Will rising interest rates result in a market crash? The answer to this question is not so easy according to a research report from Bank of America on the topic.

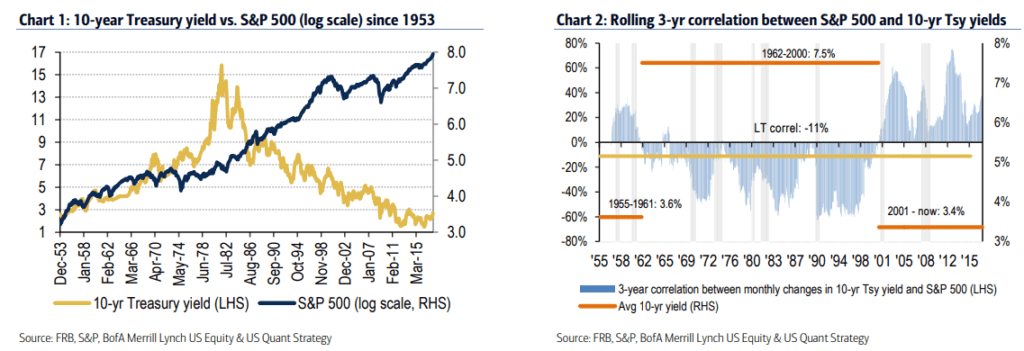

The report, which was published earlier this week, notes that over the past 64 years, stocks have exhibited a weak and inconsistent correlation with interest rates, which makes it difficult to determine how they will react over the next few years as central banks around the world continue to tighten monetary policy.

According to the research by Bank of America's analysts, over the past 64 years, the correlation between equities (S&P 500) and interest rates has been -11%. In some periods, however, the relationship has been more clear. For example, according to the data, the correlation was negative for most of the 1960s and 1990s, during this period, higher yields were bad for stocks. But since the turn of the century, the relationship has been positive and has been "trending higher since the recent trough of 13% in late 2015." The best year for stocks was 2013, during which the S&P 500 returned 32% despite a 100bp+ rise in 10-year yields (despite the "taper tantrum").

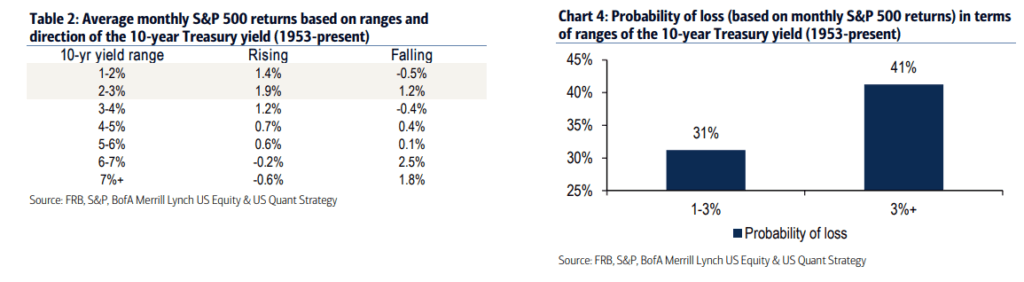

While there has been no apparent correlation between equity returns and rates over the past six decades, there does seem to be some relationship between rates above 3% and equity returns. Specifically, according to Bank of America's data, the best S&P 500 returns have occurred when 10-year Treasury yields have ranged from 2% to 3%, mainly when yields have been rising. While average historical stock returns remain positive until interest rates cross above 6%, the probability of losing money begins to increase as interest rates pass above 3%. These findings seem to support the correlation data above. Stocks were most negatively correlated with treasury yield between the 1960s and 1990s when rates ranged from 4% to 16% and ever since the relationship has exhibited a positive correlation as rates have remained below 4%.

All else being equal, lower rates imply lower discount rates and higher valuations for all financial assets. So, in theory, assets are worth more when yields are lower. According to the analysts' calculations, all else being equal every 50bp increase in the normalized real risk-free rate reduces the fair value of the S&P 500 by roughly 6% to 8%. That being said, generally, when yields are rising growth is improving. Therefore, the report notes, stronger growth tends to offset a rising risk-free rate, which once again makes it difficult to reach a sweeping conclusion.

Despite some evidence of a relationship existing, there are no "magic numbers" for investors to work off the report concludes. A lot will depend on how markets react as the Fed unwinds its balance sheet:

"This question is hard to answer, as we are in uncharted territory in terms of the unprecedented magnitude of monetary stimulus. But in the few historical instances during which the Fed shrunk its balance sheet, stocks outperformed bonds, large caps outperformed small caps, and Value outperformed Growth."

In conclusion, just flip a coin.