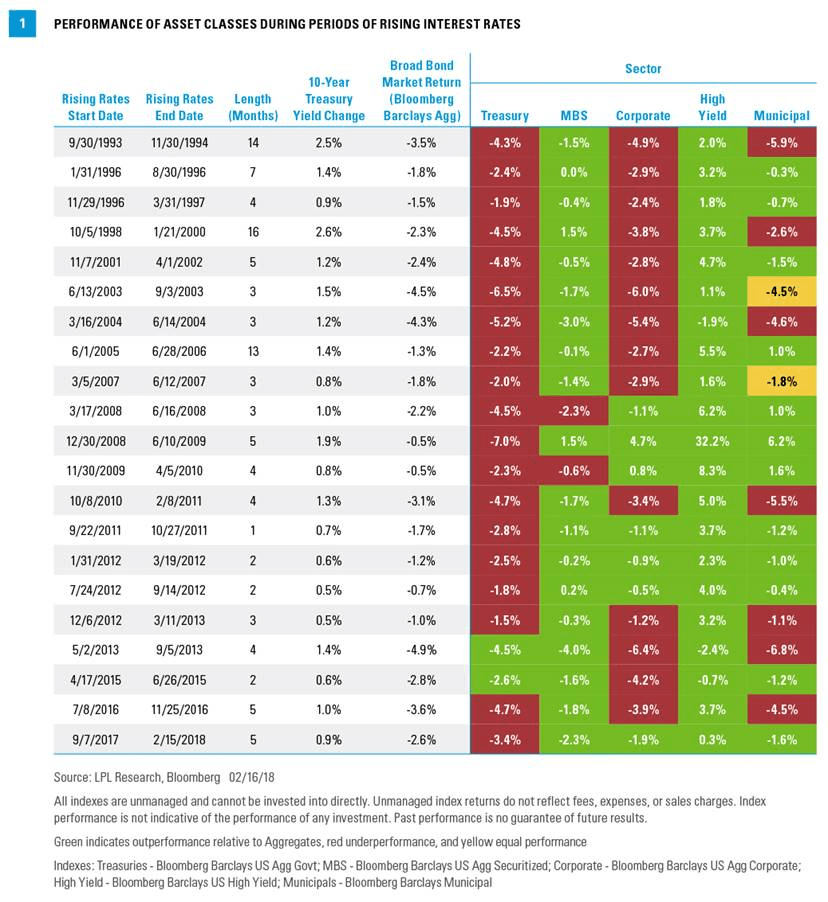

An efficient way to determine proper positioning is to examine prior periods of rising rates to identify what has worked well (and what has not). Figure 1 reviews periods of rising interest rates over the past 25 years. As shown, the Bloomberg Barclays Aggregate, a proxy for the broad high-quality bond market, posted a negative total return in rising interest rate periods, confirming the principle that as rates move higher, high-quality bond prices move lower. The sectors can be compared with the broad bond market returns to determine relative outperformance or underperformance against the benchmark, in this case, the Bloomberg Barclays Aggregate. The performance review in Figure 1 results in several takeaways for bond investors.

- The difference between credit risk and interest rate risk is a meaningful one of which investors should be keenly aware. Of the sectors shown, U.S. Treasuries have the least credit risk, as they are backed by the full faith and credit of the U.S. government. They carry elevated interest rate risk, however, as their price sensitivity to interest rate changes (duration) is higher than the broad Bloomberg Barclays Aggregate. This explains Treasuries’ underperformance in most of the rising rate periods in Figure 1. High-yield bonds, conversely, possess higher credit risk and lower interest rate risk. Generally, interest rates rise when economic growth and inflation pick up, a scenario that’s usually a good backdrop for economically sensitive portions of fixed income, like high yield. The additional yield cushion is also a buffer against higher interest rates that could push prices lower. This explains why high yield has outperformed the broad Bloomberg Barclays Aggregate during rising rate periods over the last 25 years. Despite this outperformance, we still believe lower-quality fixed income should be used at the margins of higher quality, for suitable investors.

- Sector diversification and yield curve positioning can help investors during rising rate periods. Investment-grade corporate bonds possess greater interest rate sensitivity than the broad high-quality market, because of their longer maturities. We favor the intermediate portion of the yield curve, which boasts diversification benefits without the significant interest rate risk of long-term bonds. By either targeting intermediate-maturity corporate bonds directly, or using an active investment manager to position the portfolio opportunistically, investors can manage the headwinds of rising rates on investment-grade corporates.

- High-quality mortgage-backed securities (MBS) have performed well in most rising interest rate environments. This can be attributed mostly to the sector’s shorter duration. Importantly, MBS are not without their own unique risks. If rates move significantly higher, fewer homeowners refinance their mortgages at the higher rates. As a result, investors can be left with investments that have a longer maturity than expected, essentially locking in lower interest rates.

Rising Rate Strategies

Although interest rate risk is present in almost all bonds, it can be managed by buying shorter maturity bonds with higher coupons. Generally, the longer the maturity and the higher the bond’s duration, the more sensitive the bond’s price is to changes in interest rates. For example, a bond with a duration of five years will decline in price by 5% if all Treasury yields rise by 1%, all else being equal. The higher the duration of the bond, the higher the yield should be, as investors need to be compensated for the time it takes to regain their principal investment. Historically, despite greater sensitivity to changes in short-term interest rates, short-term bonds perform relatively well in rising rate environments because they don’t require investors to tie up their money for long, making reinvestment at higher rates possible.

Another factor is the bond coupon. For example, a Treasury bond paying a 2% coupon when interest rates increase to 3% will decline in price. If not, the bond will not compete with the higher-yielding bonds entering the market at the new prevailing interest rate. If the coupon was well above the 3% rate, then the bond is said to have coupon protection. This demonstrates that the higher the coupon is on the bond, the more defensive the bond is against rising rates. In other words, rates need to rise substantially before the market would require a significant discount in price to make the bond attractive.

Keeping Perspective

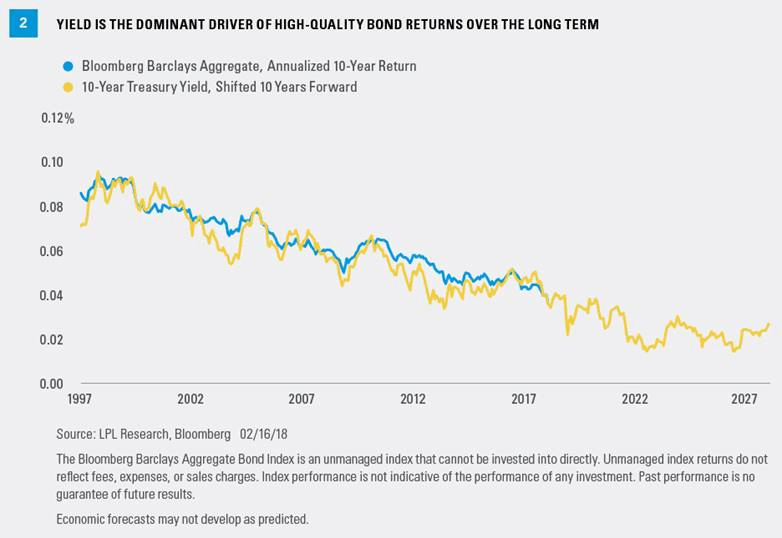

Even though bond prices fall as interest rates rise, and interest rates have risen notably since the beginning of the year, investors should remain focused on their long-term objectives. By focusing on total return rather than on short-term market price fluctuations, investors can avoid selling at inopportune moments due to emotion. Total return is the rate of return over time that is derived from interest income, plus gains or losses on the price of the bond. As interest rates rise, the cash flows of the bond will eventually be reinvested at higher prevailing interest rates. Over a longer horizon, the investor may chip away, or even overcome, price declines that occurred due to rising interest rates [Figure 2]. The takeaway is critical: it pays to remain patient.

Conclusion

Fixed income performance thus far in 2018 has delivered a painful reminder of the impact of rising interest rates on bonds. Rate increases of this magnitude are relatively infrequent, and much of the pain may be over already. Nonetheless, it is important for investors to remain diligent in their asset allocation choices. Well-diversified portfolios that maintain a shorter duration profile with allocations across various sectors and asset classes may help to manage the risk associated with additional interest rate volatility.