In this feature we examine the hedge fund industry’s year of positive inflows, providing a breakdown of asset flows by strategy, and what this may mean for the year ahead.

Check out our H2 hedge fund letters here.

Industry Growth As Inflows Return

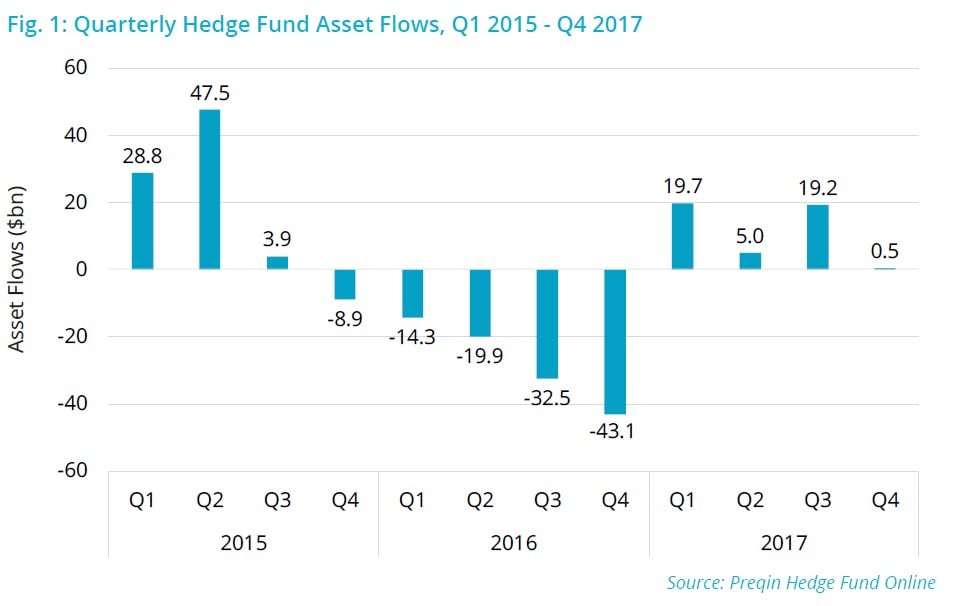

Having suffered a year of net outflows (-$110bn) in 2016, hedge funds reversed this trend in 2017 with net investor inflows amounting to $44.4bn and positive net flows recorded in all four quarters of the year (Fig. 1). However, a greater proportion of hedge funds saw outflows (49%) than inflows (46%) over the course of 2017, highlighting the continued difficulties faced by many managers.

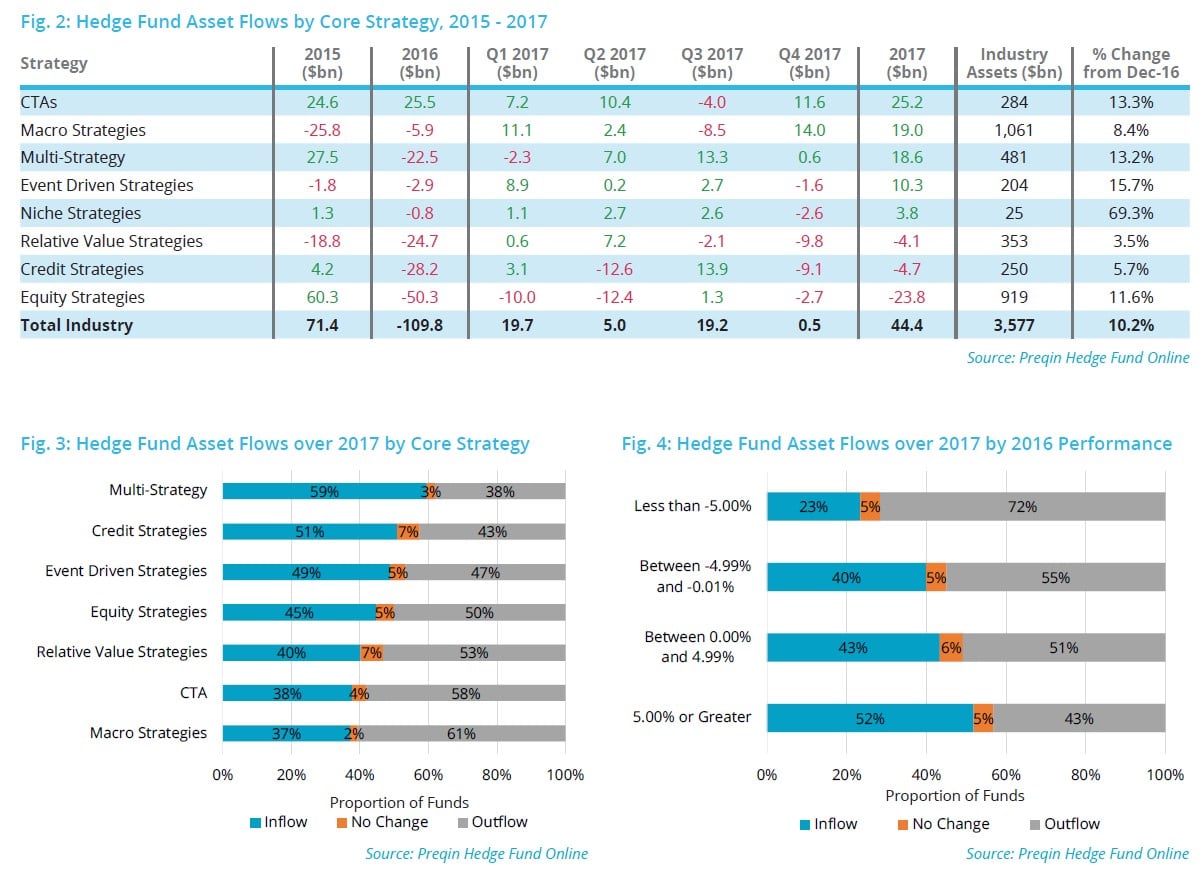

Driven by this influx of investor capital, as well as strong hedge fund returns (+11.45%) in 2017, the industry’s assets continued to grow throughout 2017, reaching $3.58tn as at December 2017, an increase of 10.2% since the end of 2016 (Fig. 2).

Inflows By Strategy

Macro strategy funds and CTAs recorded the greatest net inflows of any top-level strategy in 2017 (Fig. 2). CTAs saw total net inflows of $25.2bn, which led to strong growth in AUM, despite the strategy delivering an annual return of just 2.89%. Aggregate AUM for the strategy grew by 13.3% in the 12 months to December 2017 to stand at $284bn.

Macro Strategy funds delivered a 5.32% return in 2017 and saw net inflows of $19.0bn; the combined effect of these inflows resulted in industry assets increasing 8.4% in the 12 months to December 2017, reaching an overall figure of $1.06tn.

Equity strategies recorded significant net outflows (-$23.8bn) over the course of 2017. However, despite this, the annual

performance (+15.32%) of equity strategies in 2017 drove aggregate strategy assets up by 11.6% since the end of 2016 to

December 2017.

Top Performers Attracting Inflows

Past performance remains a key factor in determining a fund manager’s ability to attract new capital. As shown in Fig. 4, the majority (52%) of funds that generated returns of 5% or more in 2016 experienced net inflows; by contrast, almost three-quarters (72%) of funds that generated a loss of greater than 5% in 2016 saw outflows in 2017. Therefore, although past performance may not be indicative of future performance, it is a clear signifier of future asset flows.

The amount of investors that were looking to allocate fresh capital to the asset class in 2017 will help bring renewed optimism to many industry participants this year. However, the success in fundraising varies significantly from manager to manager based on strategy, region, size and performance. This emphasizes the need for fund managers and allocators alike to have access to comprehensive fund-level data, giving them the greatest insight into the direction of capital flows in 2018 and beyond.

Capital Flows: Outlook For 2018

Following the trends seen in 2017, what can we expect to see in the industry in 2018?

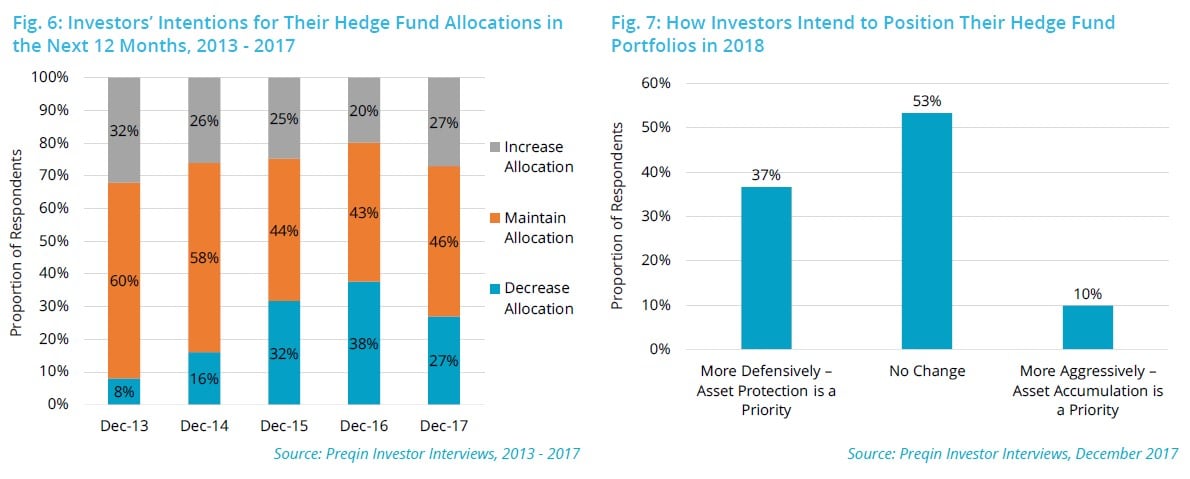

Preqin’s December 2017 interviews with institutional investors active in hedge funds reveal the end of a trend we have seen since our December 2014 survey: for the first time in this period, the proportion of investors that plan to reduce their exposure to hedge funds over the next 12 months does not outweigh the proportion intending to increase their exposure (Fig. 6). In fact, the greatest level of investors since December 2013 are looking to increase the amount of capital dedicated to hedge funds in the coming year.

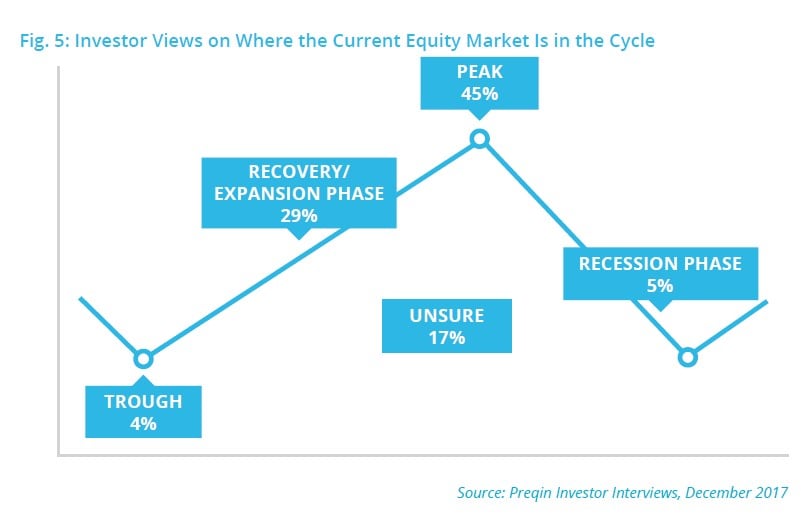

With more capital likely to be allocated to hedge funds this year, how will investors use these vehicles within their portfolios? Nearly half (45%) of investors interviewed in December 2017 believe equity markets may have reached a peak in 2017 (Fig. 5). Consequently, 37% of investors plan to position their portfolios more defensively in 2018, compared to 10% that plan to position them more aggressively (Fig. 7).

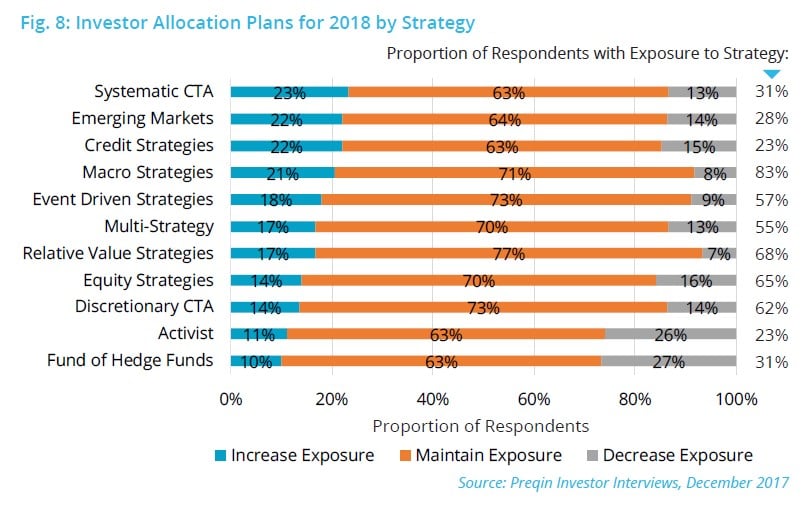

As a result, we continue to see strong appetite for diversifying strategies which may protect investors in the case of a market correction. CTAs look set to play a key part in this. Although a relatively small proportion (31%) of investors interviewed invest through systematic CTAs compared with other strategies, a significant 23% of these plan to increase their weighting towards systematic CTAs over 2018 (Fig. 8). CTAs can provide uncorrelated returns to hedge funds and equity markets, a possible reason behind investor demand for this strategy in the coming year.

Just 8% of investors plan to decrease their exposure to macro strategies funds, with 2.5x more (21%) looking to increase their allocation to these strategies. Although macro strategies generated the second lowest annual return of any top-level strategy in 2017, investors may also be looking to these strategies to add downside protection to their portfolios should the extended equity market run come to a sudden stop.

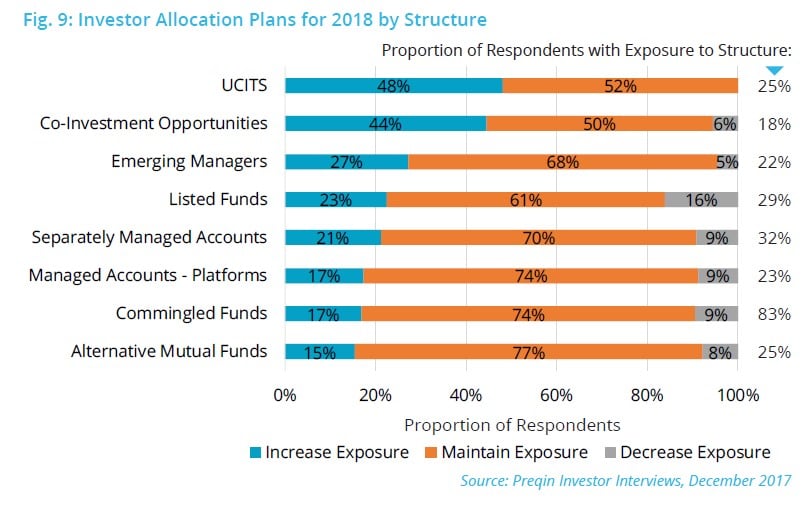

Investors are also looking to alternative structures to shape and protect their portfolios in 2018. Although fewer investors use UCITS within their hedge fund portfolios than other fund structures such as commingled funds (25% vs. 83%, Fig. 9), these investors show a strong appetite for the structure over 2018: nearly half (48%) plan to increase their investments in alternative UCITS over 2018, with no investors surveyed planning cuts to their UCITS holdings.

Investor appetite for co-investment opportunities in the hedge fund space is growing: two years ago, just 13% of investors indicated that they co-invested alongside their hedge fund managers; at the end of 2017 we estimate this to be closer to 18%. And these investors look set to grow their exposure over the course of 2018: 44% plan to increase their investments in hedge fund co-investment opportunities, and just 6% plan to reduce them. Co-investment opportunities provide investors with tailored strategies and access to high-conviction, potentially higher return trades. In addition, with fees likely to remain a significant issue in 2018, such opportunities can come with significant fee discounts.

The return of net inflows into hedge funds in 2017 has been a welcome change for fund managers and looks set to continue into 2018. A possible downturn in the equity market is leading many investors to batten down the hatches and position their portfolios defensively for the year ahead. Consequently, products and structures such as macro strategies funds and systematic CTAs are likely to see the greatest inflows in 2018. In contrast, equity strategies could see further outflows, driven by the number of investors that believe the equity market has peaked.

Article by Preqin

See the full report below.