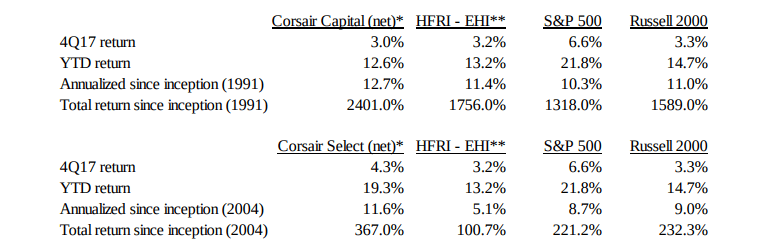

Corsair Capital Management gained an estimated 3% for the fourth quarter ended December 31, bringing full-year performance to 12.6% net according to a copy of the firm’s full year and fourth quarter letter to investors which has been reviewed by ValueWalk.

Unfortunately, this performance lagged the firm's peers and the broader market. For the period the S&P 500 Returned 21.8%, and the HFRI Equity Hedge (Total) Index gained 13.2%. Still, over the long term Corsair's performance remains robust with an annualized return since inception (1991) of 12.7% compared to 10.3% for the S&P 500 and 11.4% for the broader equity hedge fund index.

Corsair Capital Management: Focus on long-term fundamentals

In the letter to investors, Corsair Capital Management laments its positioning for the year. In a year in which large tech stocks generated the bulk of the market performance, smaller value stocks, which the firm specializes in only produced a high single-digit return. Indeed, smaller, non-growth stocks as represented by the Russell Value Index only added 7.8% for the year. Considering this performance, and the 62% net long positioning for Corsair "we feel quite pleased with our results" the letter opines.

And despite growth stocks' strong outperformance over the past few years, Corsair started 2018 in the same way that it has been investing for the past 27 years, by investing in companies led by activist managers going through strategic change.

The letter draws readers' attention to a recent article printed in the Wall Street Journal by Mark Hulbert, which "makes a strong statistical argument downplaying the significance of any investment advisor’s 12-month performance." Instead of using 12-month performance figures of the article argues "you improve your chances of picking a winning adviser by focusing on periods for longer than one year." Corsair agrees with this view and takes time to "remind everyone" in its letter that investing remains "a marathon and not a series of consecutive sprints."

The most substantial contributors to the Corsair portfolio during the fourth quarter were VOYA Financial, Huntsman Corp, Ferroglobe and Sinclair Broadcasting. On the negative side, Houghton Mifflin Harcourt Co. and Tronox Ltd. produced losses for the firm.

Looking for exclusive access to hedge funds? Check out Hidden Value Stocks.

VOYA was the largest contributor during the period, and Corsair's team of analysts believe, but this company still has plenty of room to run as it restructures the business. During the fourth quarter of 2017, the firm announced the sale of its closed block a variable annuity business and most of its ongoing annuity business, two sales which are expected to complete during the first half of 2018. Its life insurance business is also on the chopping block. When these transactions are complete a strong retirement business, investment management business and employee benefits business will be left, which should lead to a substantial re-rating of the stock as the business should be much easier to understand according to Corsair. The firm's analysts believe this company could earn $5 a share in 2019 and demand a higher earnings multiple thanks to its newfound simplicity. The company is also planning to repurchase close to 15% of its current market capitalization over the next 12 months.

Houghton Mifflin Harcourt Co. Lost 23% during the fourth quarter of 2017 after a competitor warned about slowing sales. While this is disappointing, Corsairs analysts believe "the sales will ultimately occur," and the market is not fully appreciating the policies of the group's new CEO. It is believed that the group can achieve $1 per share in annualized free cash flow through its cycle and "should be worth towards 15x."

A final core position the firm notes in its full-year letter is Caesars Entertainment, which emerged from bankruptcy during the period under review.

The fund's team sees several ways Caesars could unlock shareholder value going forward:

"a) an iconic franchise, b) several avenues of potential revenue growth and opportunities to lower its cost structure, c) a region benefitting from positive fundamental tailwinds and a US economy with growing wages and lower taxes, and d) a strong balance sheet to support accretive M&A and potential stock buybacks."

As management executes, the stock could be worth as much as $30 per share.

Below is more on Caesars Entertainment

Following a contentious restructuring process, Caesars Entertainment (“CZR”) emerged from bankruptcy in Q4 2017 with high quality assets, new growth opportunities, expanding margins and, in our opinion, an undervalued stock. CZR recently re-entered the public markets as an orphan stock due to the convergence of several non-fundamental factors. Despite an $11B market cap, investors are being distracted by the recent terror attack on the Strip in Las Vegas, limited segment financial disclosures, a misunderstood acquisition and a prisoner exchange in the shareholder base. However, we believe that the stock could double over the next 2-3 years driven by secular tailwinds in its business, competitive advantages, pent-up revenue growth, significant cost-cutting opportunities and capital allocation flexibility.

................

Business History and Fundamental Tailwinds

“Proven management execution, significant presence in growing Las Vegas, strongest loyalty program in the gaming industry, 50 million strong and very strong free cash flow profile that's growing...” – CZR CEO Mark Frissora

CZR, the largest gaming company in the US, owns and operates resorts and casinos, primarily on the valuable Las Vegas Strip. In fact, almost half of the company’s revenue and two-thirds of its EBITDA are generated in Las Vegas, with the remainder mostly at regional casinos in a dozen other states. CZR’s Total Rewards loyalty program is the largest in the industry and we believe represents a material competitive advantage versus peers. Given the company’s strong cash flow generation, Apollo (“APO”) and Texas Pacific Group (“TPG”) led an LBO of CZR in 2008, slapping $25B of debt onto its balance sheet. Following a 2012 IPO, CZR’s equity collapsed under its unmanageable debt load and filed for bankruptcy in 2015.

Subsequent to its litigious restructuring, CZR emerged from bankruptcy as a healthy company with a bright future. Today, CZR is operating with marquee brands and a strong balance sheet amid a strong U.S. economy with wage inflation and generally lower taxes. Las Vegas is also benefitting from the arrival of the NHL’s Vegas Golden Knights and should further benefit from the upcoming move of the Oakland Raiders. In addition, CZR is benefitting from the $600MM renovation of its rooms and properties during the bankruptcy. Moreover, the company also stands to gain from its development of two of the largest convention centers in the US, with bridges to its Harrah’s Las Vegas and LINQ casinos. We expect average daily rates (ADRs) for CZR to steadily increase as a result of these initiatives

.....................

Valuation and the Corsair Lens

Despite fundamental tailwinds, CZR stock remains under pressure as distressed investors, private equity firms and first lien bondholders exit their positions. In the meantime, we believe large, long-only institutional investors are waiting until the company’s 10-K is filed and research coverage is picked up by the major brokerage firms. While the stock continues to be plagued by this technical selling along with a misunderstood acquisition and the shock of a terror attack, the Corsair Lens sees several aspects to shareholder value; a) an iconic franchise, b) several avenues of potential revenue growth and opportunities to lower its cost structure, c) a region benefitting from positive fundamental tailwinds and a US economy with growing wages and lower taxes, and d) a strong balance sheet to support accretive M&A and potential stock buybacks.

The stock is currently trading for 9.6x our 2018 EBITDAR projection, but is closer to 8x when factoring in the revenue and cost synergies from the Centaur assets, potential future licensing deals and efficiencies in labor and marketing spend. We believe CZR could trade at 10.5x 2019 EBITDAR, or $21 per share, which better reflects the company’s strong fundamentals. Going forward, we see EBITDAR growing from $2.1B in 2016 to over $3.1B in 2020 as management executes its playbook. By then, we believe CZR could be a $25-$30 stock.