What happened?

As you probably know on December 22, 2017, President Trump signed into law the Tax Cuts and Jobs Act of 2017 (“TCJA”). Among its provisions, the TCJA reduces the statutory U.S. Corporate income tax rate from 35% to 21% effective January 1, 2018. And included was a mandatory deemed repatriation tax on foreign earnings, repeal of the corporate alternative minimum tax and the domestic production activities deduction, and expensing of certain capital investments. Here are two very different examples.

Check out our H2 hedge fund letters here.

Skyworks Solutions Inc. (Nasdaq:SWKS) in its quarterly (10-Q) report 5th Feb 18, disclosed a onetime charge of $18.5 million related to the revaluation of its deferred tax assets and liabilities, using the new federal statutory tax rate of 21%,

And Warren Buffett reported in the latest shareholder letter how Berkshire Hathaway will receive (over time) a gain of $29 billion as a result of the tax changes.

So, why did Skyworks Solutions Inc. end up with a one-off tax $18.5 million charge, while Berkshire Hathaway ended up with a one-off $29 billion gain?

We can eliminate the size of each enterprise, as size doesn’t matter. The nature of each company does play a part in determining the tax consequences, but first, we need to explore the underlying accounting principles of corporate income tax.

The amount of corporate income tax paid by a company, at financial years’ end, is not based upon accounting profits.

Yes really!

Accounting profit is determined using the requirements in (GAAP) accounting standards for the recognition and measurement of revenues, gains, expenses, and losses, whereas taxable profit is determined using income tax laws.

The differences between accounting profit and taxable profit generally relate to four broad categories as follows:

1. Certain accrual accounting items

2. Values other than original cost

3. Non-deductible items

4. Tax incentives.

In the case of Skyworks Solutions Inc., we know that the one–off $18 million is due to revaluation of assets and liabilities.

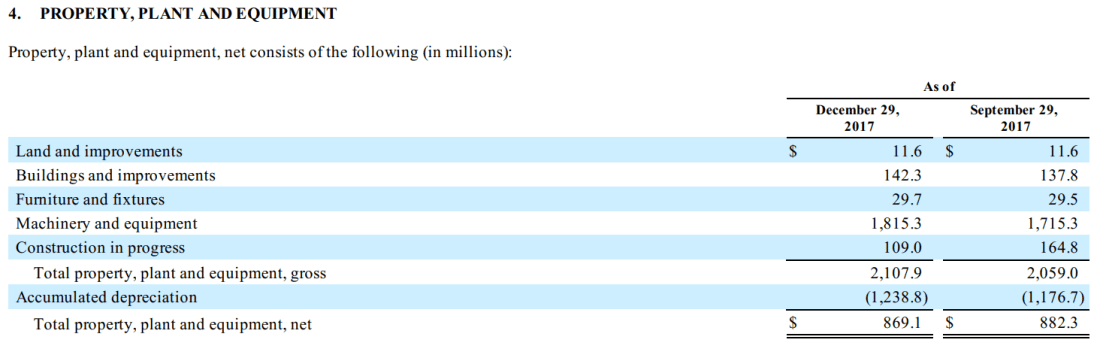

From the table below for Note 4. PPE, Machinery and Equipment increased by $100 million, plus land and improvements increased by $4.5 million. These increases in valuations are, as I suspect, the chief cause of the $18 million tax charge. (Without detailed disclosure of the assets and revaluation method used by the company’s accountants, we can only take an educated guess).

This tax charge relates to point 2. Values other than original cost.

For tax purposes, the $100 million increase in asset value for Machinery and Equipment is taxed at the company tax rate, as the class of assets (in this case the Machinery and Equipment) base carry amount has increased in value. (Table below for Note 4.)

The class of assets (Machinery and Equipment) are originally based upon their initial cost. But normally a business doesn’t buy all the equipment and machinery at once, but accounting practices allow the company accountant to group certain assets together, to simplify the process.

Let’s assume for simplicity that Machinery and Equipment cost in total $2 billion, and let’s assume the $1.7 billion figure at 2017 is the net value of Machinery and Equipment after depreciation of the $2 billion original value.

Tax law will allow a particular asset to be depreciated at say 25% per year on a straight line basis, but common accounting practices for the exact same asset would only depreciate at a 10% straight-line basis.

By allowing companies to depreciate an asset at a higher rate (25%), it reduces the net income and thus the amount of income tax payable. (This type of tax incentive is encouraged by Government to boost investment and thus help drive the economy)

In this case, we’ll assume that both the tax depreciation rate allowed and the accounting depreciation rate is the same, at 10% over 10 years.

At end of the first year, the depreciation works out at $200 million (2 billion times 10%), so the carrying amount of Machinery and Equipment is $1.8 billion dollars at the end of the first year and that is the beginning figure for year two.

Say 3 years later, a total of $600 million in depreciation has occurred and the Machinery and Equipment carrying amount is $1.4 billion.

Now let’s say that the company accountant determined that the carrying amount of the Machinery and Equipment is below the market value for the same Machinery and Equipment. The company accountants revalues the Machinery and Equipment up by $100 million.

Now, it is worth $1.5 billion, so what happens is that $100 million dollar increase is taxed at the company tax rate $21 million (100m times 21%). This $21 million becomes a deferred tax liability to the company, and which will be paid in the next financial period, assuming it makes a profit.

And this why Skyworks Solutions Inc. had a one-off tax charge of $18 million. Now, the $3 million dollar difference (21m – 18m), I suspect, another unrelated one-off tax deductible.

What will occurred to Berkshire Hathaway is the opposite. Berkshire’s deferred tax liability was reduced by the fall in the tax rate.

Return to our Machinery and Equipment example. That $100 million dollar increase was taxed at the company tax rate of 35%, before 2018, would have resulted in a deferred tax liability of $35 million.

But as the tax rate has fallen from 35% to 21% that $35 million dollar liability falls to $21 million, decreasing the amount of tax owed in the future by $14 million.

“When you reduce a [company’s tax] liability the net worth [of the company] goes up.” Warren Buffett.

In the first instance, Berkshire had close to $100 billion in unrealised [equity] investment gain, and the deferred tax liability was close to $35 billion and with the tax rate falling to 21% the deferred tax liability has dropped by $14 billion – but the tax liability only comes due once the equities are sold.

Berkshire Hathaway other deferred tax benefit was due to our previous discussion related to the amount of deferred tax liabilities Berkshire is required to pay for its fixed assets.

We touched on how a government will allow bonus depreciation to encourage investment because the bonus amounts of depreciation reduce the amount of tax payable on current earnings.

Return to our previous example of Machinery and Equipment, where we were depreciating at a 10% rate over 10 years and the carrying amount was $1.4 billion net after $600 million in depreciation.

Now imagine that the tax depreciation rate was 25% instead of 10%. After year 4, the $2 billion asset base has been fully depreciated and for tax purposes, the carrying amount is written down to $0.

But the accounting carrying amount of Machinery and Equipment is still $1.4 billion. That means that the accounting depreciation cannot be used to reduce earnings.

As the accounting depreciation continues to depreciate, and it creates a deferred tax liability. For instance, the $200 million depreciation charge each year is taxed at the company tax rate.

For years before 2018, the depreciation charge was taxed at 35%. The drop in the company tax rate reduces the current deferred tax liability amounts from previous years, same as in the unrealised equities gain.

Take care, as all these deferred tax changes are not related to cash, similar to accounting profit, these changes will affect future financial transactions.

Takeaway:

These large one-off charges/gains will distort earnings, and it our job as investors see through these one-off charges/gains and calculate the underlying earnings from core operations.

These will no doubt fool average “investors” who don’t understand what occurred, which should present us with opportunities.

Watch below Warren Buffett further explain how the new Corporate Income Tax changes affect Berkshire Hathaway.

I’ll be running a 10 week Investment Analysis Clinic for immediate investors and not for beginners – check it out here.

Article by Searching For Value