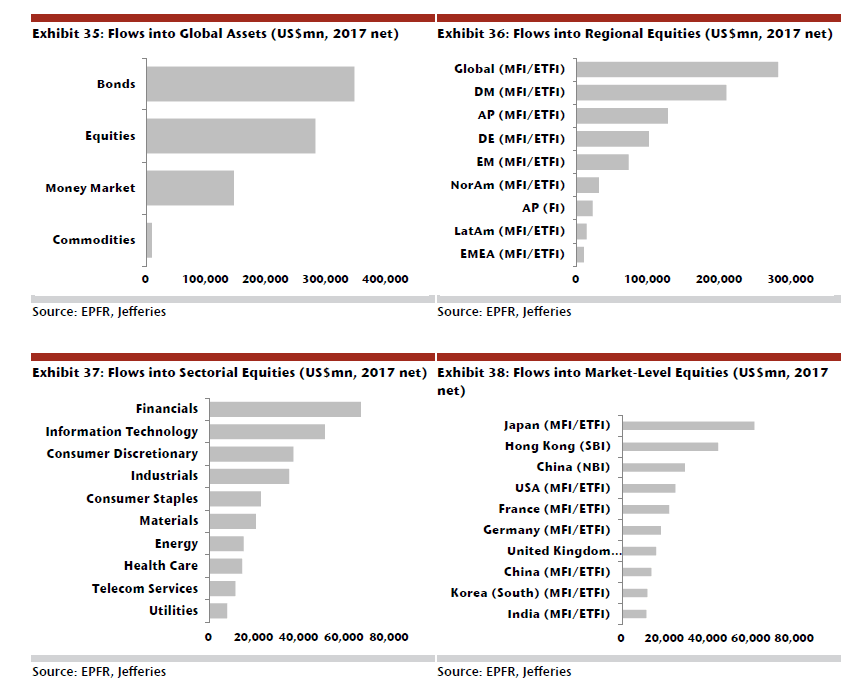

Although the overarching story of global markets in 2017 was subdued volatility, overall there were net inflows almost entirely across the board – with global equity mutual funds/ETFs (US$281bn), bond funds (US$346bn), global money markets (US$145bn) and commodities (US$8.6bn) recording increases. Investors poured record net inflows of over $620bn into global equity mutual funds/ETFs and bond funds – recording an impressive combined tenfold increase from 2016 when the US election and Brexit speculation depressed risk appetite. During 2017 investor confidence was supported by moderate interest rate policy actions from central bankers worldwide, combined with consistent upward momentum in global equities as the year progressed.

Global Equities

Global equity mutual funds/ETFs saw the biggest turnaround year-on-year up from 2016’s net outflow of -US$92bn to US$281bn in 2017. Part of the upward global equity performance can be attributed to the 10% fall in the US dollar over the year. At the sector level: financials, IT, health care, consumer staples, materials, telecom services and utilities all experienced record high net inflows globally for 2017. Geographically, each of the largest economic regions experienced net equity inflows throughout 2017 with Japan experiencing the highest net inflows (US$61bn) via mutual funds/ETFs in 2017. Even the UK saw net inflows of US$16bn into equities - despite the sizeable political turmoil surfacing from Brexit discussions and the rash decision from UK Prime Minister Theresa May to hold a snap election in June. Overall, there has been a sizeable shift into ETFs over mutual funds as investors show a preference for passive over active. Specifically, stock mutual funds experienced $153bn of redemptions.

Commodities

2017 saw net inflows in gold (US$9.5bn) and precious metals (US$9.4bn) lead the pack in commodities. However, relatively unsurprisingly, energy funds experienced outflows (-US$867mn) for the second consecutive year, driven by the persistence of 2016 risk factors.

Money Markets

Recording net inflows of US$145bn, money markets saw the best year-on-year gain since the 2008 financial crisis. The US money market captured the lion’s share of net inflows (US$121bn) – with the biggest spike coming towards the end of the year in November/December.

Fixed Income

Fixed income funds attracted more inflows than equity funds in 2017. Europe attracted inflows based on the perceived stability created by the election of Macron in France, combined with the welcomed stimulus action from the European Central Bank. Meanwhile in Asia, inflows were supported by the BoJ bond-buying programme alongside Chinese economic strength. Inflation-protected bonds also experienced a second year of sizeable inflows (US$10bn).

Net inflows were dominated by investment grade bond funds (up US$70bn), with a notable trend of rotating out of government bonds into corporates that has continued through from 2016. However, investors are still discerning in the quality of corporate bond investments chosen - with high-yield bond funds experiencing outflows over 2017 (-US$17bn).

Emerging Markets

EM valuations tumbled following Trumps election over a year ago and investors withdrew close to $30bn from the EM asset class/currencies – based on an expectation that Trump would implement damaging protectionist policies once in office. However, a year later the story has turned around with EM investors experiencing the best year of performance in almost a decade and the MSCI EM index gaining a stellar 30 percent and EM bonds returning 8.1 percent in 2017.

What to expect for 2018?

2017 was a year of arguably steady market activity – with positive net inflows across various asset class funds. 2018 might prove to be a more volatile year – with the end of Janet Yellen’s term as US Fed Chairperson in February and the Greece’s 3rd financial bail-out expiring in August. Meanwhile the uncertainty surrounding Brexit will persist at least until its scheduled conclusion in October which will be shortly followed by US mid-term elections in early November. Each of these events has the potential to reduce risk appetite. On the other hand, they might in fact lead to increased optimism - if investors and asset managers regard these events as potential opportunities rather than driving a flight to quality. Throw into the mix the growing digital asset investment space, with cryptocurrencies and blockchain technology steadily garnering legitimacy, and 2018 looks set to be a year of increased prospects.

Data and charts via Jefferies