For February 21, 2018, our forensic accounting red flag is from an amusement park operator with significant hidden non-operating income.

Check out our H2 hedge fund letters here.

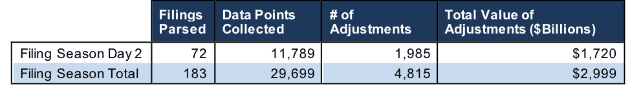

We pulled this highlight from yesterday’s research of 72 10-K filings, from which our Robo-Analyst technology collected 11,789 data points. Our analyst team used this data to make 1,985 forensic accounting adjustments with a dollar value of $1.7 trillion. The adjustments were applied as follows:

- 878 income statement adjustments with a total value of $133 billion

- 788 balance sheet adjustments with a total value of $745 billion

- 319 valuation adjustments with a total value of $842 billion

Figure 1: Filing Season Diligence for Wednesday, February 21st

Sources: New Constructs, LLC and company filings.

We believe this research is necessary to fulfill the Fiduciary Duty of Care. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how these adjustments contribute to meaningfully superior models and metrics.

Today’s Forensic Accounting Needle in a Haystack Is for Consumer Cyclicals Investors

Analyst Pete Apockotos found an unusual item yesterday in Six Flags’ (SIX) 10-K.

On page 80, SIX disclosed a $72.9 million reversal of stock-compensation expense. The compensation committee determined that they were unlikely to hit the $600 million modified EBITDA target that would trigger executive stock grants in 2017, so they took a big gain to offset previous recorded stock-option expense. Essentially, the company got a $72.9 million (27% of net income) boost to reported net income for failing to hit its performance target.

This non-operating income misleadingly boosted SIX’s reported EPS by 147% in 2017. After this adjustment, our model shows that after-tax operating profit (NOPAT) grew by a much more modest 22%. Failure to adjust for this non-operating item creates the illusion that SIX is growing profits much faster than it truly is.

This article originally published on February 22, 2018.

Disclosure: David Trainer, Pete Apockotos, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Article by Sam McBride, New Constructs