Spruce Point Capital Management is pleased to announce it has released the contents of a unique research report on Matthews International Corp. (Nasdaq: MATW). Spruce Point has conducted a forensic financial review of MATW and believes it to be a poorly organized company suffering from operational problems, declining financial performance, accounting and financial control weakness, and is excessively levered with nearly $1 billion of debt and limited covenant cushion. Based on our research opinions, we believe investors and the public would be best served with the immediate resignation of MATW’s CEO, CFO and Controller.

As a result, we have issued a "Strong Sell" opinion and a long-term price target of approximately $18.50 - $24.50 per share, or approximately 55% to 65% downside risk.

Spruce Point Has Established A Short Position in Matthews Int’l (MATW) And Sees 55% - 65% Downside For The Following Reasons:

Poorly Organized Company With Significant Fundamental Headwinds: Matthews Int’l (Nasdaq: MATW) is comprised of three unrelated businesses in the death care (“Memorialization”), branding and packaging services (“SGK Brand Solutions”), and Industrial Technologies. In our view, each business is mediocre and struggling from a variety of issues, resulting in organic sales to decline in aggregate. In Memorialization, cremation rates are rising causing less casket sales, cheaper imports from China are causing price and margin compression, while virtual memorials are an easy substitute for MATW’s bronze/granite structures. Matthews SGK business is being weighed down by spending deferrals of consumer packaging companies and FDA regulatory delays. Its Industrial Technology business (just 9% of sales) has margins near all- time lows while management has been investing for years into R&D for “new product development” with little details provided to investors; at best, it is a carrot to bait investors for some upside amongst its portfolio of lagging businesses

Recent Acquisitions Have Failed To Deliver: Hoping to spark growth, MATW has completed 10 acquisitions since FY 2013 and spent $1.0 billion. Its two largest acquisitions were Schawk ($616m/Brand Solutions/2014) and Aurora Products ($219m/Memorialization/2015). Based on our research, these deals have failed miserably to meet expectations. As a result, MATW is bloated and saddled with declining organic growth of 1-3% in Memorialization and 3-5% in Branding. All along, MATW has been promoting how its ERP investment would yield great benefits and allow for seamless acquisitions, but after six years of implementation (average implementation time is 21 months), investors have no clue how much MATW has spent on this project, and not a single accounting disclosure has been made on its software amortization policies. Don’t be shocked that years ago Schawk admitted software capitalization accounting issues

Mounting Evidence of Dubious Financial Results: MATW has taken classic measures to obscure its problems such as realigning segment reporting and promoting highly “adjusted” figures. MATW has reported $176.8m of pre-tax charges since 2012 (with ~$165m related to acquisitions and strategic cost reductions). Charges have totaled a whopping 16% of its deal costs. When put into context of other successful calls Spruce Point has made identifying companies struggling to integrate targets (eg. NCR, ACM, ECHO, CECE, GEF), MATW is the worst we’ve ever seen! When we look closer at its operational footprint, we find little evidence that it has accomplished anything. SG&A margin is rising as are other fixed cost of operations. Not surprisingly, management is now touting “adjusted free cash flow” metrics, which we think overstates 3yr cumulative cash flow by nearly 30%. With sales slowing, and accounts receivables ballooning, Matthews quietly initiated an accounts receivable securitization facility in April 2017; in our view, a tacit admission by the Company its cash flow isn’t as robust as it appears

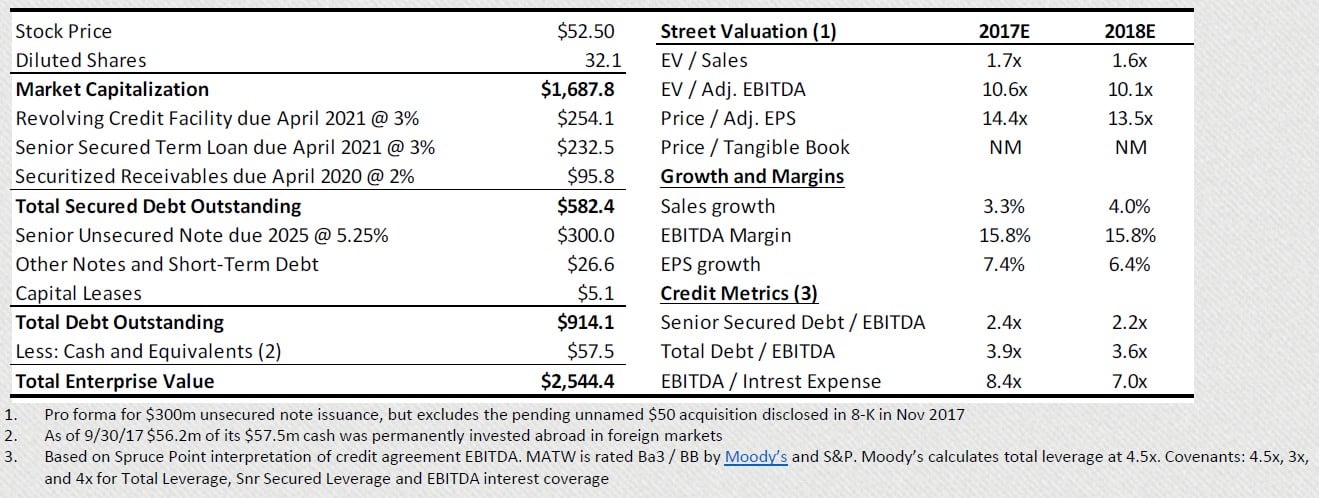

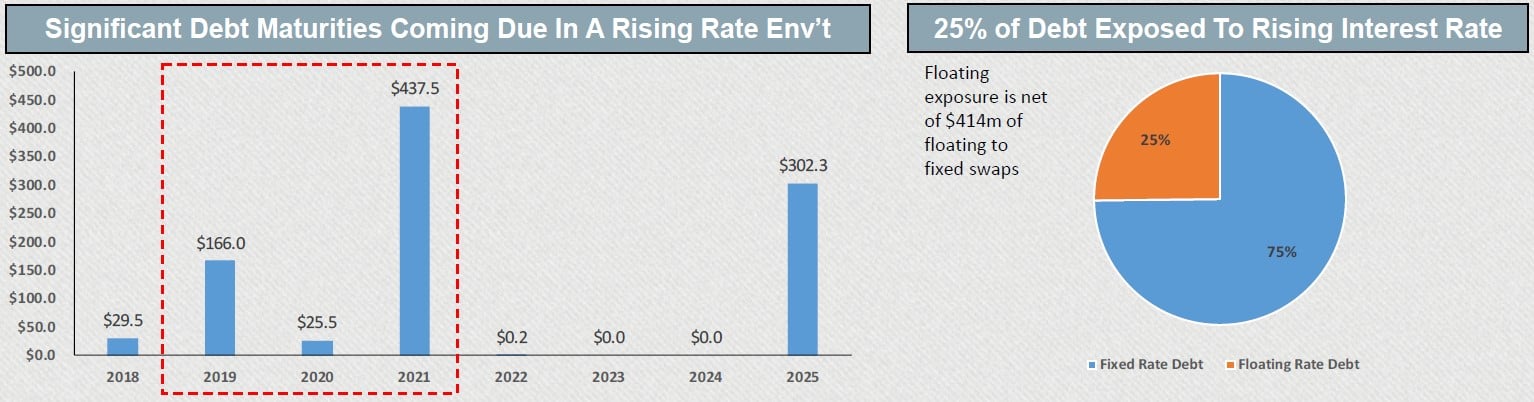

Debt Ballooning To Near A Billion Dollars With Very Little Covenant Cushion: MATW’s acquisition ambitions are problematic now that organic growth is declining, interest rates are rising, and nearly 60% of its assets are goodwill and intangibles ready to be impaired. MATW sells equity investors on its heavily Adjusted EBITDA of $238m. However, equity investors would be wise to look carefully at MATW’s credit agreement, which we estimate places the EBITDA for covenant purposes at closer to $220m, or 7% lower. We estimate its Total Leverage Ratio is close to 4.0x vs. a maximum leverage covenant of 4.5x. Matthews recently issued a senior unsecured bond at 5.25% due 2025, but it has significant other maturities coming due in 2019-2021. Liquidity could become an issue of focus for investors in this junk credit. Almost 100% of cash and equivalents are permanently invested abroad, which makes MATW heavily dependent on its credit facility to balance its capital needs for $50m/yr of capex, $20m/yr in dividends, and to continue pursuing its reckless acquisition strategy (note: its last $50m acquisition “announcement” in Nov 2017 was quietly filed as an 8-K, and MATW didn’t even disclose the company’s name)

Serious Financial Control Issues and Governance Concerns: We have little reason to trust MATW’s ability to maintain financial order. Setting aside the fact that Schawk had previously restated financials, reported material weaknesses, and received a Wells Notice from the SEC, in July 2015 MATW revealed a material weakness of financial controls when it disclosed theft from a long- time employee of nearly $15m, making MATW the subject of Western Pennsylvania’s largest corporate embezzlement in history. This event came after another MATW employee was sentenced to jail in Jan 2015 for running a fake invoicing scheme. By Nov 2015, MATW declared its Material Weakness had been solved, and changed auditors from PwC to E&Y in December 2017. Spruce Point believes that investors should be extremely cautious in light of our own findings that MATW:

- incorrectly accounts for dividends and share issuance in its equity accounts, 2) has taken frequent and large charges that don’t reconcile between its SEC filings and investor presentations, and have not resulted in meaningful cash flow gains, and

- management’s compensation has risen at a 30% CAGR during this same period of mediocre performance

Sum-of-Parts Valuation Gets Us To 55%-65% Downside: We believe MATW should fire management and split up the Company. However, we believe this would expose MATW’s extreme overvaluation. Shares might “look” cheap at 1.6x, 10x, and 14x 2018E Sales, EBITDA, and P/E but it’s because Street estimates take management’s highly adjusted results at face value, and pencil in low single digit growth. Even management doesn’t seem confident in its outlook, and only says adjusted earnings will grow at a rate consistent with FY2017, without further elaboration. Yet, the analysts covering MATW see 48% upside to nearly $78/sh – a major disconnect! Given our evidence that adjusted financial results appear dubious, we base our valuation on GAAP results, assume no growth, and apply peer trading multiples at a slight discount to reflect MATW’s mediocre businesses and below average margins and growth. Our sum-of-the parts valuation implies $18.50 - $24.50 or approximately 55% - 65% downside

Capital Structure and Valuation

Astute investors are looking carefully at MATW’s high leverage in a rising rate environment and lack of organic growth. Spruce Point will detail MATW’s struggling acquisitions, low earnings quality, and financial control concerns

Article by Spruce Point Capital Management

See the full PDF below.