It’s all a go into 2018 for the US market with tax reform, that slashes top corporate income tax to 21 percent from 35 percent, whilst also allowing for immediate expensing of capital project costs, launched into action. President Donald Trump signed the Tax Cuts and Jobs Act into law on December 22nd 2017 and the impact is beginning to take shape.

Corporate Shifting

Unsurprisingly, bulge bracket corporate names have been quick off the mark – with Exxon announcing plans to spend $50 billion in U.S. projects over the next five years, partly as a result of the new tax and regulatory changes. 1 What is more surprising, however, is right at the other end of the spectrum, companies as seemingly savvy as GE may pay dearly as a result of the Tax Cuts & Jobs Act. While the reforms cut corporate tax to 21 per cent, they also limit international companies’ accounting of credits and losses.

A minimum tax on “global intangible low-taxed income”, has been imposed on earnings of foreign subsidiaries of US companies. These companies, such as GE, will lose the opportunity of shifting profits to lower-tax jurisdictions. Add to this the “base erosion anti-abuse tax” – which limits companies’ ability to benefit from tax credits and you can see where the reform may not quite add up for some corporates. GE had to take a charge of $3.5bn in Q4 2017 from the tax overhaul – including $2.2bn from the credits and losses tax changes, as well a $1.2bn charge for a new tax charged on past foreign earnings. 2

Credit Quality

The whopping income tax saving has already sent markets and institutions into a flutter – impacting the credit quality of debt issuers across the ranking spectrum – the US government municipals, corporates, financial institutions, utilities and structured finance vehicles will all be affected according to recent research from Moody’s. 3

High quality companies will benefit but low quality levered companies could get hit hard. Specifically, Moody’s notes:

The limitations on interest deductibility will be negative in a downturn or recession. It is possible that low-rated or cyclical companies could see more of their income become taxable as their financial performance deteriorates and their interest expense to EBITDA/EBIT rises meaningfully above the 30% threshold. In certain cases, companies will generate negative free cash flow as a consequence of the change in the calculation for interest deductibility. In addition, the limitation on the use of net operating losses will exacerbate the challenges that companies face in a deteriorating scenario.

Economic Impact

While the tax reform will jolt financial markets and institutions, the research from Moody’s indicates that the impact on the US economy will be limited. Based on the current business climate non-financial companies are likely to prioritize share buybacks, M&A and the paying down existing debt. Little of the tax savings will reach beyond the highest echelons of pay in these companies – limiting the trickle-down effect into low level wages and consumption spending.

Utilities & Homes

Utilities will not fare so well as a lower statutory tax rate will lead to contractions in utilities revenues. The reform also cuts bonus depreciation and will reduce tax deferrals. However, utilities may attempt to offset negative financial implications of the tax bill through regulatory channels. As for home prices, Moody’s forecasts that there will be a slight negative impact on national home price appreciation – based on downward pressure on house values and weakening mortgage performance.3

Fiscal Impact

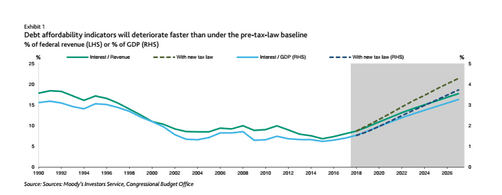

The research from Moody’s further estimates that the tax legislation will reduce the tax intake of the federal government by upwards of a sizeable $1.5 trillion over the coming decade – putting the figure close to 1% of GDP on average, such that the interest-to-revenue and debt-to-revenue indicators will be significantly affected for the US. 3 Deficits are expected to widen faster with the reform in action and will lead to quicker accumulation of federal debt.

Monetary Policy

A major factor that has stymied many an asset manager over the past three years is predicting monetary policy action and the resulting impact. The tax reform is expected to have little impact on inflation – in no small part because there is a wide balance of factors in play provide deflationary and inflationary pressure at the top-down level. Additionally, at the micro level the tax reform is expected to have little impact on mainstream wages and spending, creating little bottom-up inflationary disturbance. As such the Federal Reserve policy will most likely continue along the expected trajectory of three rate rises this year.

Source:

1https://energyfactor.exxonmobil.com/perspectives/economic-boon/

2https://www.congress.gov/bill/115th-congress/house-bill/1

3 Moody’s Investor Services, Cross-Sector US, 24th January 2018