Institutional investors tend to avoid cyclical businesses due to their unpredictable nature. Trying to predict when the cycle will turn is almost impossible, which results in volatility, the opposite of what investors like to see.

However, Whitney George of Sprott Asset Management is not put off by these qualities. In fact, George prefers cyclical businesses for bargain hunting. As part of this trade, he believes it’s time to go long asset managers.

- Does Passive Investing Have A Cap Of Market Cap?

He’s quite good at picking winners as well. In the 15 years at the helm of the Sprott Focus Trust, George has earned a net annualized 11.2%, vs. 9.7% for the Russell 3000.

In the December issue of Value Investor Insight, Whitney George talks about his strategy and outlines some of the companies he is interested in today. Below is a brief outline of the interview.

- Looking for value stock ideas? Check out ValueWalk’s exclusive value newsletter.

Buying cyclical stocks

The core reason why George likes cyclical businesses is simple: valuation. While he favors high-quality businesses with a strong management team, balance sheet and industry-leading margins, non-cyclical companies exhibiting these qualities are usually expensive.

The team at Sprott are looking for companies trading at “an attractive absolute valuation,” which they define as “our estimate of a company’s normalized operating earnings divided by its enterprise value.” Companies trading at a ratio in the “low-to mid-teens” qualify. George goes on to say that while such valuations are not always a function of cycles, “basic cyclicality that you can understand is very often a source of mispricing.” This mispricing tends to emerge as “Cycles are difficult for many investors to deal with because they often create short-term disappointments that people hate.”

“I’m basically doing time arbitrage – finding companies where economic, industry or company-specific disappointments prompt short-term investors to sell me their shares at compelling absolute valuations based on what I consider normal longer-term earnings power.”

One example that Sprott owns today is Kennedy-Wilson, which it has owned for around 15 years. The team believes that this stock is undervalued because it is difficult to understand. Over the past decade-and-a-half, the company has created an enormous amount for value for investors and is “one of the best real estate asset managers in the world.” However, the group is organized in a “complex, not-easy-to-understand way,” which hides its attractive qualities. George believes that as the company starts “selling more than they buy” the underlying value should start to surface leading to a re-rating of the shares.

Gold and gold mining stocks feature heavily in the Sprott Focus Trust’s portfolio accounting for around 13% of assets. George believes that this is an insurance policy for the rest of the portfolio, and it’s also a cyclical play. He says that the gold cycle is currently in a “sweet spot” as after years of booming production and profits, followed by a sudden crash, miners are now better positioned to profit long-term. Demand and development have been slashed, and there may be “underinvestment in development” as a result. If gold prices push higher, miners’ improved operating leverage will allow them to generate better profits in this cycle than the last.

Time To Go Long Asset Managers?

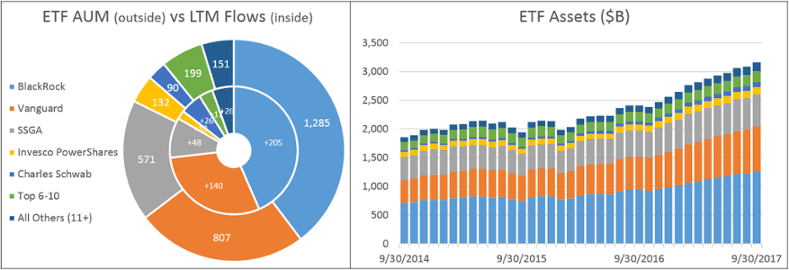

One group of companies that has really taken a beating over the past ten years is asset managers. Stricter regulations, improving technology, greater competition and the rise of passive investing has hammered asset managers’ stocks. Sentiment towards the industry is at an all-time low.

Nonetheless, ever the contrarian, George and his team believe that they see value and think it is time to go long asset managers. Specially, they like the look of Franklin Resources.

This is a cyclical play. Even though Franklin has seen the value of its assets under management decline by around 15% since 2014, George believes that it’s only a matter of time before the market turns, and active managers once again become popular with investors.

“The objective of most active managers is to reduce risk, and in bull markets reduced risk means reduced returns,” he says. “The underperformance compounds with the length of the bull market, especially when stocks are highly correlated as they have been in recent years. It’s a toxic recipe that has led to the most pronounced backlash against active managers in history.” However, this can’t last forever and if the rally falls apart, he believes investors will flock back to active managers “twice as fast” as they moved to passive in the first place.

As well as the potential cyclical upturn, the shares are cheap making it the perfect time to go long asset managers:

“The shares currently trade at about 14.5x the $3 per share the company earned in its 2017 fiscal year, but if you net out $18 per share of cash on the balance sheet, that earnings multiple falls to 8.4x. We think at these levels investors are ascribing a value to assets under management that they think will be flat or down forever. We don’t think that’s going to be the case.”

Away from the asset managers, Whitney George likes the look of Pason Systems, an oil services company. Even though this company has seen revenues collapse since 2014, it’s still cash flow positive and has a rock-solid balance sheet with C$160 million in net cash.

“If operating income gets back to 80% of the C$260 million the company earned at the peak of the last cycle, at an 8% cap rate that implies a per-share value of around C$30. I don’t think that valuation would be unreasonable at all, given the company’s market share, profitability and potential to grow in markets outside North America and by continuing to provide additional services that increase revenue per rig.”

See also: Hidden Value Stocks newsletter has exclusive access to value hedge funds.