Article by RCM Alternatives

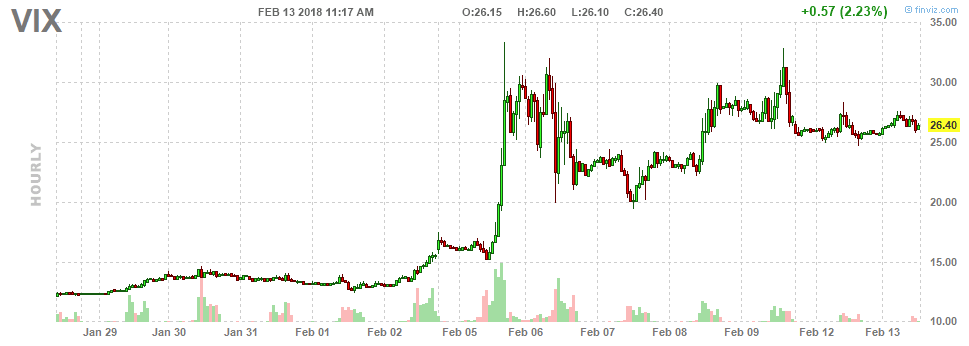

Yes. It’s another post about the VIXpocalypse, but when it’s been years since we’ve seen the VIX Index spike and stay at those higher levels, it bears attention. Not to mention the big swings for both volatility traders and normal managed futures/macro funds because of the VIX tail wagging the S&P dog. We can see from the chart below that this VIX (VIX Futures) move is much different than any in the past 8 years or so, with readings not dropping below 20 the entire week. The previous half life of volatility spikes seemed to be about 5 hours instead of 5 days.

(Disclaimer: Past performance is not necessarily indicative of future results)

As we explain in our “Investing in VIX and Volatility Whitepaper” the VIX index was created after the 1987 crash to be used as a gauge of implied volatility over the next 30 days, with the higher people are willing to pay for protection via put options on the S&P 500 reflected in the index. They are willing to pay more and more as fear gets higher and higher, which is why the VIX got the reputation as the “fear gauge.”

Enter February 5th, 2018 – where something curious happened – the fear gauge disconnected from actual fear in the market. We expect a rather normal curve showing VIX prices rising as the S&P daily return declines. But last week was literally off the chart in terms of this relationship. It turns out, Monday’s move in the VIX showed THE biggest outlier in this correlation back to 1990, with the VIX Index spiking 115% on just a -4% S&P 500 drop. To give you context, a typical 4% drop in the S&P results with a 30 or 35% spike in the VIX. Here’s it visualized:

We’d been asking rhetorically what happens when there’s more volatility sellers than buyers for months now, and there’s your outlier answer. The fear of going off a cliff when actually just hitting a speed bump. Of course, the VIX being so low was a big part of this – making large percentage moves easier to see. But short VIX futures covering was just as much a part of it, actually driving the market the VIX is supposed to be tracking lower. To hear what Volatility traders have to say about trading these markets, download our VIX and Volatility Trading Webinar Recording or read our VIX and Volatility Whitepaper.