On December 22, 2017, the President signed into law the Tax Cuts and Jobs Act, which is officially titled ‘An Act to Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018’. Here are four main points from the new tax bill that may affect you in short trust rates, child tax credit, deductions and 529 plan.

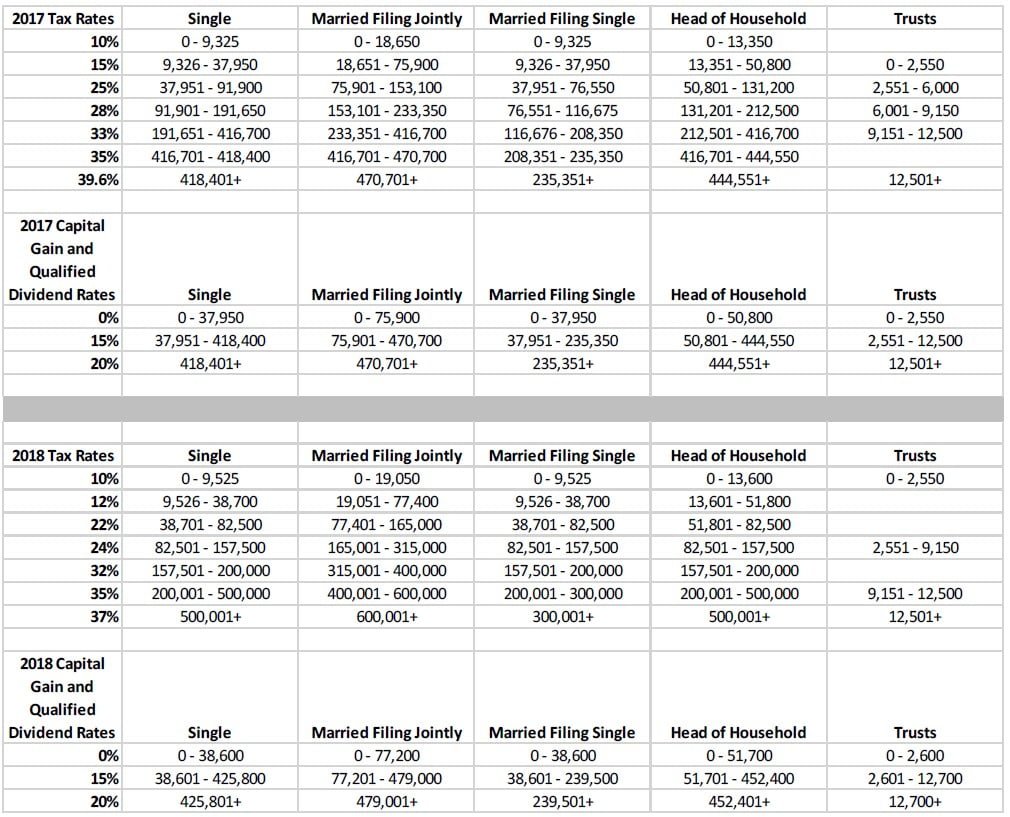

[REITs]1. Lower Individual and Trust Tax Rates

2. Standard Deduction is Almost Doubled, and Fewer Itemized Deductions are Allowed

a. The Standard Deduction has been almost doubled for 2018, as shown in the chart below.

The increased standard deduction expires after 2025.

b. State and Local Taxes: The new tax law limits the total deduction of state, local, and property taxes to $10,000. This new limitation expires after 2025.

c. Home Mortgage Interest Deduction: Effective 2018, the home acquisition debt limit is reduced to $750,000 from $1,000,000. The $1,000,000 debt limit is still applicable to homeowners who entered into a binding written contract prior to December 15, 2017, to close before January 1, 2018. Interest on home equity debt is no longer deductible. The new mortgage interest limits expire after 2025.

d. Miscellaneous Deductions are no longer deductible through 2025. These miscellaneous deductions include: Investment expenses, tax preparation fees, and unreimbursed employee business expenses.

e. The Limitation on Itemized Deductions is suspended through 2025.

3. 529 Plan Use is Expanded

Beginning in 2018, 529 plan distributions can now be used to pay tuition expenses for public, private, or religious, elementary or secondary schools. There is an annual limit of $10,000 per student that can be withdrawn each year for these expenses. The 529 plan rules for postsecondary education institutions remain unchanged.

4. Child Tax Credit

The child tax credit is increased to $2,000 (from $1,000) per qualifying child under the age of 17. The credit is phased out when modified adjusted gross income exceeds $400,000 (previously $110,000) for married couples filing joint, and $200,000 for all other taxpayers. The increased credit as well as the increased phase out limits expire after 2025.

Please contact PagnatoKarp if you would like a tax projection completed to assist you in calculating your personal impact from the new tax bill.

Resources: IRS, TheTaxBook

***

At PagnatoKarp, our focus is on YOU. We go beyond wealth management to simplify and elevate your lifestyle so you have more time to spend on what matters to you most.

We offer digitally integrated, in-house services for investment, planning, tax, legal, private banking, family governance, concierge, and travel. With True Fiduciary™ Standards and Family Office services, you receive transparent advice focused on safety of assets, simplicity, and cost. Please contact PagnatoKarp at 703-468-2700 or www.pagnatokarp.com