Vilas Fund Partner letter to investors for the fourth quarter ended December 31, 2017. See an update on their impressive short Tesla Inc (NASDAQ:TSLA) short thesis.

Dear Vilas Fund Partner,

Before we begin the discussion of performance, we would like to remind our investors that we use a concentrated value approach to our investments, which primarily includes equities but has included bonds as well. The goal of the Vilas Fund, LP is to produce long term returns that exceed equity market averages by a material amount, net of fees. To accomplish this goal, we are willing to tolerate both the markets going up and down as well as our strategy going in and out of favor. It is our hope that over many seasons, our strategy will produce a performance record that will compound capital faster than the vast majority of other options in the marketplace.

Performance Discussion

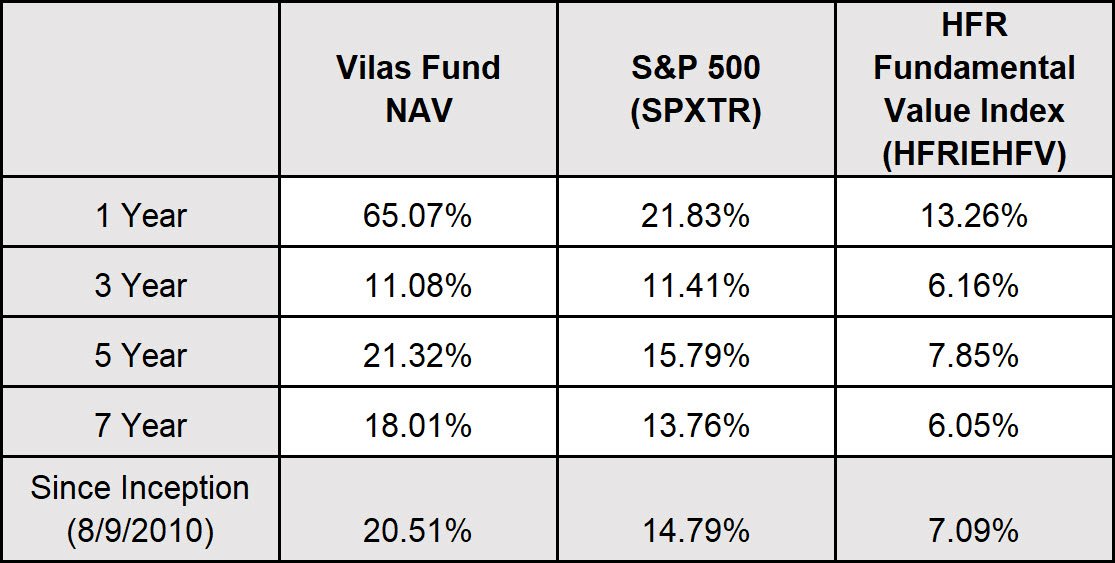

The Vilas Fund, LP rose 65.1% in 2017, net of all fees and expenses. This compares to the 21.8% gain in the S&P 500 Total Return Index. Since the inception of the Fund on August 9, 2010, the Fund has returned 20.5% annualized, net of fees, vs 14.8% for the S&P 500 and 7.1% for the HFRI Fundamental Value Index. This has compounded an initial investment of $1 million into $4.0 million in the Vilas Fund vs. $2.8 million in the S&P 500 and $1.7 million for the average hedge fund in our category. As the Fund has returned a net negative amount of capital gains since inception, the returns we have generated have not been partially taxed away.

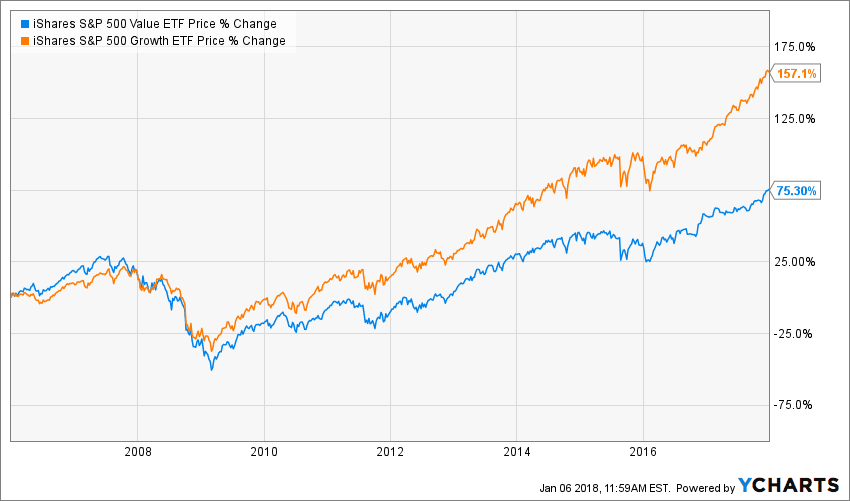

Importantly, this performance was generated without value outperforming growth and despite the fact that the Fund’s short position in Tesla is now our largest holding, long or short. Tesla was up 46% in 2017. Growth stocks have beaten value stocks over the last 12 years and the differential was especially acute this year as growth stocks had twice the return of value stocks (Growth up 24.6% in 2017 vs Value up 12.5%). Being long value and short growth has been suboptimal for years.

Market data shows that value stocks outperform growth stocks by material amounts over very long periods of time. However, if we go back from 12/31/93 until 12/31/2017, growth stock returns have exceeded value stocks by a whopping 2.12% per year (6.44% annualized for value vs 8.56% for growth). This is due to the fact that this period includes both the growth stock run in the late 1990’s as well as the period since the financial crisis, or tech bubble #2 as we think of it. In our opinion, this differential is far too great and a large, potentially rapid, reversion to the mean will occur. When? We have no idea. What will make it change? Again, no idea but recessions tend to put an end to speculation and return investors to the things that matter: earnings, dividends and book value. A recession does not seem to be anywhere on the horizon, so we are quite unsure when this will reverse. The markets look many years into the future, however, so by the time it is clear to all that the Economy is slowing down, it will likely be too late.

Current Environment

The world has become risk seeking instead of risk averse. It appears that many investors seem to be more worried about missing out than worried about losing their money. This can be the only explanation for investors around the world purchasing assets with no dividends, no earnings, no interest payments, or asset value. Scarcity alone is not an investment attribute; diamonds are scarce, and they have been a lousy investment for many years. Investing is purely a function of writing a check today to receive income and, hopefully, capital appreciation in the future. Income is needed, in the long run, to facilitate capital appreciation. When there is no income today or in anyone's reasonable time horizon, investing in those assets becomes pure speculation. This can be the only explanation for digital currencies and extremely high valuations for money losing or barely profitable enterprises. We are witnessing a bubble today that is one of the poster children of the Greater Fool Theory, whereby a speculator needs to find a more foolish person than himself to sell his assets to. These always end badly, using history as a guide.

Current Positioning

Our investments can basically be described as predominately deep value with short positions in glamour stocks with little earnings or asset values backing them. The Fund has roughly $3.50 in long positions for every $1 in short positions. While there are those who question the wisdom of shorting some of the “best companies”, we have made roughly ten times more money in our long positions than our short positions have cost the Fund. Interestingly, the profit on our “old economy” paired stocks such as Target, Kroger, WW Grainger, Walgreens, Express Scripts, Viacom, Daimler, Honda, GM, and Ford is roughly twice the amount that our glamour shorts, including Tesla, Amazon and Netflix, have cost us. The long positions are trading at roughly 12x forward estimates while the glamour short positions are, to be generous, 200x earnings. We agree there should be a spread. But instead of 188, we see 20-25 as a better differential between high growth PE ratios and deep value. After all, the money all companies earn is the same color.

The Fund is positioned, in general, with three main drivers of future returns: banks vs interest rates, Old Economy vs New Economy, and foreign vs domestic. Of course, there are other holdings such as GE, General Mills, and Zimmer that don’t fit this generalization but, overall, these are the biggest opportunities. As interest rates, both short-term and long-term, rise with global economic growth, banks and insurance companies will benefit. Banks need to keep a staggering amount of money in High Quality Liquid Assets, which in essence means Treasury Bills, due to regulatory requirements enacted after the financial crisis. This is required to protect society against potential “runs” on banks whereby both depositors and financial markets reduce their exposures and willingness to lend. Thus, the banks are holding a tremendous amount of money in cash that earns more the higher short-term interest rates go. Further, higher rates will make banks more competitive vs wholesale lenders and captive finance companies as their branches finally begin to deliver the benefits of cheaper deposits. Insurers have similar liquidity requirements and benefit, too, from rising short term rates.

We believe interest rates are too low and that long-term government rates should be 4-5% in a few years. Typically, long term interest rates need to compensate owners for their willingness to tie up their money for many years, exposing them to interest rate risk. Looking at long term data, ten-year Treasuries tend to return 2% more than inflation; thirty-year Treasuries return 3% more. Given the current inflation level of 2.2% (CPI) that appears to be accelerating with higher oil prices and economic growth, our target for long term rates is derived. With 4% unemployment, rising house prices, and strong economic growth, it is simply a matter of time for fixed income investors to demand higher rates of return for the risks they are bearing. This, too, will benefit banks and insurance companies as they can invest in higher yielding securities, adding significantly to their income.

Our second main investment theme is Old Economy vs New Economy, to use the terms from the last period of ridiculous valuations. Our holdings of auto stocks (Honda, Daimler, Ford and GM) have generated far more profits than our loss in Tesla and, unless financial gravity is repealed, this should continue. Our holdings in retail, including Target, Kroger, CVS, Walgreens, WW Grainger and Express Scripts, have dramatically outperformed our short position in Amazon. In our view, 12 times earnings is better than 250 times, regardless of the story. And finally, our position in Viacom has nearly offset our loss in Netflix. Again, in aggregate, we have made over two times more money in our “old economy” stocks than we have lost in our short positions. However, someday we think we will be right and will see the valuations of the ridiculous fall to mortal levels. This should reverse the losses in our short positions and create material profits. At the same time, the pressures on the Old Economy stocks should subside due to lesser fears of their demise from their New Economy competitors, leading to rising share prices. In this environment, as occurred from 2000-2002, our strategy should excel.

And finally, we have a material portion of the Fund invested in foreign stocks as they have generally lagged the US market badly and are far cheaper. For example, Barclays, our largest long position, is trading at roughly ⅓ the price to tangible book multiple of JP Morgan. Given that we still believe that JP Morgan is reasonably attractive, we hold a small position in it. However, we believe that Barclays will dramatically outperform the domestic banks and should experience significant multiple expansion. Barclays is a good bank, not perfect, but better than many. Overall, the Fund has roughly 43% of our net equity exposure in foreign names. Importantly, these are entirely developed country exposures such as Japan, Germany, Switzerland, and the UK. It is one thing to venture abroad in this manner, it is another to attempt to deal with generally lousy legal and accounting systems in developing nations. Not that these are bad places to invest but they are much riskier and demand tremendous focus. The vast majority of our short positions are domestic as the valuations in the US are far higher than elsewhere.

And, Tesla

Tesla is our largest position, long or short. The company cannot survive the next twelve months without access to capital from Wall Street Banks or private investors. We estimate that Tesla will need roughly $8 billion in the next 18 months to fund operating losses, capital expenditures, debts coming due, and working capital needs. However, it appears that due to past SEC investigations and current investigations (which terrifyingly have not been disclosed by the company), it will likely be difficult for Tesla to access public markets. According to a recent analyst report, there have been 85 SEC requests for additional information and disclosures in the last 5 years. This compares to Ford Motor Company’s total of zero over the same time frame. This means that Tesla is pushing many, many boundaries. When a company is under formal investigation, it is difficult, if not impossible, to raise capital from public markets as these investigations must be made public, which generally craters the equity and debt values. Therefore, Tesla investors better hope there are a number of Greater Fools in China or elsewhere to keep the company solvent. At some point, the music stops and there aren’t any open chairs. No matter how good a social investment makes you feel as it is going up, extreme anger will result if most or all of your money is permanently lost, especially when it is due to false and misleading statements by senior company officers. This is when the DOJ steps in and escorts untruthful managements to their new living quarters.

Conclusion

We continue to believe that a “teeter totter” market will appear. Deep value stocks, in general, are far too cheap and glamour stocks are far too expensive. Thus, we expect value stocks to rise and glamour stocks to fall. It is far too simplistic to assert that all stocks will trade together, as many pundits do, given the last 12 years of the growth bubble inflating at an accelerating pace. If, or better yet when, this occurs, the Vilas Fund, LP should participate in both the re-rating upward of depressed stocks and the bubble popping for the massively valued glamour names. In this environment, we would be quite hopeful that our lead over the S&P 500 and the competition should expand. For this reason, we are very optimistic about the future and thank you for your investment with our firm.

Sincerely,

John C. Thompson, CFA

CEO and Chief Investment Officer

Vilas Capital Management, LLC.