Private debt assets under management grow threefold in the past decade

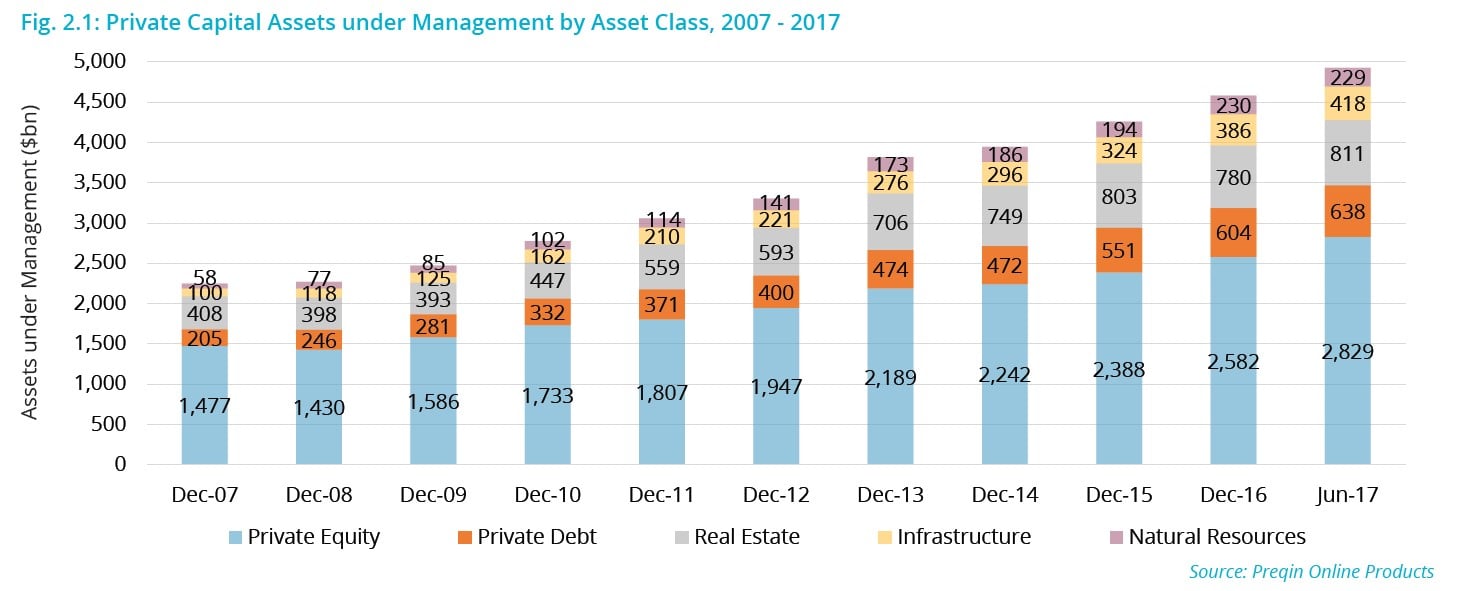

The private debt industry has tripled in size since the end of 2007, reaching a new record of $638bn in assets under management as of the end of June 2017 (the latest data available). The asset class has shown a consistent pattern of growth in assets, despite increased capital distributions to investors in recent years. Although the net flow of capital to investors has been negative in 2015 and 2016, each year saw more than $90bn returned to investors, an unprecedented high, and H1 2017 alone recorded a further $71bn in capital being returned, raising the prospect of the industry distributing more than $100bn through the year for the first time. This strong performance in recent years has buoyed investor appetite and spurred consistent high fundraising levels. This pattern looks set to continue into 2018: 42% of investors say they intend to commit more to private debt in the year ahead than they did in the 12 months prior.

2018 Preqin Global Private Debt Report Highlights:

- As of June 2017, private debt assets under management have grown to a record $638bn. The industry has tripled in size since December 2007, when AUM stood at $205bn.

- Capital calls and distributions reached unprecedented levels in 2015 and 2016, with each year registering $100bn in calls and over $90bn returned to investors.

- 2017 is on track to break those records, with the first half of the year seeing $55bn called up from investors, and $71bn returned to them.

- Distributions have been driven by strong performance: private debt funds returned 18.4% in the year to June 2017, and an annualized rate of 10.9% in the five years to that point.

- Strong performance has pleased investors, with 51% holding a positive view of the asset class. Furthermore, 42% plan to commit more to private debt in 2018 than they did in 2017.

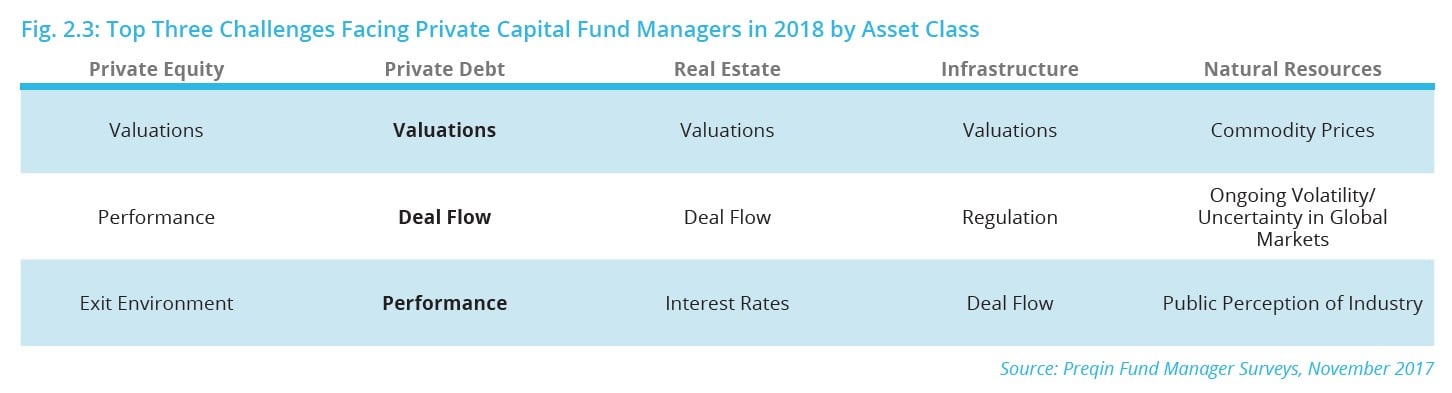

- However, recent influxes of capital have driven dry powder to record highs, and seven out of 10 fund managers report that there is more competition for transactions compared to 12 months ago.

Ryan Flanders, Head of Private Debt Products:

“The private debt industry has maintained its course of strong, consistent growth through 2016 and into 2017. Funds have seen strong performance, and fund managers have been able to both put capital to work and return capital to investors at greater levels than ever before. This has stoked investor confidence, and many have looked to reallocate capital to the asset class in ever-increasing quantities, spurring record fundraising levels. Given the sustained appetite among investors, and the fact that many plan to commit more fresh capital in the year ahead, indications are that the industry can maintain this rate of expansion in the months to come.

However, there are dangers that come from growing too fast too quickly, and fund managers and investors alike are alive to concerns that the influx of capital to the asset class might make for a challenging deal making environment. Dry powder available to fund managers approached a quarter of a trillion dollars as of the end of 2017, and has created pricing pressure. Both fund managers and investors cited valuations as their top concern for 2018, and if fundraising continues at its current pace, these conditions are likely to intensify.”

Article by Preqin