What the activism world is talking about

Activist investor Elliott Management has revealed a stake in U.K. telecommunications company Sky as investors prepare to vote on Twenty-First Century Fox’s $16.6 billion bid for the remainder of the broadcaster (it already owns 39%). The activist’s investment comes as the controversial merger faces opposition from both shareholders and regulators alike. The U.K.’s Competition and Markets Authority watchdog announced last Tuesday that it had provisionally found the proposed acquisition not in the public interest, saying it believed the transaction would result in the Murdoch family having “too much influence over public opinion and the political agenda.” Meanwhile, activist investors Crispin Odey, Jupiter Asset Management, and Polygon Investment Partners have been urging Fox to increase its offer. The timing of Elliott’s investment raises the prospect that it will join the fray and intervene in the takeover, just as it has done many times in the past, and also pits it against ValueAct Capital, which urged Fox to complete the consolidation or dispose of the stake.

What we'll be watching for this week

- Will Dan Loeb’s Third Point Partners make demands at Pinnacle Foods public?

- Will Nuance Communications provide details about its succession plan now that three activists have called for more transparency on its CEO search process?

- Will shareholders of J. Alexander’s vote in favor of its merger with 99 Restaurants at the company’s annual meeting Tuesday, despite activist investor Marathon Partners Equity Management’s opposition?

Activist shorts update

This week sees the launch of The Activist Investing Annual Review 2018, produced in association with international law firm Schulte Roth & Zabel. As with last year’s Review, we will once again be ranking the five most impactful short sellers. Will it be last year’s winner, Glaucus Research? How about the stars of new documentary, The China Hustle, Dan David or Carson Block? The greatest stock price declines were experienced by GeoInvesting target Great Basin Scientific and White Diamond Research’s Delcath Systems – that has to count for something, right? Then there’s ranking value destruction, a title that could only go to Viceroy Research for its role at Steinhoff International. The wait is getting shorter... soon it will go to zero.

For more on activist short selling, see this piece in London’s CityAM, trailing the Activist Investing Annual Review.

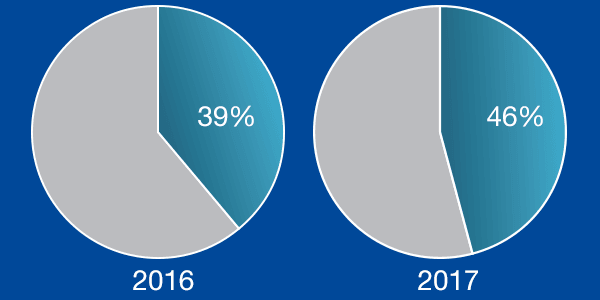

Chart of the week

In 2017, 46% of EMEA headquartered companies publicly subjected to activist demands had a market cap of over $2bn, up from 39% in 2016.

For bespoke data requirements, contact our team at [email protected] or subscribers of Activist Insight Online can visit our interactive statistics page.

Article by Activist Insight