This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (February 1, 2018). Subscribe on the right side of the page for the complete text.

Economic growth accelerated in 2017, the unemployment rate is sitting at a 17-year low, housing prices are up significantly, Consumer Confidence is near the highs of 2000, corporations are doing cartwheels thanks to tax cut legislation, and the stock market has recently set new records. Not a bad start to the year, eh?

Fat Wallets & Stuffed Purses

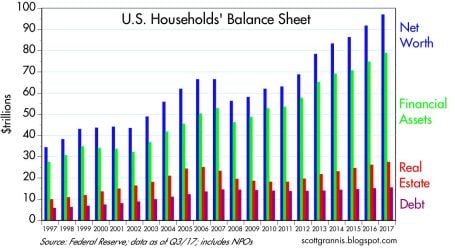

The strength of the economy, coupled with the optimism of business and consumers, has resulted in a financial boon for Americans, as shown in the chart below. Not only have financial assets and real estate gone up significantly since the 2008-2009 Financial Crisis, but household debt has also remained relatively stable. The combination of these factors have American households sitting on almost $1 trillion in household value, a new record.

Source: Calafia Beach Pundit

As we move ahead through the first month of 2018, the +5.8% gain in the Dow Jones Industrial Average, and the +5.6% advance in the S&P 500 index have further fattened wallets and stuffed the purses of equity investors. On an annual basis, the results only look even better, with the Dow up +32% and the S&P +24%. Given the sharp appreciation in value, casual observers might expect a flood of new investors to pile into stocks and equity mutual funds…not true. Actually, this buying phenomenon has yet to occur. However, it is true investor sentiment has begun shifting to a “glass half-full” perspective due to the vast number of positive economic headlines. Nevertheless, it’s important for investors to remember this pace of gains cannot be sustainable forever.

There is no theoretical limit on the number of potential market moving events. The stock market could temporarily get rattled by another North Korean nuclear test, a terrorist attack, a geopolitical standoff, an inflammatory tweet, an infinite number of other unforeseen events, or stock prices could simply go down due to profit-taking (i.e., investors sell to lock-in gains). Regardless, the economic momentum is palpable and the president did not waste any time at the recent State of the Union address to remind Americans.

Currently, there are limited signs of euphoric stock buying, but there will be a point in time, as in all economic cycles, when investment excesses will overwhelm demand and will therefore lead to a recession. Let’s not forget, an overzealous monetary policy (i.e., too many rate increases), led by a new Federal Reserve chief (Jerome Powell), is another scenario which could slam the breaks on an overheated economy.

Follow the Money

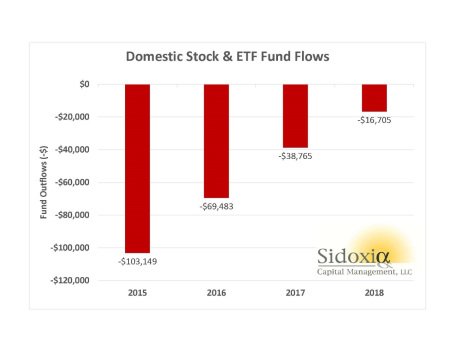

In attempting to read the tea leaves about the future direction of the stock market, we are inspired by the famous quote from the 1976 film All the President’s Men, “Follow the money.” Actions speak louder than words in our book, which is why at Sidoxia Capital Management (www.Sidoxia.com), we track the money buying and selling actions of investors. There is never a shortage of information, and the professionals at the ICI (Investment Company Institute) are kind enough to publish the Weekly Fund Flows data (see chart below), which details the amount of dollars funneling in and out of stock and bond funds. Despite the stock market more than tripling in value, and contrary to common belief, more than -$200 billion has poured out of domestic stock funds and ETFs (Exchange Traded Funds) from 2015 through early 2018.

Source: ICI through 1-17-18

How can this counterintuitive money exodus transpire during a bull market? Quite simply, corporations have been using record piles of cash to buy trillions of dollars in stock through “stock buybacks” and “mergers & acquisitions” activity. All this corporate stock purchase activity has offset the money flowing out of funds, which has helped catapult stock prices higher. History tells us, that before this long-term bull market that started in 2009 ends, flows into U.S. stock mutual funds and ETFs will turn significantly positive after years of hemorrhaging.

Many speculators and traders waste time on a plethora of unreliable sentiment surveys and indicators (e.g., CBOE Volatility Index, AAII Sentiment Survey, Put-Call Ratio, etc), but my 25+ years of investment experience tells me the fund flows data works much better as a longer-term contrarian indicator. To put “contrarian” investing in English, famed billionaire investor, Warren Buffett, summed it up best when he said, “Be fearful when others are greedy and greedy when others are fearful.”

Sharing the Wealth

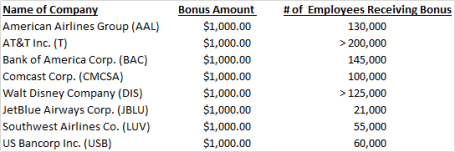

Speaking of greed, corporations have been greedy capitalists as they have watched profits surge to record levels. Yet many of these greedy corporations have decided to share some of the spoils garnered from the recent tax legislation with rank and file employees. For instance, consider the small sampling of the following large corporations that have decided to pay their employees bonuses:

Overall, even though trillions of savings remain in cash and money is still flowing out of US stock funds, the investment glass is shifting from a glass half-empty perception to a glass half-full impression. A time will come when the masses will believe the glass half-full will turn to a glass over-flowing. I don’t think anyone can predict with any certainty when that time will arrive, but I will continue doing my best to drink as much water as possible before it spills.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in T, CMCSA, DIS, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in AAL, BAC, JBLU, LUV, USB, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Article by Investing Caffeine