Traditional asset allocation models focus on diversification across asset classes or sectors, with a goal of maximizing risk-adjusted return. However, maximizing excess return is fundamentally an active management decision.

The influx of passive products changes that dynamic and the way that the market views asset allocation decisions. Passive vs. active becomes one choice in a series of independent decisions.

1) What Is the Optimal Passive Allocation for a Particular Investor or Mandate?

The optimal allocation can be based on asset class or factor-based exposures. The goal is to determine the optimal deployment of capital to meet the portfolio’s objectives for performance, income, asset level, liquidity, etc.

2) Do the Portfolio’s Needs Require Excess Risk-Adjusted Return Beyond What Is Available in the Optimal Allocation of Broad Markets?

If so, the investor needs to be open to the additional costs and risks associated with some amounts of active investing for the potential of excess returns it could bring. If, however, the investor’s needs can be satisfied by the markets themselves, the investor has more low-cost options than ever to seek pure passive investments to replicate broad markets.

3) What Is the Optimal Approach to Implementing the Selected Asset Allocation Strategy?

The most active approach is to manage the assets ourselves, selecting individual securities. Whether we’re implementing an active or passive strategy, a level of scale and in-house expertise is needed to justify internal management, particularly when cheap passive alternatives exist.

Thus, in addition to evaluating your internal capabilities, it is important to evaluate whether it would be more effective (or cheaper) to leverage external managers for portions of the portfolio.

If looking to external managers, we need to determine proposed value add. Clarify the purpose of leveraging that manager and then monitor whether they continue to adhere to their mandate and deliver the desired value add. That purpose differs by asset class, by vehicle, and by active vs. passive management style.

In considering active management, does the manager’s skill justify the higher fees of active management? How do you identify and differentiate skill from luck, and how do you quantify the impact of the active decisions made by that manager?

If active management is not desired or does not provide an adequate return (alpha) for the extra risk in a given segment, you should look for the most efficient passive exposure (beta).

4) Can You Implement or Inexpensively Replicate a Passive Strategy Internally?

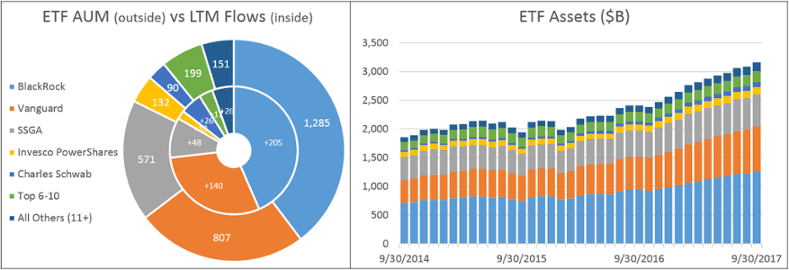

Passive assets have been concentrating, with a growing percentage of the market managed by a smaller number of managers.

The three largest ETF managers (BlackRock, Vanguard, and SSGA) manage 82% of ETF assets. The top five (adding Invesco PowerShares and Charles Schwab) manage 89%, and the top 10 managers account for 95% of assets. This trend has accelerated over the past year, with 83% of new flows going to the top three, 91% to the top five, and 95% to the top 10.

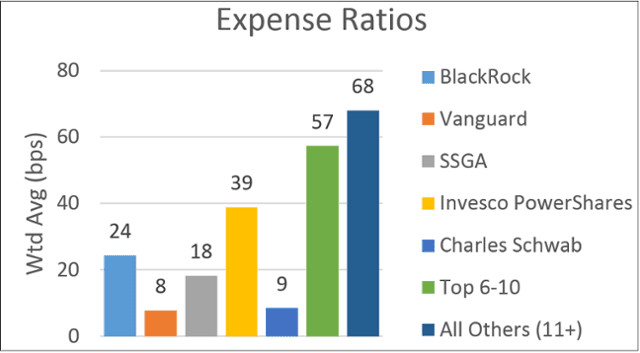

As those managers have scaled, they have become more efficient and expanded their sophistication while lowering fees.

Some markets and more complex strategies are still able to justify higher expense ratios. However, there remains a general trend toward large asset managers continuing to grow their asset base while lowering their fees.

It is important to note that passive investing through large asset managers has its own considerations of which we should be aware. Certain risks become more prevalent as those massive firms continue to grow, including:

- Capacity and liquidity concerns

- A lack of agility and ability to make tactical shifts

- The market reverberation that could result from any operational or organizational failures

Always evaluate the choice of manager, strategy, and product on both an independent basis and in the context of the larger portfolio.

Impact of Passive Products on Implementing Asset Allocation Models

The availability of new products allows asset allocators to do more and implement more robust models.

ETFs allow for passive exposure to a slew of factors used in modern asset allocation models, reducing reliance on asset class and sector positioning.

Portfolio managers can also leverage products designed to isolate core performance drivers. The proliferation of smart beta products and mechanisms for implementing portable alpha strategies presumably allows us to optimize the mix of cheap market or factor exposure (beta) and expensive manager skill (alpha).

As the breadth and liquidity of passive products increase, there are more options for making quick tactical allocation decisions. Portfolio managers can also branch out beyond traditional equity and fixed income asset classes, seeking alpha or diversification from other asset classes, e.g. private markets, liquid alternative investments.

“Passive” does not necessarily mean less risky, and it is important that both the manager and its clients understand the investments, their exposures, and the inherent risks. The onus is on the manager to fully understand and account for this increased complexity before leveraging new passive products or new asset allocation techniques.

As new, more complicated asset allocation models enter the market, one must ask:

- Does the model generate results that are suitable for the client?

- Are the model’s assumptions and implications fully understood?

- Are there products and managers available for efficient implementation of the model?

It is very rare to find a product that provides 100% pure factor exposure, and those that are close are still highly dependent on the factor model definition and the quality of the optimization. One must consider what the pure factor actually represents, and what other risks or exposures are embedded in the instrument.

The shift toward passive investing opens up options, but it does not make things simpler. Asset managers and investors have access to new vehicles and more efficient mechanisms for implementing modern asset allocation techniques. It is critical to understand the decisions made throughout the asset allocation and portfolio construction process and the inherent risks in both the model and the passive products used to implement the model.

Article By Drew J. Cronin, CFA, CIPM - FactSet