They are the primary objectives of municipal bond investing: Safety. Income. After-tax return. But the market doesn’t always provide the ideal environment, and the coming year looks to be no exception. How can muni investors avoid getting knocked off course in 2018? They can adhere to these five strategies.

[REITs]- Stay invested. Muni investors may be anxious about what’s ahead for the municipal market given recent changes to tax code. But technical factors are exceptionally supportive of municipals right now.

That’s because, as 2017 drew to a close, municipal issuers raced to market ahead of expected tax reforms that could eliminate some types of municipals, such as private activity bonds.

As a result, the fourth quarter saw the biggest municipal supply surge in 20 years. State and local governments issued $60 billion of municipal bonds in December, shattering the previous record of $55 billion set in 1985, prior to the 1986 tax act.

Long-term issuance for 2017 broke $409 billion; it’s expected to reach only $333 billion in 2018, according to SIFMA respondents. In other words, expect significantly less supply ahead. And less supply means the market is likely to rally.

We saw a similar supply surge and subsequent slump in 2010 and 2011. At the end of 2010, the taxable Build America Bond program concluded, bringing a mass of issuance into 2010 that would otherwise have taken place in 2011. The following year, market supply topped out at just $287 billion, and the Bloomberg Barclays Municipal Index rallied, returning 10.7%.

Investors who stay on the sidelines during supportive supply conditions in 2018 will miss out on a potential rally.

- Be mindful of the Fed. Of course, supply conditions aren’t the only variable affecting the market. Over the near term, yields and inflation may remain low and the US curve relatively flat. But with the US economy operating at full capacity, the Fed isn’t going to tolerate these easy conditions for very long. They’ve planned three more rate hikes for 2018.

We actually expect them to hike rates four times to counter global pressures and tap the brakes on the US engine more firmly. It could take even more hikes if the recently passed changes in US tax policy cause growth and inflation to accelerate more than they expect.

As the Fed taps on that brake, the currently flat US Treasury and muni curves will begin to steepen, and those long-dated muni yields will begin to climb. These are conditions that call for an underweight of long bonds.

- Buy credit, but be choosy. While long bonds aren’t the best option for boosting income today, municipal credit can help bolster portfolios as rates rise. That’s partly because the official rate hikes and rising yields that accompany them are a response to a strengthening economy. Improving economic conditions help to bolster revenues and, in turn, creditworthiness.

Many states’ rainy-day funds have now surpassed their pre-financial-crisis highs. And, according to the Census Bureau, tax collections for municipalities were 3.1% higher in third-quarter 2017 than the same period a year prior. This was the 29th quarter of growth out of 32 quarters since 2009.

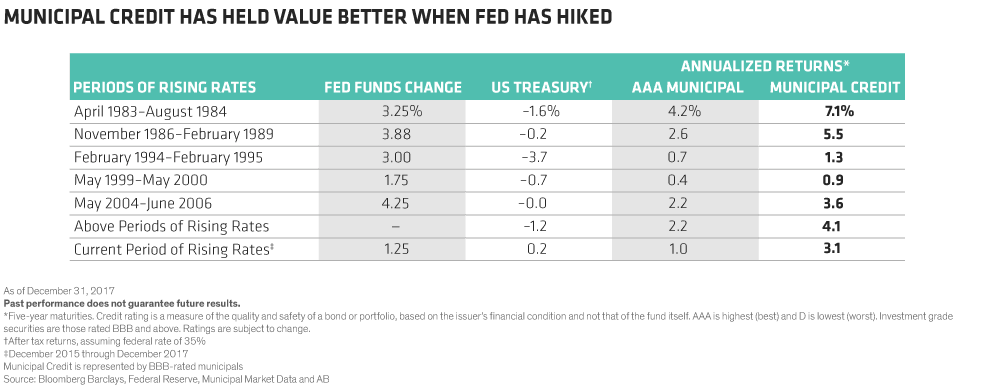

But that’s not all. Historically, when the Fed has raised the federal funds rate, muni credit has held its value better, outperforming both US Treasuries and high-quality municipal bonds (Display)—and this pattern continues to hold true today.

However, since credit spreads have tightened, leading to stretched valuations, caution is key when choosing which credit to invest in. Muni investors should avoid reaching for yield and instead concentrate on careful selection that maximizes opportunity and reduces risk.

We’re finding many of these opportunities among A-rated and BBB-rated municipals. These offer an income-generating spread over high-grade munis, but they are liquid enough that we can sell them quickly when even better opportunities arise.

High-yield municipal investors should limit holdings of tobacco bonds and Puerto Rico, which together comprise more than a third of the high-yield universe. While these credits’ prices are on opposite ends of the spectrum—tobacco is priced near par, and Puerto Rico is priced around 25 cents on the dollar—neither justifies its riskiness at these valuations.

Lastly, beware of leverage. We’ve been in a near-ideal environment for leverage in the bond market. Borrowing rates are tied to very short-term rates, and these have been low. But as rates rise, borrowing costs will increase, and high-yield strategies that rely heavily on borrowing will likely see pressure on their income.

- Watch out for inflation. Whether inflation creeps higher, as suggested by some market indicators, or volatility emerges around inflation expectations and inflation policy, municipal portfolios should aim to preserve their purchasing power. A bonus: inflation protection is currently inexpensive.

But for investors who pay US taxes, buying Treasury Inflation-Protected Securities isn’t the best way to shield a bond portfolio. A muni portfolio that gets inflation protection through Consumer Price Index swaps may be more tax efficient.

- Don’t be passive. Some investors try to protect their portfolios from rising rates by building a ladder of passive muni strategies. But ladders are static. Market conditions change. Today’s elevated volatility and uncertainty make active management essentials. Furthermore, active managers outperform passive ladders 97% of the time and by a significant margin.

And don’t forget: Active muni managers with flexible approaches have even bigger advantages. Flexible mandates have more tools and strategies at hand for navigating the challenges and the opportunities that dynamic and volatile markets present. They’re also the best way for investors to keep their muni portfolios on track in 2018.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Article by Daryl Clements, Alliance Bernstein