As the global economic recovery is gathering speed, the one region that is surprising all economists is Europe. Europe, the area that only two years ago most economists had written off, grew at a rate of 2.5% in 2017, the highest pace since 2007 and many economists expect this momentum to continue into 2018.

Europe’s growth has been pushed to new highs (the region is now growing faster than the US) thanks to a strong performance in all areas, but notably France where President Emmanuel Macron has taken his first steps to cut red tape and taxes. A recovery in business optimism within the region helped push growth to 1.9% for 2017, its most substantial rate of expansion since 2011.

European Fund Managers Getting More Bullish

The promise of reforms and reduction of red tape have helped contribute to the recovery but so has rising global demand for goods and services. Europe is highly reliant on the rest of the world for exports, with the share of exports in the Euro area of GDP being twice as significant as in the US, and high volatility EM countries account for an increasing share of that. The region has benefitted from a Goldilocks scenario across the rest of the global economy as low oil prices, interest rates and high business optimism have lifted the part on a rising tide.

But does this now mean that the region is more susceptible than the rest of the world to a sudden economic shock such as a sharp rise in oil prices?

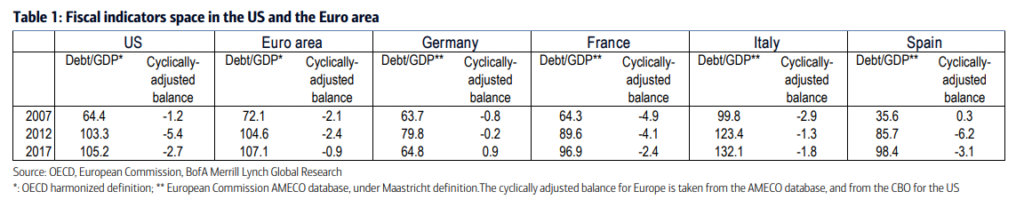

According to analysts at Bank of America Merrill Lynch, unlike the US when it comes to insulation from global shocks, Europe is better protected than the world's largest economies. The analysts point to the austerity drive that crippled Europe's economy between 2010 and 2013, which triggered a double-dip recession but helped improve the aggregate fiscal position of the region. Correctly, the analysts note that the "cyclically-adjusted deficit - the part of the fiscal balance that is not attributable to the gyrations in the business cycle - is now very low, at less than 1% of potential GDP in 2017, in sharp contrast with the US [2.7%], and the overall deficit stands at only 1.1% of GDP."

What's more, while the region is still fiscally weak, its public finances are in much stronger shape than they were in 2007, and they are probably much stronger than those of the US where the "CBO’s estimate of the deficit excluding automatic stabilizers stood at 1.2% of GDP in 2007 against 2.7% in 2017."

That being said, the one big difference between Europe and the United States is the level of cooperation between regions. Even though the European financial system has become more intertwined over the past ten years, member states' finances remain independent. The European Central Bank for its part has been trying to unify the regions fiscally by keeping interest rates on sovereign debt depressed, but it is widely expected that this support will be removed later this year.

As other central banks around the world normalize monetary policy Bank of America's analysts write "we could see a significant rise in funding costs in Europe." This might not "force member states into a return to austerity," but it may limit states' ability "respond to a cyclical shock."

Put just, while Europe's recovery might look firm, a significant global economic shock may expose the region's financial weaknesses and lack integration without the backstop of central bank quantitative easing.

All that is without factoring politics - AfD came in second in a poll published yesterday. If Merkel decides to allow a million more migrants, the AfD could very well overtake the CDU.