Leaving investors tied into the asset holdings with little-to-no get-out clause, illiquid investments have always presented market participants with a conundrum. The lure of capturing the illiquidity premium to boost aggregate portfolio returns is enough to tempt certain investors into allocating to illiquid assets. Sensible investors will seek to optimise their risk-reward ratios before jumping in – but the very nature of illiquid assets means that the historical price and volume data available is patchy and notoriously volatile.

A look at Private Equity

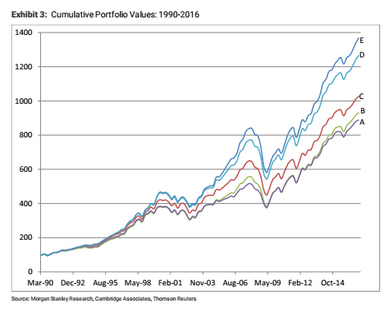

So, is it a foregone conclusion that illiquid assets should be avoided altogether? Recently published research from Morgan Stanley found that quarterly historical return data from the 26 years between 1990 and 2016, shows that funds with a large percentage invested in private equity assets have consistently produced return advantages (between 1.5% and 2%) relative to a traditionally allocated 60/40 equity/bond portfolio.1

A Play on Cyclicality?

Before we get too excited by these figures we should also consider that the same research indicated that the same return advantage fell to closer to 0.5% over the more recent 2010-2016 period of analysis. In the current low interest rate environment, a 1% difference in returns can be significant. The recent surge in US equity performance has contributed to the closing in on this gap in the return advantage. This suggests there may be a play on cyclicality to be made with respect to a rotation to increased illiquid allocations (to a certain limit of course) according to a counter-trend with economic cycles.

What can history teach us?

The historical analysis and findings from Morgan Stanley found that returns are negatively impacted due to liquidity charges alongside the cost of binding commitments when it comes to adding illiquid assets to the most liquidity sensitive funds. In these cases, the net returns advantage can be eroded in its entirety and investors would be better off looking for liquid assets offering the same returns and volatility and the flexibility they desire.1

However, for funds that are less sensitive to liquidity constraints there is significant advantage to be captured from holding illiquid assets – assuming these investors/ fund managers can apply effective timing of course.

The Trade-Off

Many investors cannot necessarily afford to sign away flexibility in their allocations over long periods of time – which is what would be required to capture benefits from illiquid asset holdings. Like many other areas of strategic investing there’s always a catch, or as we say in the industry – a “trade-off” to be made. Investors who can stomach the commitment, lack of data, volatility in pricing and the implicit costs might we rewarded for their risk-taking longer term. But for an average extra return of 1-2% per annum is it worth it after factoring in the higher risks involved? For most the answer may very well be no – thankfully there are sizeable risk-adjusted gains to be had in liquid markets in the current market climate (with the S&P 500 up 4% in the first few weeks of 2018 alone2). For those with more capital to risk, taking a turn at private equity might prove fruitful. A useful first step would be to carry out some thorough due diligence and perhaps a consideration of counter cyclical timing.

Sources:

1 Morgan Stanley, Portfolio Strategy Illiquidity Returns and Liquidity Charges, 17th January 2018

2 Financial Times Market Data, S&P 500 INDEX, INX: IOM https://markets.ft.com/data/indices/tearsheet/summary?s=INX:IOM