ETFGI reports record-breaking 2017 for US-listed ETFs and ETPs with assets increasing 34.3% to reach a record US$3.42 trillion

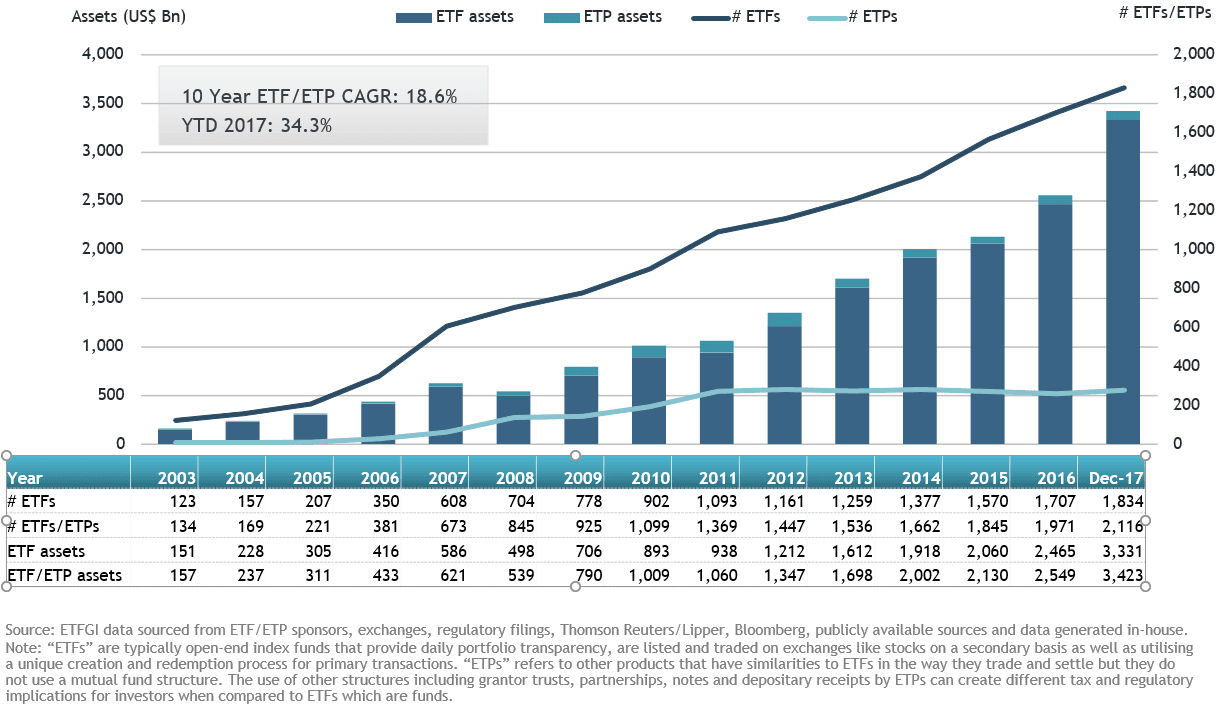

LONDON — January 5, 2018 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that assets invested in ETFs and ETPs listed in the United States increased by 34.3% during 2017 to reach a new high of US$3.42 Tn at the end of December.

[REITs]According to ETFGI’s December 2017 US ETF and ETP industry insights report, an annual paid-for research subscription service, assets invested in US-listed ETFs/ETPs grew by a record US$874 Bn during 2017, over double the previous record of US$419 Bn set in 2016. The increase of 34.3%, from US$2.55 Tn at the end of 2016, also represents the greatest growth in assets since 2009 when markets recovered following the 2008 financial crisis.

This record was achieved on the eve of another milestone for the ETF industry: the 25th anniversary of the listing of the first ETF in the US, the venerable SPDR S&P 500 ETF (SPY US), on 22nd January 1993. At the end of 2017, SPY on its own accounted for assets of US$271 Bn.

During 2017 ETFs/ETPs listed in the US saw record net inflows of US$468 Bn; 68.0% more than net inflows for 2016, and over double the average for net inflows over the previous 5 years. December 2017 also marked the 23rd consecutive month of net inflows into US-listed ETFs/ETPs, with US$44.3 Bn gathered during the month.

The majority of these flows can be attributed to the top 20 ETFs by net new assets, which collectively gathered US$209 Bn during 2017. The iShares Core S&P 500 ETF (IVV US) on its own accounted for net inflows of US$30.2 Bn.

Top 20 ETFs by net new assets: US

| Name | Ticker | Assets (US$ Mn) Dec-17 |

ADV (US$ Mn) Dec-17 |

NNA (US$ Mn) 2017 |

| iShares Core S&P 500 ETF | IVV US | 139,496 | 1,007.2 | 30,195.48 |

| iShares Core MSCI EAFE ETF | IEFA US | 42,255 | 245.6 | 20,881.46 |

| Vanguard FTSE Developed Markets ETF | VEA US | 68,411 | 314.8 | 17,462.32 |

| iShares Core MSCI Emerging Markets ETF | IEMG US | 42,768 | 402.7 | 16,589.23 |

| Vanguard S&P 500 ETF | VOO US | 83,676 | 492.1 | 14,958.61 |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | LQD US | 39,075 | 661.2 | 11,483.56 |

| iShares MSCI EAFE ETF | EFA US | 84,560 | 1,430.6 | 11,201.29 |

| iShares Core U.S. Aggregate Bond ETF | AGG US | 53,013 | 289.2 | 10,843.83 |

| Vanguard FTSE Emerging Markets ETF | VWO US | 66,694 | 436.4 | 9,265.53 |

| Vanguard Total Stock Market ETF | VTI US | 90,938 | 292.6 | 8,337.21 |

| Vanguard Intermediate-Term Corporate Bond ETF | VCIT US | 18,621 | 88.5 | 7,964.25 |

| iShares Core S&P Small-Cap ETF | IJR US | 36,017 | 198.4 | 6,539.16 |

| SPDR S&P 500 ETF Trust | SPY US | 271,379 | 20,740.7 | 6,210.60 |

| Vanguard Short-Term Corporate Bond ETF | VCSH US | 21,681 | 137.3 | 5,843.18 |

| Financial Select Sector SPDR Fund | XLF US | 32,751 | 1,677.7 | 5,765.33 |

| iShares MSCI Eurozone ETF | EZU US | 15,363 | 332.4 | 5,667.14 |

| Vanguard Total Bond Market ETF | BND US | 37,233 | 161.4 | 5,401.07 |

| Vanguard Value ETF | VTV US | 36,532 | 128.6 | 5,075.11 |

| Vanguard FTSE Europe ETF | VGK US | 18,403 | 161.8 | 4,787.27 |

| Vanguard FTSE All-World Ex-US Index Fund | VEU US | 22,268 | 97.5 | 4,697.90 |

Similarly, the top 10 ETPs by net new assets collectively gathered US$7.80 Bn during 2017.

Top 10 ETPs by net new assets: US

| Name | Ticker | Assets (US$ Mn) Dec-17 |

ADV (US$ Mn) Dec-17 |

NNA (US$ Mn) 2017 |

| iShares Gold Trust | IAU US | 10,148 | 96.2 | 1,929 |

| VelocityShares Daily 3x Long Natural Gas ETN | UGAZ US | 1,000 | 245.3 | 1,275 |

| iPath S&P 500 VIX Short-Term Futures ETN | VXX US | 932 | 934.8 | 1,063 |

| ProShares Ultra VIX Short-Term Futures | UVXY US | 394 | 297.4 | 883 |

| SPDR Gold Shares | GLD US | 34,899 | 797.3 | 756 |

| VelocityShares Daily 2x VIX Short Term ETN | TVIX US | 217 | 91.1 | 622 |

| FI Enhanced Global High Yield ETN | FIHD US | 1,134 | 3.3 | 357 |

| United States Natural Gas Fund LP | UNG US | 678 | 79.8 | 352 |

| FI Large Cap Growth Enhanced ETN | FLGE US | 1,729 | 3.5 | 292 |

| iShares S&P GSCI Commodity-Indexed Trust | GSG US | 1,394 | 3.8 | 277 |

US-listed Equity ETFs/ETPs saw net inflows of US$38.9 Bn in December, bringing net inflows for 2017 to US$336 Bn. Fixed income ETFs and ETPs experienced net inflows of US$5.07 Bn in December, growing net inflows for 2017 to US$111 Bn.

Please contact [email protected] if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.