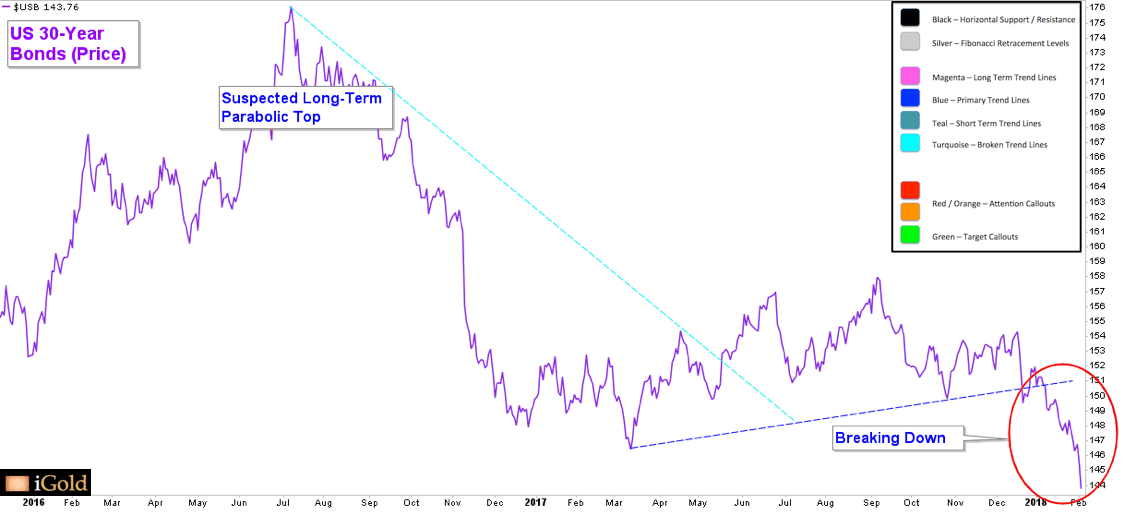

This week the stock market experienced its worst weekly decline since 2016, kicking off fear across the world markets. This fear was in response to rising bond yields, or stated inversely, falling bond prices. 30-year U.S. bonds dropped by more than 3.0% for the week. In a market that very rarely experiences 1.0% changes, such a decline is massive. In 2016 the 30-year bond was 2.10%, and yields have now increased to 3.08% per year.

According to Rebecca Patterson, chief investment of the Bessemer Trust, “It’s all driven by bond yields. It’s not that the level is that frightening, but the speed of the move is causing anxiety.”

As we have been reporting for two years now, bonds have formed a long-term multi-decade top. The last time one of such size was reached was in 1950, following the post World War II bond-investing. If we assume that the average person begins to pay attention to financial markets approximately around when they turn 22, only people born before 1928 would ever have seen a long-term top in U.S. bond prices like this one. We are only seeing the beginning of this decline.

Our question remains the same: how can indebted governments financially support themselves if interest rates are scheduled to continue to rise for years or decades into the future? The answer to that is that the central banks will print the money they need to cover the difference. When central banks find themselves trapped between a rock and a hard place, and when they have the ability to print new money at will, they will always choose the hard place of devaluing the currency.

Is the Market Irrational?

A recurring theme in this series of articles is that it is possible for us to be fundamentally correct and yet find ourselves on the wrong side of the market. Let’s break down the chain of events that we have seen this week:

- U.S. long-term bonds had their worst weekly decline in a long time.

- Bonds work as a promise of future payment for dollars.

- However, the only asset class that held its value throughout all of this and the resulting panic was the U.S. dollar.

Following this, the market left the dollars of the future for the dollars of the present. Something to keep in mind is that markets are not held to rational actions. It brings to mine an adage that seems particularly relevant today: markets can stay irrational longer than you can stay solvent.

Generally, amidst moves such as these, we can look at gold as a safe-haven. Not so this week, with gold declining by more than 1.3%. We were expecting this decline, however, based on the technical analysis completed over the past month which showed us a possible zone for an interim high was in the process of forming (see https://bullionexchanges.com/blog/2018/01/22/technical-analysis-precious-metals/).

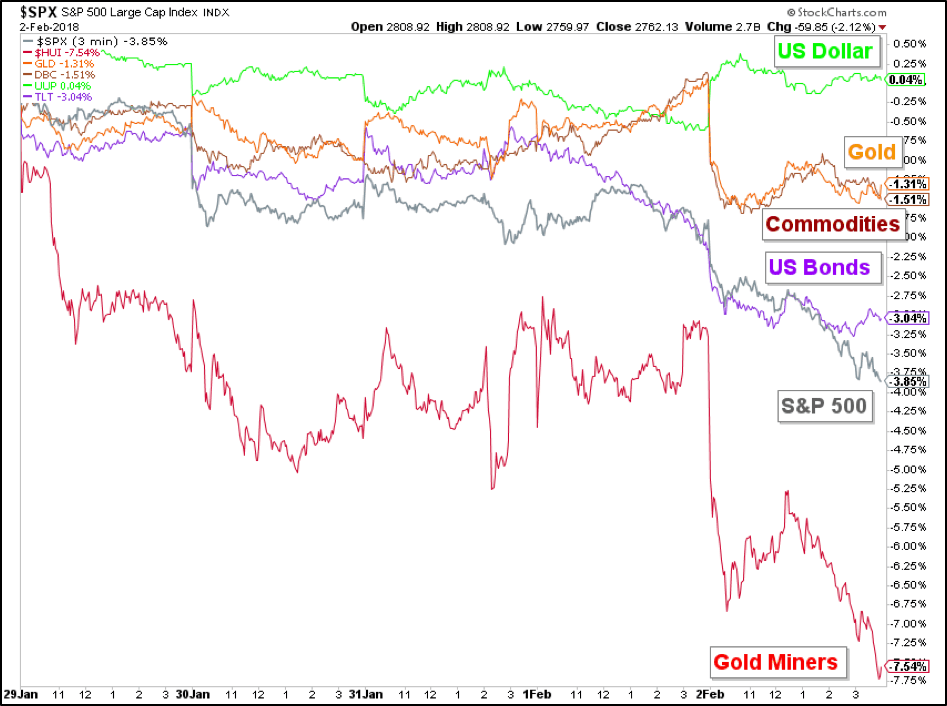

Comparing Broad Assets

A comparison of the broad assets for the week will allow us to put this information into perspective.

1 Week Comparison

- The U.S. dollar was a refuge this week against the fearful selling of all other asset classes. Overall for the week, the dollar ended evenly.

- In the middle of the week, gold dipped by 1.3%, staying close to broad commodities, which fell by 1.5%.

- U.S. bonds sharply declined, with 30-year bonds falling by more than 3.0%.

- U.S. stocks, shown by the S&P 500, dropped by almost 3.9%, the worst drop we’ve seen in two years.

- Senior gold miners experienced losses in gold and stocks, decreasing by more than 7.5% for the week.

A Recap of the Federal Reserve Meeting

This week was the last meeting with Janet Yellen as Fed chairwoman. Nothing particularly significant occurred, as interest rates were held to their current levels of 1.25-1.50%. Inflation in the 2.0% range is still what the bank is holding to as its official policy, and the U.S. employment market is staying stable.

Although the official Fed statement had no impact on the markets, the interview that followed with former Fed chairman Alan Greenspan, who served from 1987-2006, was one of the most shocking that we have experienced of any Fed official. His comments about the existence of bubbles in both the stock and bond market seem to have set off the selloff experienced this week in both U.S. asset classes.

If you missed it, take a look at this short clip from Bloomberg: https://www.bloomberg.com/news/articles/2018-01-31/former-fed-chair-alan-greenspan-sees-bubbles-in-stocks-and-bonds

The bottom line is that the genie has been let out of his lamp. The fear in the largest global debt market is tangible, and now that it has been released it will be much more difficult to contain it.

The irony here is that Greenspan was the man largely responsible for the stock market bubble of 2000 and the credit crisis of 2008, and this week he may have single-handedly been responsible for beginning the most dynamic part of the bond bear market that we have been expecting on the charts.