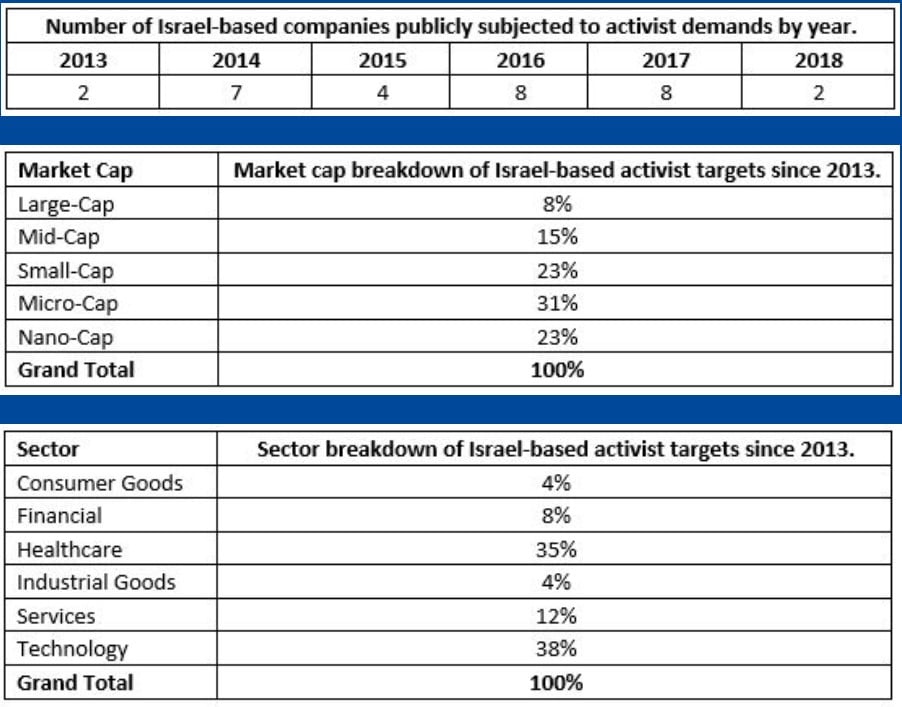

Elliott Management’s letter Tuesday to the interim chairman of Bezeq Israel Telecom follows two years of brisk activity in the Middle Eastern state, where the number of companies publicly subjected to activist demands was tied at a record eight in each of 2016 and 2017.

As might be expected, Israel’s dominant industries, healthcare and technology, are well-represented among activist targets.

And while more than three-quarters of the 26 unique companies targeted had a market capitalization of under $2 billion (USD), campaigns by Elliott and Starboard Value indicate that greater attention is being paid to Israeli companies.

Please see below for a selection of stats on shareholder activism in Israel since 2013.

For a magazine feature about activism in Israel, click here.

Activist Insight can help with bespoke data requests. Please note that requests may require 24-48 hours to complete, depending on their complexity.

Kind regards,

Josh Black

Article by Activist Insight