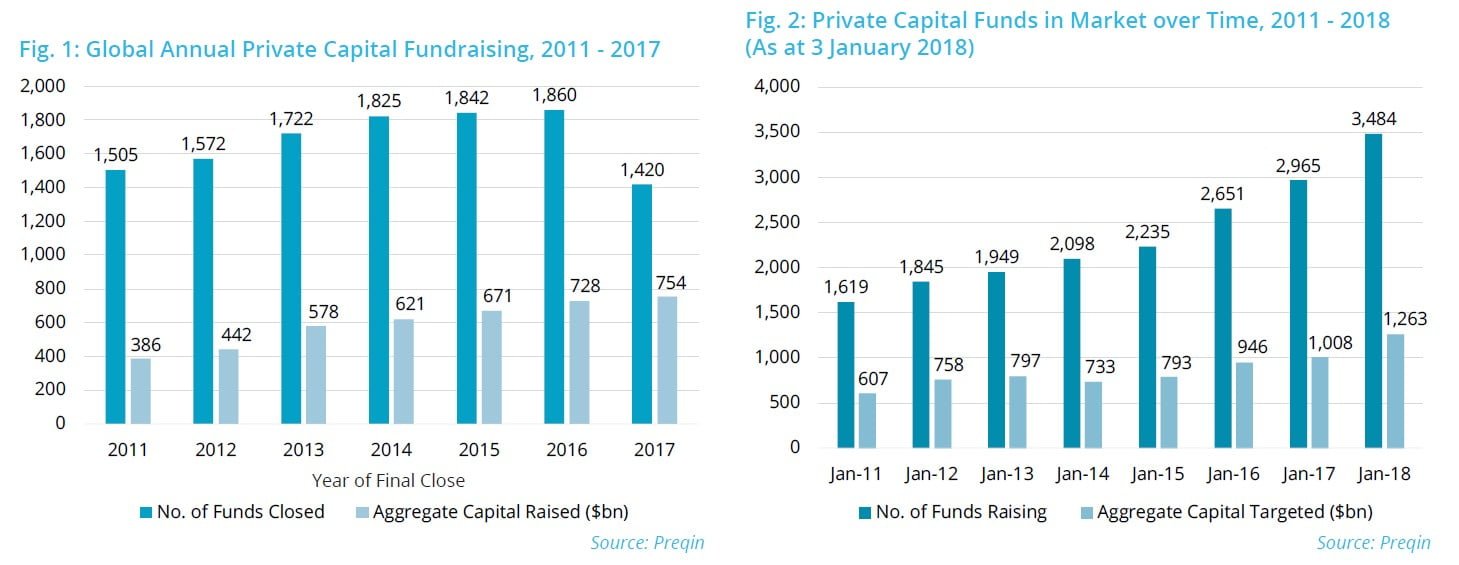

At the end of September, Preqin asked whether a dip in quarterly fundraising might represent a slowdown in overall activity, or simply a pause in a record-breaking year. Three months later, the private capital industry has recovered its momentum: 261 funds raised a total of $162bn in Q4, making 2017 a banner year for the industry. Overall, 1,420 private capital funds reached a final close through the year, securing a combined $754bn in investor commitments. This surpasses the previous record of $728bn raised by 1,860 funds in 2016, despite notably fewer funds closing.

This is largely due to the closure of several record-breaking funds: 2017 marked the closure of the largest ever buyout fund and the largest ever infrastructure fund, as well as funds ranked among the five largest ever for venture capital, secondaries, growth and natural resources. Overall, the average size of private capital funds closed in 2017 was $570mn, significantly above the average of $445mn seen in 2016 and surpassing the previous record of $475mn in 2008.

The record amounts of capital being committed to the industry will be an encouraging sign for fund managers, but there may be concerns about the twin pressures of fundraising competition and capital concentration in the months ahead. Although Preqin expects fundraising figures to rise by up to 10% as more information becomes available, the number of funds closed marks a decline from 2016. While huge amounts of capital are being allocated by investors, fewer funds are reaching a final close than in previous years, with the most experienced and high-profile managers accounting for rising proportions of total fundraising year on year.

At the same time, the rate of new funds coming to market is accelerating, and has consistently hit new heights throughout

2017. At the start of January 2018, there are 3,484 private capital funds seeking investment, 2.5x the number of funds that closed in the preceding 12 months. This is twice the proportion that it was five years ago, a sign of how the fundraising market has become more competitive in recent years. With investor demand remaining strong, 2018 may see further robust fundraising, but if current trends continue many managers will nevertheless find fundraising a challenging process.

Private Equity: Landmark Year In 2017

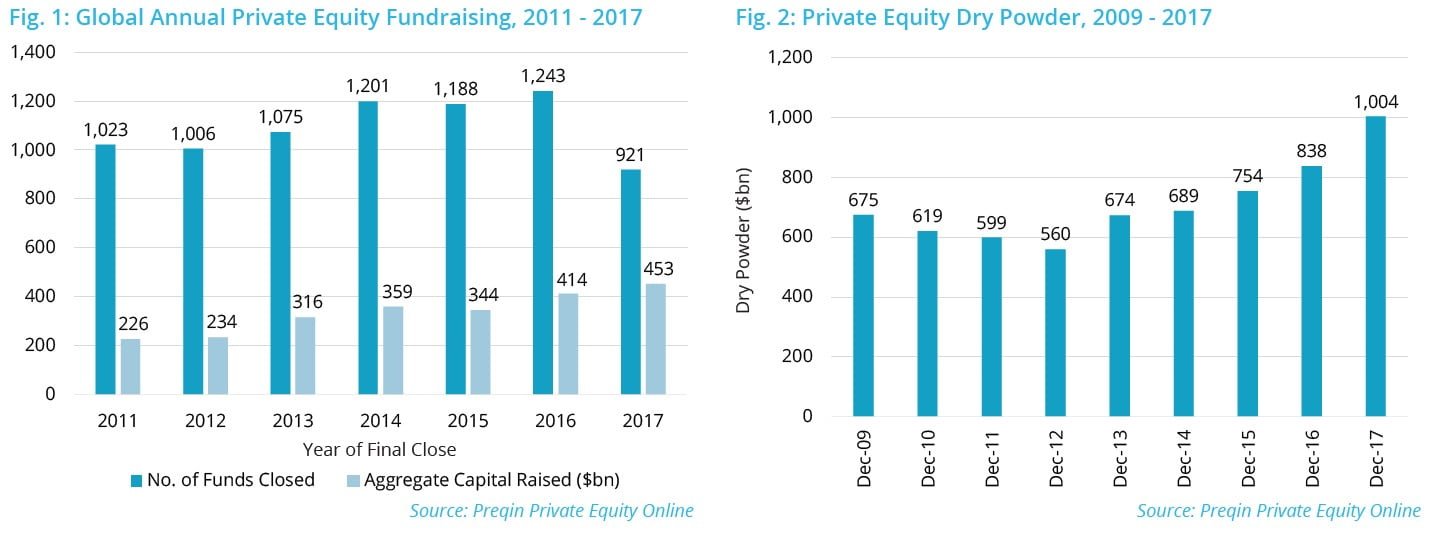

2017 saw 921 private equity funds reach a final close, securing a total of $453bn in investor commitments. This is an all-time fundraising record for the private equity industry, surpassing the previous record of $414bn that was raised by 1,044 funds in 2007. Preqin expects these figures to rise by up to 10% as more information becomes available. This was driven by the closure of mega buyout funds: mega funds of $4.5bn or more raised $174bn, far more than the $119bn raised by the equivalent group in 2007.

With such strong fundraising, it is unsurprising that dry powder levels continued to rise through 2017, and at the end of December exceeded $1.00tn, up from $838bn at the end of 2016. However, this landmark is not necessarily positive for the industry: entry prices for assets remain very high, and with so much available capital competing for deals, this will only increase the challenge for fund managers looking to deploy capital in 2018.

Key Findings:

- 2017 saw 921 private equity funds raise $453bn. This exceeds the previous record of $414bn set in 2007.

- North America-focused funds secured a record $272bn, while Europe-focused funds raised $108bn, equalling previous levels.

- Buyout funds raised $289bn through the year. Of this, mega funds of $4.5bn or more account for a record $174bn, while other sizes saw fundraising totals fall from or stay level with 2016.

- Venture capital funds raised $55bn, while growth funds secured $39bn, both lower totals than in 2016. Secondaries funds raised $37bn, significantly surpassing previous records.

- Robust fundraising has driven dry powder to new heights, and total available capital reached $1.00tn at the end of December.

- At the start of 2018, there are 2,296 private equity funds in market, seeking a combined $744bn in investor commitments.

- Of these, 1,050 vehicles have already held an interim close, securing a total of $268bn from investors.

2017 has proved a landmark year for the private equity industry, as it has surpassed the fundraising highs seen a decade ago. Apollo Investment Fund IX has become the largest private equity fund ever closed, breaking a record that has stood for a decade. At the same time, buyout and secondaries funds have both marked record fundraising totals, while venture capital and growth funds have continued the strong fundraising patterns seen in recent years.

While this is encouraging for the industry, it is notable that the bulk of capital raised in 2017 has been secured by the largest vehicles, with smaller funds not surpassing previous totals. This trend looks set to continue: there are still funds in market that are aiming to be the largest of their type, including SoftBank Vision Fund. Interim closes held by these vehicles have helped push the capital available to fund managers above $1tn for the first time, a landmark which both confirms the strength of the fundraising market and puts enormous pressure on fund managers to deploy capital in the coming months.

Christopher Elvin

Head of Private Equity Products

Private Debt: Direct Lending Drives Record 2017

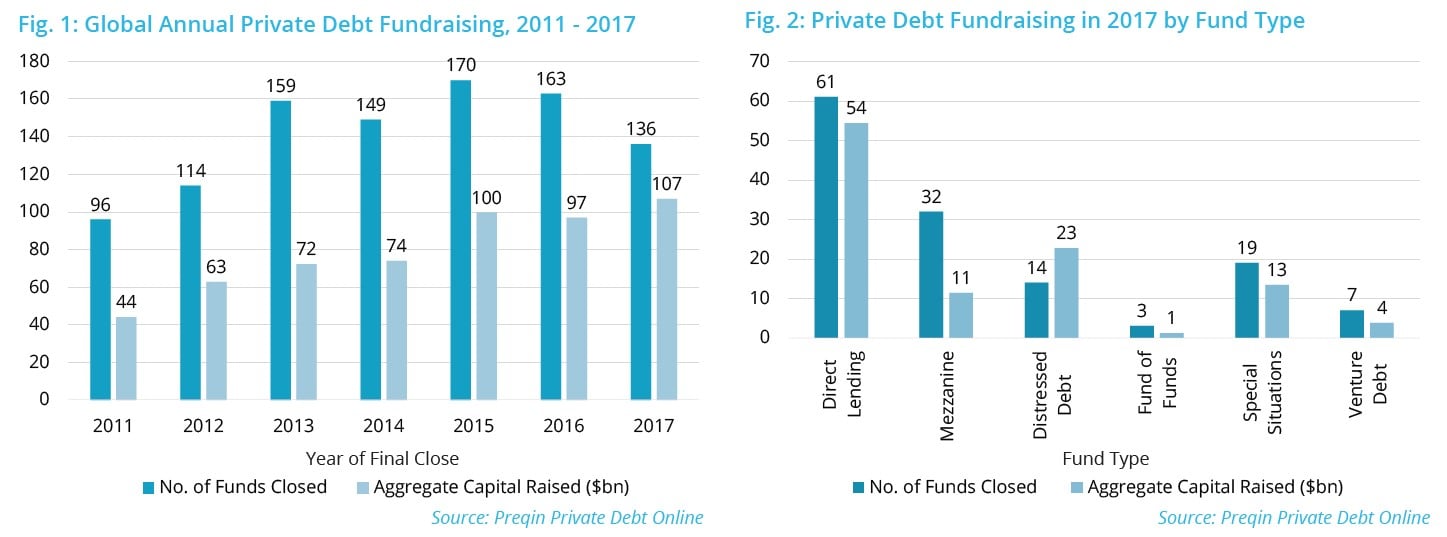

2017 was a record year for private debt fundraising, as a combined $107bn was raised by 136 vehicles. Preqin expects these figures to rise by up to 10% as more information becomes available, going beyond the previous record of $100bn set in 2015. This was primarily driven by direct lending funds: 61 funds employing this strategy secured a total of $54bn, significantly above the $38bn raised in 2015, the previous high. By contrast, just 14 distressed debt funds closed through the year, raising an aggregate $23bn. This is the lowest number of vehicles closed for the debt type since 2014.

Private debt funds that closed in 2017 also tended to see faster fundraising processes, and have experienced greater success in their efforts. The average fund closed in 2016 spent an average of 19 months in market, but this has dropped to 14 months in 2017, an eight-year low. At the same time, 58% of private debt funds closed through the year exceeded their target size, the largest proportion Preqin has recorded. This includes over a quarter (27%) of funds that raised 125% or more of their targeted capital.

Key Findings:

- Private debt funds marked a record 2017, as 136 vehicles raised a total of $107bn. This surpasses the previous record of $100bn raised by 170 funds in 2015.

- Sixty-one direct lending funds secured a record $54bn, while 14 distressed debt funds raised $23bn and 19 special situations funds secured $14bn.

- North America saw the most activity, with 75 funds focused on the region raising a total of $67bn. Europe-focused funds secured $33bn, while Asia-focused funds raised $5.9bn.

- The largest private debt fund closed in the year was Intermediate Capital Group’s Senior Debt Partners III, which raised €4.2bn for direct lending investments.

- Strong fundraising pushed private debt dry powder to record highs. Capital available to fund managers reached $234bn at the end of December.

- At the start of 2018, there are 336 private debt funds in market, seeking a combined $159bn.

2017 has proved to be another strong year for the private debt fundraising market, as fundraising topped $100bn. Fund managers also seem to be achieving increased fundraising success and a quicker fundraising process: the average fund closed in 2017 raised more than its stated target in less than a year and a half. This is indicative of strong investor appetite, as more institutions become active in the private debt space each year.

So far, growth in private debt fundraising has not relied on a small coterie of mega funds, diverging from fundraising trends apparent in private equity. Instead, we have seen a number of significant but not outsized funds being closed to focus on specific regions or markets, with the largest fund closed this year securing €4.2bn. However, the number of funds closed in 2017 is notably lower than in recent years, and with several mega funds in market, the asset class could be seeing the emergence of a trend towards capital concentration already prevalent in private equity.

Ryan Flanders

Head of Private Debt Products

Article by Preqin

See the full PDF below.