What you need to know about the market dip

There is no question that an impending stock correction has been on people’s radar. Market watchers who have been calling for a significant sell off – some for many years now – may feel vindicated as nerves run high and negative headlines abound following recent market action.

No clear macro factor driving selloff

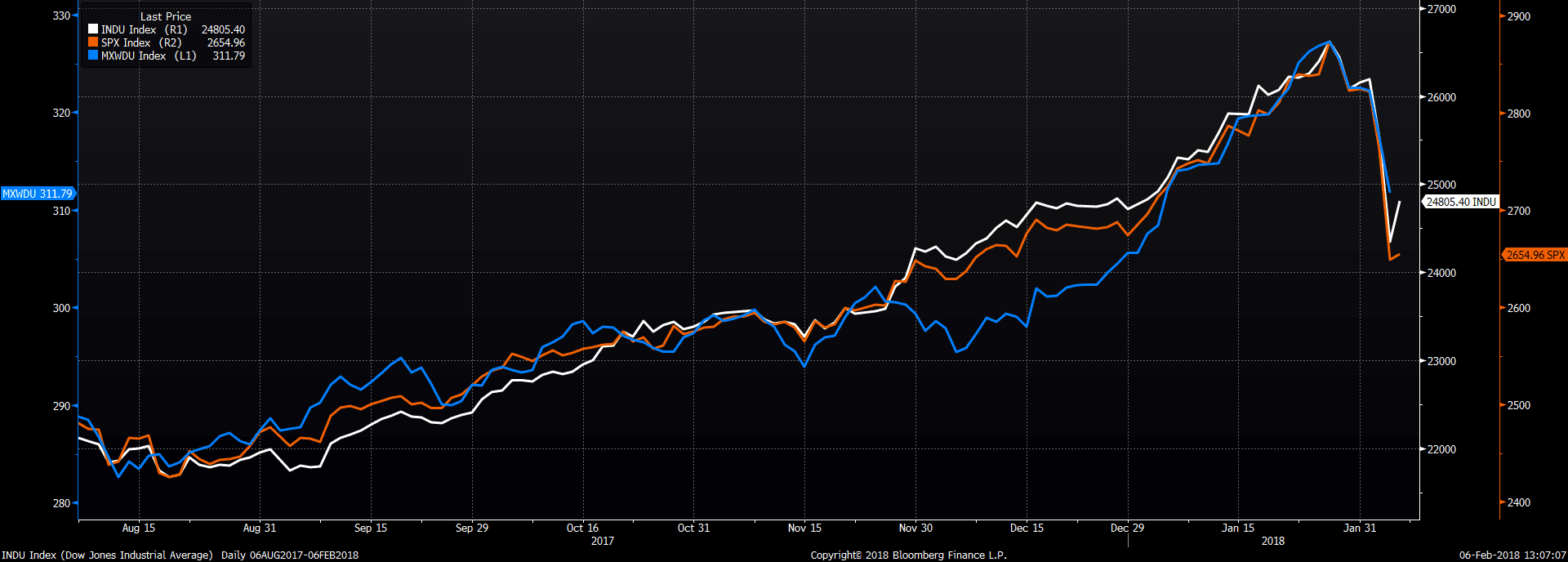

Cracks emerged in markets last week as the potential for inflation made some market participants nervous that the U.S. Federal Reserve will be forced to hike rates faster than expected. On Monday, markets looked weak all day, but towards the end of the sessions stocks took a leg lower and ultimately erased all the gains of the year.

That said, fears of higher inflation and/or a more restrictive Fed are nothing new. This environment feels as if markets are squeezing out short volatility trades while remaining skeptical of high stock valuations.

Volatility is dead; long-live volatility

Volatility is back with a vengeance. As measured by the CBOE Volatility Index (VIX), we haven’t seen these type of volatility levels for many years. Historically, a VIX level above 50 tends to correspond with a 20% correction in stocks; despite breaking through 50 Monday morning, stocks are down less than 10% – meaning the VIX has outpaced a selloff in equities.

Since the global financial crisis, markets participants have become deeply committed to selling volatility and although stocks are making a lot of headlines as of late, short volatility trades are where the real pain has been. Short volatility is more than being short VIX, it is an input for options traders, it is a functional input for portfolio position sizing, and it bleeds into a lot of areas and a lot of different investment strategies. For people really committed to low volatility, this price action scary and significant.

This feels scary but it’s not that different

As of Tuesday, liquidity has been decent, credit markets have remained fairly orderly, and funding hasn’t been under pressure. As a reminder, a stock “correction” is when stocks fall 10% from their peak. We are not there (yet) in most stocks. There have been 50+ times since the global financial crisis where stocks fall in a similar manner to the last few days and they each have provided buying opportunities. Only a handful of those times have we actually had an official stock correction.

What’s next?

We are waiting to see how the rest of the week develops but we remain committed to systematic rules-based investing. If equities level off a bit and investors can remain cool-headed, then the market may normalize, and we’ll avoid a full stock correction. In which case we would expect some of these trends to re-emerge and persist. If things get significantly scarier from here (i.e. a true stock correction) trend-following managed futures strategies will eventually bet against stocks and have the potential to make money in a trending bear market, adding a dose of potentially non-correlated returns during what has historically been a painful period for traditional portfolios.

Article by Sarah Baldwin, Longboard Funds