Deltec International Group letter for the first quarter of 2018, titled, “Paradise Lost.”

Dear Investor,

We are pleased to provide you with our latest Deltec Investment Letter, an excerpt from our Q1 2018 Deltec Quarterly Global Strategy Outlook presentation, entitled “Paradise Lost”.

To access a copy of the full presentation, which contains additional charts and data, please scroll down to the end of the page.

Last Quarter’s Key Calls:

The below calls were published within the last Quarterly Outlook, Investment Positioning and Key Trades materials, and expressed across Deltec’s Investment Advisory, Investment Management and Investment Fund portfolios:

Remaining Overweight Equities: Over the last quarter the MSCI All World Index generated a total return of 9.2%, strongly outperforming the Barclays Global Aggregate Bond Index, which rose by only 1.3%.

- Remaining Long Japan: Over the quarter, our positive view on Japan was contrarian, and the best performing Developed Market in our focus universe, as the MSCI Japan Index rose by 11.6%, outperforming the MSCI All World Index by 2.4%.

- Remaining Long Global Technology: Over the quarter, Global Technology sectors experienced some volatility, however outperformed their relative indices, and were amongst the top performers globally. The MSCI Global Technology Index rose by 11.5%, outperforming the MSCI All World Index by 2.2%.

- Remaining Underweight Interest Rate Sensitive Sectors: Over the quarter, the US REITs Index underperformed the S&P 500 by 14.2% and the US Utilities Index underperformed by 17.0%, whilst the Europe REITs Index underperformed the Eurostoxx 600 by 3.2% and the Europe Utilities Index underperformed by 4.9%.

- Maintaining a Barbell Duration Strategy within Bonds: Over the quarter, our barbell duration strategy, to maintain short duration and long duration Bond exposure, outperformed as the belly of the curve underperformed. The Bloomberg Barclays Floating Rate Note Index rose by 0.6% and the US Aggregate 10 Year+ Bond Index rose by 0.3%, whilst all other parts of the yield curve generated negative returns.

Paradise Lost:

“I don’t know where I’m going from here, but I promise it won’t be boring.” - David Bowie (1947 – 2016)

Market participants are currently benefitting from the combination of strong global economic growth driving higher earnings and a surfeit of liquidity suppressing discount rates, all leading to significant asset price appreciation and the most robust market expansion in over a decade. In the coming periods we will see the end of these idyllic conditions and the commencement of more classic cyclical conditions, which will result in a continuation of asset price appreciation, although also a return of asset price volatility.

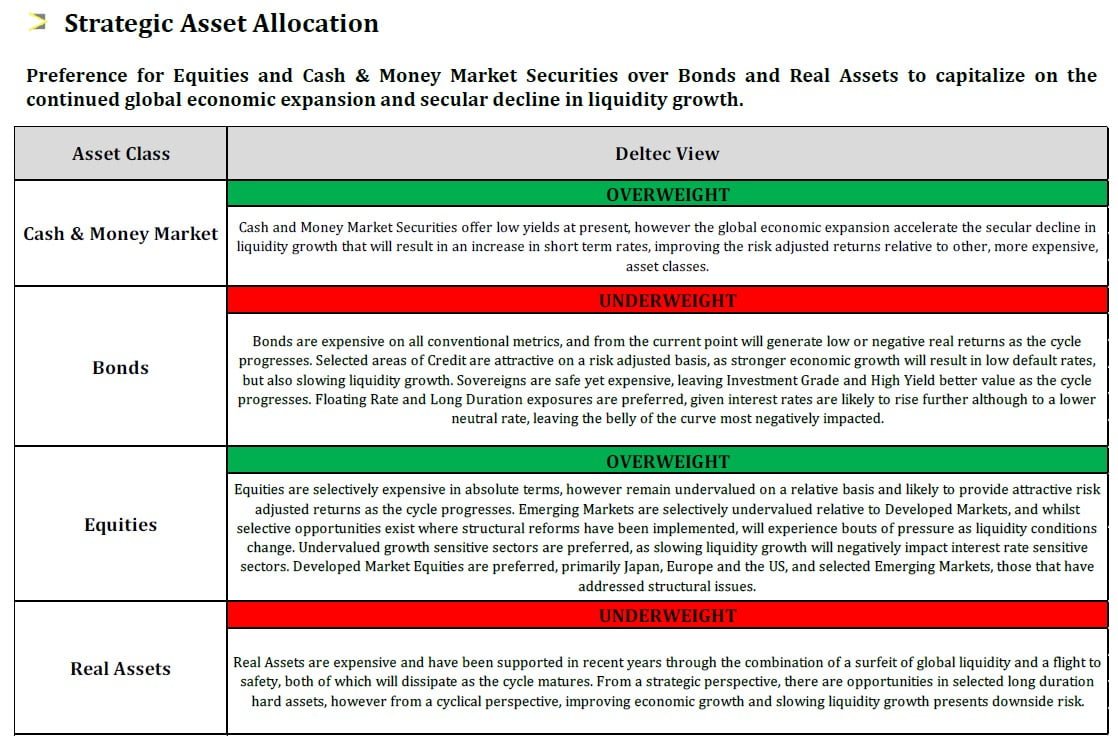

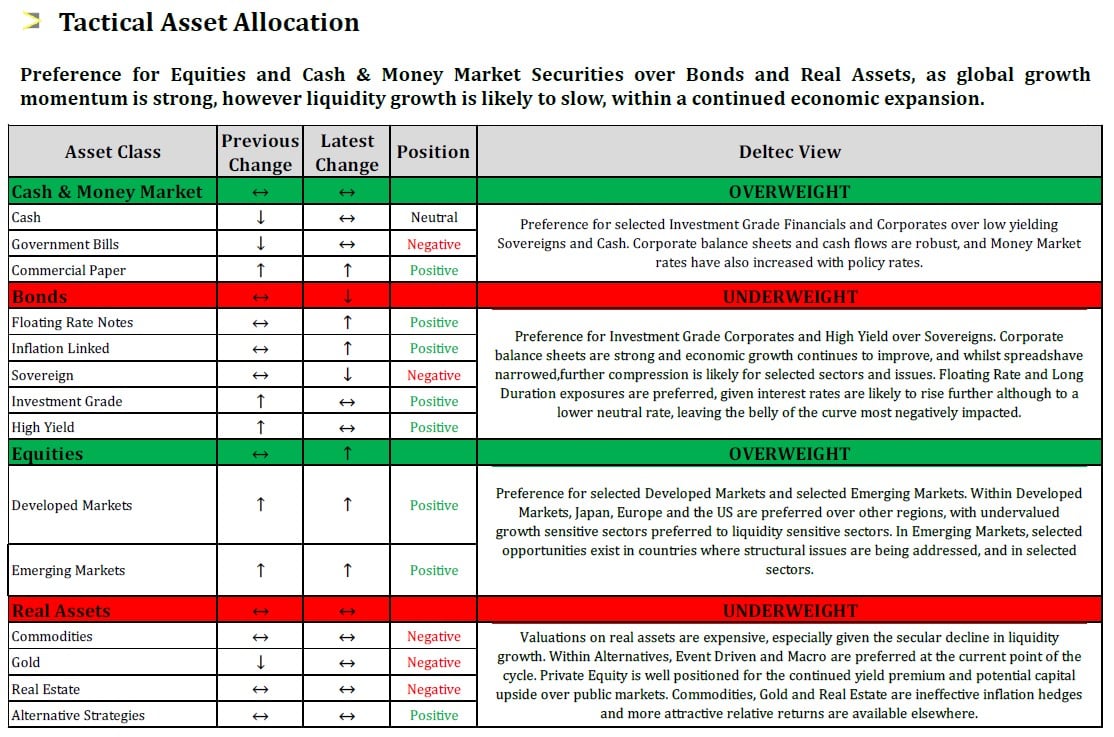

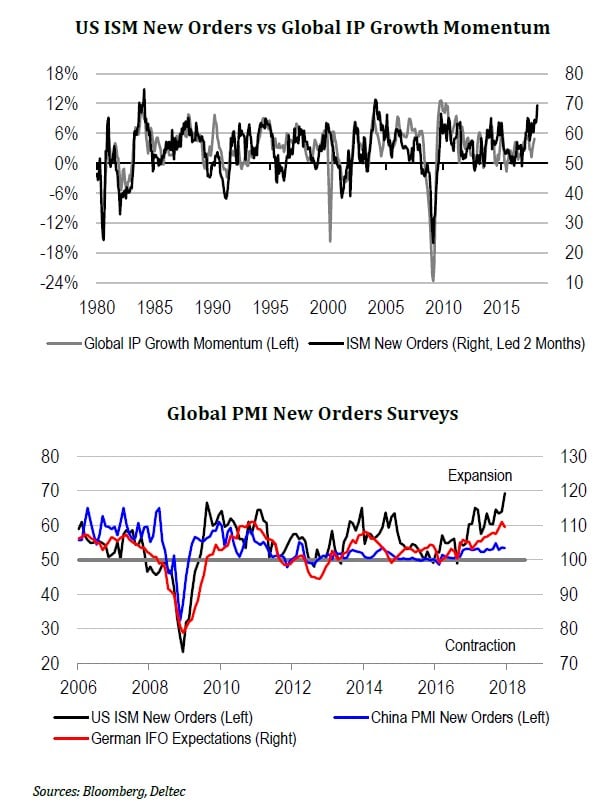

From a short term, or tactical perspective, investment markets are driven by second derivatives, primarily growth momentum and liquidity growth. At present, growth momentum is rising, however liquidity growth is peaking, which will lead to a continued positive environment for asset prices amidst bouts of volatility and periods of consolidation, particularly for liquidity and interest rate sensitive assets. From a long term, or strategic perspective, investment markets are driven by the relationship between economic growth, liquidity conditions and asset prices. The global economic expansion is currently only approaching the midpoint, broadening across regions and sectors, against the backdrop of a secular decline in liquidity growth that is only beginning. This will lead to selectively higher asset prices as the cycle progresses.

The key risk to the outlook is no longer a systemic tightening of financial conditions causing deleveraging, political uncertainty suffocating the recovery or idiosyncratic country risks resulting in a premature end to the cycle, but rather the magnitude and extent to which policymakers tighten liquidity conditions. The current subdued inflation outcomes mitigate this risk in the short term, however only productivity growth will mitigate this risk in the long term, unlikely delaying the tightening cycle, though likely suppressing it.

A major regime shift is underway for economies and markets. As we enter this new era, individuals, corporations, investors and policymakers must address its numerous challenges: Ensuring productivity growth amidst a secular decline in liquidity growth, sustaining competitiveness in an environment of protectionism, promoting creativity in an age of commoditization, maintaining free movement of labor in an age of demographic decline and fostering intelligent ideas to shape a world of artificial intelligence. This era will generate immense social and technological changes that will challenge the conventional notions of industrial production, inflation and asset prices. For some, this will lead to tremendous investment opportunities, although for many, this will seem like Paradise Lost.

Global:

From a short term, or tactical perspective, the current environment is characterized by strong global growth momentum, contained inflation and a surfeit of liquidity. However, this environment will change over the coming periods, with the outlook for inflation key to how long this highly favorable period continues. Whilst economic conditions are expected to remain robust, liquidity growth will selectively slow, the combination of which is likely to lead to higher asset prices, amidst bouts of volatility, particularly for liquidity and interest rate sensitive assets. From a long term, or strategic perspective, outright global economic conditions are strong and driving earnings growth; liquidity conditions are changing rapidly although discount rates remain contained and; asset prices are elevated, although only selectively so. This environment is likely to see higher asset prices as the cycle progresses, although require far greater selectivity at a regional and sector level.

Investment Conclusion:

In the coming period, stronger economic growth will support growth sensitive assets, however changing liquidity conditions will negatively impact interest rate sensitive assets. Equities are currently expensive on conventional metrics, however rising earnings should effect more attractive absolute and relative valuations. Credit is expensive, however can remain so, as economic conditions are consistent with low default rates. Slowing liquidity growth will positively impact Money Market Securities and Floating Rate Notes and negatively impact Bonds, particularly so mid-duration, as limited long term inflation will see long duration assets relatively well supported. Real Assets are expensive in absolute and relative terms. From a relative perspective, undervalued growth sensitive assets will outperform liquidity sensitive assets, with selected Equities providing the best risk adjusted returns, followed by Money Market Securities, Credit, and Real Assets. Read: Global Investment Conclusions

Emerging Markets:

Emerging Markets are experiencing a virtuous expansion, due to the combination of increasing real interest rate differentials, stable USD liquidity conditions, stronger growth momentum and significant earnings upgrades, all driving substantial capital inflows. From a tactical perspective, growth momentum is strong, given the operationally leveraged exposure to improving Developed Market growth. Slowing global liquidity growth in the coming periods will see selected bouts of weakness, given the financially leveraged exposure to Developed Market liquidity, as will the lower growth environment in China for those countries exposed. From a strategic perspective, growth will be highly country and sector specific, as a secular decline in liquidity growth will, at the margin, cause deleveraging, currency depreciation and liquidation of FX reserves. Those markets undertaking the necessary structural reforms coupled with monetary and fiscal measures will outperform those reliant on capital inflows or a drawdown of FX reserves.

Investment Conclusion:

Despite the appreciation to date, stronger earnings and capital inflows should continue to support asset prices. With the major challenge in the coming periods being slowing liquidity growth, those Emerging Markets with less reliance on USD liquidity conditions, higher real interest rate differentials and stronger FX reserve positions will be better positioned, and those sectors and companies with global exposure will outperform. Read: Emerging Markets Investment Conclusions

United States:

US growth momentum is currently strong, driving an outright economic expansion that will be durable, even in the upcoming era of declining liquidity growth. Importantly, the expansion is broadening across sectors, as the drivers of economic growth extend from consumption and housing towards industrial production and business investment. From a tactical perspective, in the coming periods growth momentum will experience a temporary peak, inflation will rise and liquidity growth will slow. From a strategic perspective, the economy is past the midpoint, however the outlook is strong, supported by favorable demographics, an improving policy environment, increased capital investment and significant technological change, which will extend the cycle.

Investment Conclusion:

Whilst growth momentum is currently strong, valuations are selectively expensive. As the economic expansion is likely to continue for several more periods, rising earnings and a still low discount rate will remain supportive of asset prices, however slowing liquidity growth and rising interest rates will limit the appreciation and cause bouts of volatility. This environment favors undervalued growth sensitive sectors over expensive and liquidity sensitive sectors. Read: United States Investment Conclusions

Europe:

European growth momentum is strong and leading indicators of outright growth are at multi-decade highs, with the private sector driven expansion able to withstand any residual policy uncertainty across the region. From a tactical perspective, an improvement in global conditions is lifting trade and industrial production, and a stabilization in domestic conditions is lifting consumption and asset prices. Current loose monetary conditions are likely to begin to turn in the coming periods, however the economy and banking sector are well positioned to withstand these changes. From a strategic perspective, the economic expansion is not yet at the midpoint, leaving several more periods for continued cyclical growth. Demographic factors, differentiated fiscal priorities and a lack of structural reform present risks, however rising capital investment and technological progress, if maintained, should alleviate these challenges.

Investment Conclusion:

The strengthening economic expansion is likely to lead to a further improvement in earnings growth in the coming periods, with the rising currency remaining a headwind for certain sectors. Given this interplay, greater selectivity is required going forward, with the preference remaining for financials, cash flow generative cyclicals and beneficiaries of increased corporate capex, as interest rate sensitive exposures are susceptible to tightening liquidity conditions. Read: Europe Investment Conclusions

Japan:

Japan’s growth momentum is improving strongly and outright economic growth is now firmly in the expansion phase, with several indicators the strongest they have been in several decades. From a tactical perspective, strong growth and a diminution of fiscal policy risks will soon lead to a change to the current loose monetary conditions. From a strategic perspective, the outlook is strongly positive for the first time in almost three decades, without broad investor acknowledgement, as fund flows remain lackluster. Japan is the best leveraged developed market to the more positive global economic cycle, with capital investment countering the domestic demographic headwind.

Investment Conclusion:

Strong growth momentum will drive further earnings growth and earnings upgrades, amidst an attractive absolute and relative valuation backdrop and a lack of foreign fund inflows. As such, the market presents amongst the best risk adjusted returns opportunities available globally. Risks to the outlook are driven by exposure to China and changes in monetary policy, however these are contained at present. Sectors exposed to the global economy are likely to benefit in volume and value terms, whilst those sectors exposed to the domestic economy should continue to improve, though to a lesser extent given the longer term domestic headwinds. Read: Japan Investment Conclusions

China:

China’s growth momentum is slowing and outright growth is stable at an elevated level, benefitting from the afterglow of the prior significant stimulus programs coupled with the broadening global economic expansion. From a tactical perspective, the global economic expansion is likely to continue to provide a tailwind, however changing global liquidity conditions inducing capital outflows coupled with fading domestic stimulus and structural reform introduce downside risks, particularly for fixed asset investment. From a strategic perspective, imbalances are currently being successfully addressed, and in recent periods policymakers have managed the economy exceptionally well. However, structural challenges still abound, including continued attempts to transition the economy from investment to consumption, ongoing deleveraging, demographic headwinds and the goal to maintain industrial production dominance borne from labor in an age of transformative technology borne from capital.

Investment Conclusion:

Stable economic conditions, selective policy support and a positive Emerging Markets backdrop are likely to continue be supportive of markets, particularly those that are globally exposed. Against this, changing global liquidity conditions, fading domestic stimulus and structural reforms are likely to weigh on certain sectors, particularly those exposed to fixed asset investment. Strategic short opportunities remain in derivatives of Chinese fixed asset investment, including Commodities, Commodity Economies and Commodity Currencies. Read: China Investment Conclusions

Commodities:

The outlook for commodity prices is driven by global economic growth and global liquidity growth. At present, global economic growth is strong although compositionally changing, whilst global liquidity growth is likely to slow in the coming periods. Chinese fixed asset investment growth, the primary demand driver for commodities, is now slowing, whilst USD liquidity conditions, the primary funding source for commodity carry trades, are likely to tighten. Whilst the downside to commodities has been mitigated through the significant improvement in global growth, parts of the complex are stretched from a longer term perspective, with only selected commodity providing opportunities.

Investment Conclusion:

The sharp rally in commodity prices has been supported by a significant improvement in global growth. However, slowing USD and global liquidity growth and declining Chinese fixed asset investment growth are likely to negatively impact commodities in the coming periods. Energy provides the best opportunities as favorable demand dynamics and current pricing. Agricultural commodities will remain volatile given stable weather. Industrial Metals and Bulks carry downside risk. Gold is expensive, with better risk adjusted returns elsewhere. Read: Commodities Investment Conclusions

Currencies:

In recent periods, growth across regions has become synchronized and policy coordinated, reducing currency volatility. In the coming periods, these dynamics are likely to change, as the global economic expansion is now at the point where policy settings shift. From a tactical perspective, the USD is likely to selectively decline, as relative growth and monetary policy gaps are now narrowing. From a strategic perspective, a narrowing trade deficit and shortages of USD are supportive of the currency, however productivity growth limits the longer term US inflation outlook and caps the neutral Fed Funds rate, at a time when other economies are likely to see liquidity conditions normalize, supporting their currencies. Cryptocurrencies are not an asset that generates a future stream of cash flows, nor are they a currency that efficiently transfers value, rather, they meet many of the definitions of a speculative bubble.

Investment Conclusion:

Over the coming period, the USD unlikely to appreciate, a greater reflection of the relative strength and liquidity conditions in other economies. Against this, the order of preference is for the CAD, supported by energy prices; the EUR, as growth remains strong and monetary tightening comes onto the agenda; the GBP, as policy uncertainty supersedes inflation concerns; the JPY, which still lags the world for monetary tightening; the AUD, which will continue to decline with commodity prices, asset prices and capital flows and; EMFX, which is only selectively at risk, as idiosyncratic monetary tightening and capital flows dictate the outlook. Read: Currencies Investment Conclusions

Credit:

Strong global growth momentum is likely to see spreads tighten within a rising reference rate regime, the result of a continuation of the global economic expansion. This environment will also likely see default rates remain low, however will result in slowing global liquidity growth. All told, this will result in credit spreads being contained, although volatile during bouts of liquidity tightening. High Yield credit offers value, followed by selected Investment Grade and Sovereigns. The economic expansion is expected to continue, however productivity growth will limit long term inflation, favoring a barbell strategy for duration.

Investment Conclusion:

The broad outlook for Bonds is negative, with valuations unappealing, especially as inflation rises with the extension of the cycle, even if only to a limited point. From a credit perspective, selected High Yield and Investment Grade is preferred due to the benign credit environment and relatively attractive valuations. Sovereigns are generating negative yields in real and in certain cases, nominal terms. From a duration perspective, floating rate notes and short duration issues will outperform, with the belly of the curve most at risk. Read: Credit Investment Conclusions

For further details regarding our investment positioning asset class, region and sector, please refer to the full presentation of the Q1 2018 Deltec Quarterly Global Strategy Outlook, and the Latest Investment Positioning and Key Trades documents.

Should you wish to receive Deltec Investment Research or further information regarding investing with Deltec, please contact either myself or your Deltec Representative at any time.

Best Regards,

Atul Lele, CFA

Chief Investment Officer

Deltec Investment Presentation Paradise Lost: