A few years ago there was fear that Deutsche Bank could collapse taking Germany and the rest of the global economy with it. Since then, Deutsche has made some strides to shore up its balance sheet, but is it enough?

Then in 2017, Chinese conglomerate HNA Group threw its weight behind struggling Deutsche Bank acquiring a 9.9% stake in one of Europe’s most important banks.

This support came at an excellent time for Deutsche. The bank was reeling from substantial losses in 2015 and 2016 and had just completed a massive €8 billion fundraise to bolster its balance sheet–the third fundraiser in as many years.

Deutsche Bank Says It Knows Who Is “Holding Up” The Bitcoin Market

However, now less than a year later, the very existence of HNA is now being questioned, and shares in Deutsche Bank are under pressure again as traders speculate that the Chinese conglomerate, which is struggling to pay off its creditors, will dump its stake in Deutsche in a desperate attempt to raise funds.

Deutsche Bank’s position has improved since this time last year, but only just. The firm reported a €2.2 billion loss in the fourth quarter of 2017, driven by week revenue, elevated operating and restructuring costs and taxes related to the US Tax reform. Still, despite these costs, the bank reported a fully loaded Common Equity Tier 1 capital ratio of 13.8% at the beginning of 2018, above its long-term strategic target of 13% or more. Post-tax return on tangible equity for 2017 was – 0.9% compared to the long-term strategic goal of 4.5%.

According to rating agency Moody’s, while Deutsche Bank remains a work in progress, the bank’s robust balance sheet gives management enough headroom to instigate the required turn around.

According to the rating agency, for Deutsche to achieve its “idealized future state,” it needs to cut costs down from an estimated €23 billion in 2018 to €21 billion, eliminate all restructuring costs and increase revenues from €28.3 billion for 2018 to €29.9 billion. This should enable the company to generate 9% return on tangible equity and net income of €5.4 billion.

Now the balance sheet has been stabilized, management’s primary goal will be to grow revenues. Here there is still plenty of work to do as Moody’s latest report on Deutsche’s outlook explains:

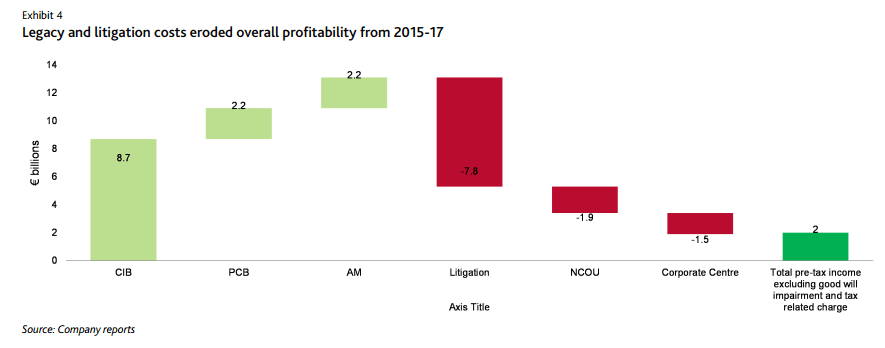

“Management’s commitment to strengthening the balance sheet and resolving litigation has cost roughly two-thirds of DB’s underlying profitability of €13.1 billion from 2015-17 across its three core lines of business, Corporate and Investment Banking (CIB), Private and Commercial Bank (PCB), and Asset Management (AM)…Standing in the way to quick progress are structural impediments and revenue weakness in some of DB’s core business lines. Core revenue (i.e., excluding those related to debt valuation adjustment (DVA), the NCOU, one-offs, HuaXia and Abbey Life) fell €5.9 billion, or 18%, to €27 billion from 2015 to 2017. Most of this drop occurred within CIB, in which revenue fell from €19 billion in 2015 to €15 billion in 2017. Revenue yields on risk-weighted assets (RWA) have been declining over this period despite the run-down in RWA.”

In related news, Deutsche Bank shares have plunged to their lowest level since 2016, let us hope this is just another hiccup.