One of the problems that we face as investors is making comparisons between investment opportunities. Similarly, company management has to make comparisons between strategic merger and acquisition opportunities. So the question is, what is the best way to do this?

One answer can be found in Michael Mauboussin’s recent paper titled – How Well Do You Compare. The paper highlights how humans are flawed when it comes to making investment decisions based on comparisons. He presents a number of systematic strategies that will help improve our outcomes.

Here’s a summary of Mauboussin’s findings:

“Comparing is something we humans do quite naturally, but you and I are not always good at it. If you are a perfectly rational person, you gather all of the salient information about your alternatives and select the option that maximizes your utility. This is a fancy way of saying you pick what makes you happy.”

The problem for us humans is that we use ‘analogy’ as our basis for comparison. Mauboussin describes ‘analogy’ as follows:

The primary mechanism we use [for comparison] is analogy. Analogy is an “inference that if two or more things agree with one another in some respects they will probably agree in others.”

Douglas Hofstadter, a renowned professor of computer and cognitive science, has suggested that analogy is “the core

of cognition.” The application of analogical thinking generally has four steps.

- First, we select a source analog that we will use as the basis of comparison with the target. Usually, the source comes from our memory.

- Second, we map the source to the target to generate inferences. Here, we are often looking for similarities.

- Third, we assess and modify these inferences to reflect the differences between the source and the target.

- Finally, we learn from the success or failure of the analogy.

Analogy can be a powerful way to compare, but there are common mistakes in its application. Here are a few based on the first three steps:

Step 1 mistakes: Most people rely on their memories to retrieve analogies. Psychologists call this the availability bias, and it shrinks the scope of inquiry. Because our experiences and memories are limited, we fail to identify proper analogies.

Step 2 mistakes: The second failure is a lack of depth. This is a faulty inference based on the superficial features of the analogy. Another way to say this is the analogy suggests correlation but fails to identify causality. Solid theory is rooted in causality. The process of theory building raises the level of understanding from one based on attributes to one based on circumstances.

Step 3 mistakes: The third failure has to do with the inferences we draw based on whether we focus on the similarities or the dissimilarities between the source analog and the target. Psychologists call this the “contrast model,” and it says the similarity between two entities is a weighted function of matching and mismatching features.

So how does that apply in the world of investing?

Comparable company analysis. It is common for an investor to assess the relative attractiveness of a company’s stock or bonds by comparing the valuation to the appropriate securities of comparable firms. Common metrics for stocks include multiples such as price to earnings (P/E), enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA), and price to book (P/B), as well as dividend and free cash flow yield. The common metric for bonds of similar maturities and terms is yield.

Which companies an analyst selects as the basis of comparison can play a large role in shaping the conclusions he or she reaches. There are two basic approaches to selecting peer companies.

- The first, which most fundamental investors use, is based on industry classification. The most popular of these is the Global Industry Classification Standard (GICS). GICS classifies companies by sectors, industry groups, industries, and subindustries. The narrower definitions are more specific but have fewer companies.

- The second approach selects companies based on the fundamental characteristics that drive value. Two companies in different industries may have more in common with one another than they do with other firms in their respective industries.

The approach using GICS misses the connection while the approach using fundamental drivers captures the link. Most fundamental investors and investment bankers do comparable company valuation analysis based on industry peers.

Both approaches have the same goal: use an input (GICS or fundamental characteristics) to generate an output (valuation). When researchers examined how analysts actually select companies for comparison, they found that analysts pick peers with high valuations when they want to argue that a stock is cheap. It appears that the comparable company analysis is less an exercise in objectivity and more an exercise in persuasion.

Another flaw in selecting industry peers is that multiples may vary for justifiable economic reasons. For instance, two companies with the same growth rate in earnings but with different returns on invested capital will justifiably trade at dissimilar P/E, EV/EBITDA, and P/B multiples. A failure to recognize the impact that return on invested capital has on valuation can lead to superficial, and incorrect, conclusions.

Comparable company analysis, like many of the methods we use to compare, can be an effective tool if used appropriately and misleading if used improperly.

So how can investors improve their ability to make comparisons?

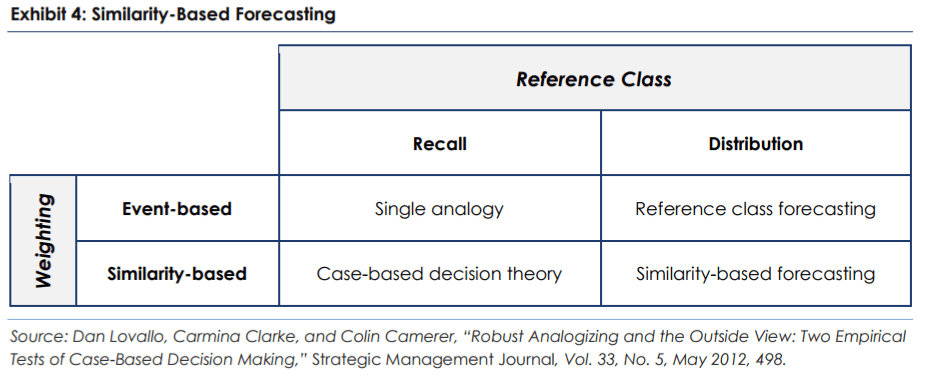

We need to address the common mistakes in order to improve our ability to compare. Dan Lovallo, Carmina Clarke, and Colin Camerer, researchers who study decision making, describe the problem of relying too much on analogies drawn from memory and offer a solution they call “similarity-based forecasting.” They suggest considering two dimensions (see exhibit 4). The first is the reference class, or what you are comparing to. The second is the weighting, or how much emphasis you should place on a particular analogy or feature.

They start by recognizing that most of us use a single analogy that we draw from memory. The reference class is one analogy, and we place all of our weight on it. If you happen upon a proper analogy, this is a quick and efficient way to compare. But single analogies can be very misleading because the scope of inquiry is too narrow.

You can prompt decision makers to consider more than one analogy and to weight them relative to the focal decision. This is called “casebased decision theory” and is generally better than single analogy recall. But it also runs the risk of having too little breadth and depth.

Lovallo, Clarke, and Camerer ran an experiment with private equity investors and found that prompting the investors to consider relevant, additional cases improved the quality of their forecasts. There are ways to be effective with case studies, but executives and investors are generally not as careful as they should be in curating and developing appropriate cases.

We tend to compare by relying on recall. Kahneman wrote, “People who have information about an individual case rarely feel the need to know the statistics of the class to which the case belongs.” This suggests we typically stop at the boundary of our memory. The decision-making research shows that the thoughtful integration of an appropriate reference class improves the quality of comparisons and forecasts.

“Reference-class forecasting” asks the question, “What happened when others were in this position before?” It is an unnatural way to think because it deemphasizes memory and experience and requires a decision maker to find and appeal to the reference class, or base rate.

But research in social science shows that the proper integration of a reference class improves the quality of forecasts. Since comparisons often rely on forecasts, reference-class forecasting is a marked improvement relative to relying solely on memory.

For example, say you are comparing two companies, one with sales of $40 billion and the other $4 billion, that both have an expected annual sales growth rate of 20 percent in the next 5 years based on the average projections of analysts. In this case, you can examine the past five-year growth rates of all companies of comparable sizes to get a sense of the plausibility of achieving that growth. The percentage of $40 billion companies reaching that rate of growth is less than half that of $4 billion companies.

Reference-class forecasting confirms that rapid growth occurs more frequently for smaller firms than for bigger ones.

Reference-class forecasting goes from using memory for comparison to a large distribution that reflects an appropriate reference class. But the approach evenly weights each outcome in the distribution. When we compare the growth rates of $40 billion and $4 billion companies, we are not asking whether some of the companies in the sample are more similar to the focal company.

Lovallo, Clarke, and Camerer argue for “similaritybased forecasting,” which uses a large distribution but then weights some of the cases more than others based on how similar they are to the relevant target.

Mergers and acquisitions (M&A) provide a good example. Historically, M&A deals have failed to create value for the acquiring company around two-thirds of the time. But acquirers fare better when they pledge a small premium, pay with cash instead of stock, and do a tuck-in as opposed to a swashbuckling deal to chart a new strategic course.

In comparing alternatives for capital allocation, an executive should consider the full reference class but may weight certain deals more than others based on their similarity to the transaction at hand.

In summary…

Comparing, while essential to effective decision making, comes naturally to humans. But our basic approach of relying on analogy can limit our ability to compare effectively. Analogy is a natural and potentially robust way to compare, but you must be careful to avoid the common mistakes, including a lack of breadth and depth as well as misallocation of attention. In each of these cases, we can use systematic strategies to improve our outcomes.

You can read the entire paper here.

Article by Johnny Hopkins, The Acquirer's Multiple