The S&P 500 is rocking new high after new high. Since the end of November, it is up 7.9% in under two months. But translate that back in to Canadian dollars and your return is a meagre 3.1%. Today the C$ is trading over 81 cents which is causing an increased flow of questions on currency from our advisors and clients. So in this Ethos, we are taking a break from behavioural finance and making it all about currency. Causes of the recent moves, what could be next, what it means for your portfolio. Why the recent move?

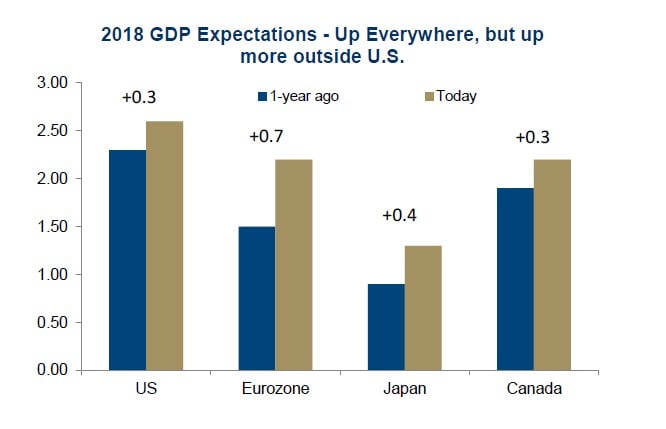

[REITs]Relative Economic Data: The economic data, which drives bond yields, which in turn then drives relative currency exchange rates, has been strong everywhere. The global economy has been doing better and better in just about all jurisdictions. Clearly we have seen forecasts move higher for U.S. economic activity, which is good for the U.S. dollar, but we have seen forecasts improve faster in other countries. The first chart is the 2018 consensus GDP forecast from a year ago and as of today. The biggest improvement is Europe, and guess which currency has been rocking it? The euro is up 16% against the U.S. dollar over the past year….how quickly those concerns over the survival of the euro have faded from investors’ memories.

This global economic expansion had been a spotty one to say the least. The U.S. clearly led the global economy out of the lacklustre growth and now we are seeing other economies catching up. This is creating a riskon environment and helping other currencies rise in value relative to the U.S. dollar.

Oil: Regarding the Canadian/U.S. exchange rate, oil remains a factor. Oil (WTI) trading above $65/bbl has been helping put a positive lift under the loonie. Global energy demand, which is firming, thanks to rising global economic activity, is the primary driver on the rising oil price. We, Canada that is, may not be viewed as the petro currency compared to a few years back, but it still is a strong influencer on our currency.

Trump & Protectionism: There are many moving parts on the political front. Protectionism in isolation is negative for the U.S. dollar as less trade results in less demand for U.S. dollar. And political uncertainty, which does appear elevated, is not positive for the dollar either.

However, the potential termination of NAFTA is a negative for the Canadian dollar. And tax reform is likely a positive for the U.S. dollar mainly from repatriation of cash held overseas by U.S. corporations. This one may prove to be more interesting as time passes. Most companies’ overseas cash is already held in U.S. dollars, so it isn’t really an exchange that occurs when the cash heads home. However, this cash is part of international banks reserves, as it is deposited at their institutions. As those reserves are moved back to the U.S., there is the potential of a shortage or less readily available U.S. credit globally. Too early to see if this will become an influencer.

Risk-on: This is likely one of the bigger influencers on the Canadian / U.S. exchange rate at the moment. Better economic growth, strong global equity returns, has the world in a risk-on mindset. Meaning investors are taking on more and more risk. Canada, and our currency, is considered a risk-on asset. So in a risk-on environment our currency tends to go up and the U.S. currency, which is often viewed as one of the safe haven currencies, goes down. Australian dollar is also considered a risk-on currency. As you can see in the top chart, our two currencies have been moving in unison during this risk-on environment (last few months) and risk-off periods (like 2015).

What Happen Next?

This risk-on environment does appear to have legs. We just went through a U.S. government shutdown that never impact equity markets. Last time this happened, the market reaction was swift and painful. This does show the current resilience of market sentiment. Hard part about sentiment is it can go in one direction longer than many expect and it can also change direction faster than most expect. Guessing the sentiment or market’s mood next is a mugs game, so we will stick with data.

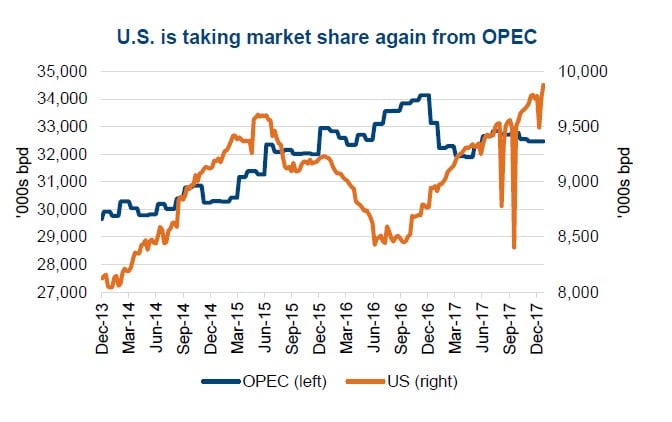

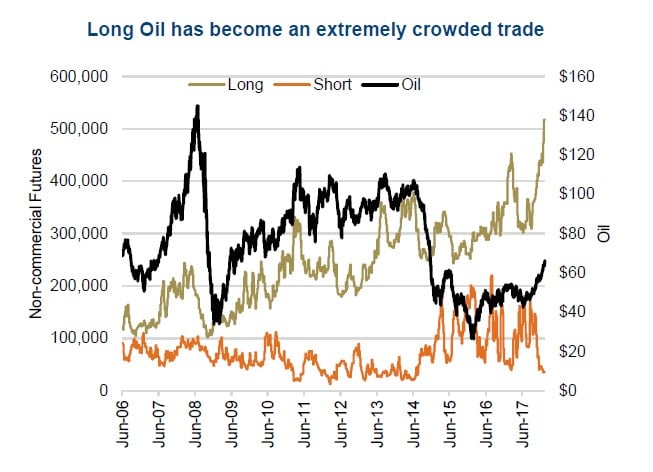

Oil is elevated and it may prove difficult to move much higher. If it does, the shale production which is already rising pretty fast will only accelerate. As a result, OPEC may become less committed to quotas to avoid this occurrence that reduces their market share. We are already seeing U.S. production rise rapidly, at 9.9 million barrels a day based on the latest weekly DOE report, while OPEC production remains flat (2nd chart). An additional factor may be just how many speculators are now long oil. The 3rd chart is the number of noncommercial longs and shorts in the oil market. Currently, the longs have exploded higher to levels never seen before while the shorts have all but disappeared.

The economic data, or more accurately the relative changes in economic data between Canada and the U.S., may prove impactful. Canada’s economy has been doing really well but a part of this has been from easy comparables. Still, respect to the data. The U.S. data has been improving as well, just not to the same extent. And over the past few weeks, the data in Canada has been better than the U.S. We expect the Canadian data to normalize this year and the data to improve in the U.S. NAFTA uncertainty vs tax reform will probably be relatively better for the U.S.

The bond market appears to be in agreement. Despite the better Canadian data, the two-year bond yields, which influence currencies the most, have been widening out again. Meaning U.S. yields rising faster than Canadian. We expect this trend to continue on the yield side and at some point will be reflected in the currency exchange rates.

A Technical View – USD/CAD trending lower but signs of exhaustion showing

Despite Thursday’s impressive reversal, the break below $1.2389 – the 61.8% retracement from the Sept/Dec rally will likely continue to dominate near term trading. Prices are likely looking for their “next” minor support at the 76.4% retracement at $1.2264. More important of course is the September 2017 low of $1.2062 which is awfully close to the entire 2011-2016 bull-run 50% retracement of $1.2048. Rather than get obsessed in the minutia of each tick, we’ll summarize by saying the near term picture looks rather difficult, with a bearish bias on the U.S. dollar but at current levels there is significant support relatively close to $1.20 to provide some key point for risk control.

The USD/CAD cross is trending lower, trading below key 50- and 200-day moving averages which are both trending lower. While medium term momentum has a bearish bias (stronger loonie, weaker greenback) we are starting to see some extremes and signs of exhaustion. The Relative Strength Index (RSI) is nearing oversold conditions with RSI of 32, and prices also breached the lower Bollinger Band. The last time this occurred was in early September which was within days of that bottom. More importantly is the positive divergences we’re seeing in momentum measures such as the RSI and MACD, suggesting a reversal of the current trend lower could occur. The RSI has failed to confirm the lows from earlier in January, longer term we’re seeing positive divergences from the extreme readings in late August.

Portfolio Implications

As long as we have a risk-on environment, the U.S. dollar will remain under some pressure relative to the Canadian dollar. While that will continue to weigh on U.S. denominated assets in portfolios, we would not be capitulating on the U.S. dollar at this point. This market is long in the tooth for a correction as we have not seen a 5% drop in what seems like a lifetime. Ok, not a full lifetime but January 2016 is now two years ago. And if we do see a correction in the coming months, the U.S. dollar will likely put its safe haven hat back on, providing a valued stabilizer when you need it the most. Plus, a lower U.S. dollar will inflate earnings of multinationals, which are predominately in the S&P 500. And a weak U.S. dollar is inflationary, which could create the data for the Fed to move faster than the market expects, providing a lift for the dollar.

After all this, I seem to have convinced myself to go buy some U.S. dollars.

Article by Craig Basinger, Chris Kerlow, Derek Benedet, Shane Obata – RichardsonGMP