When it comes to investing, buying cheap shares or markets is almost always better than buying expensive ones.

For one thing, cheaper markets have far more upside than expensive markets. And when markets fall, cheaper markets tend to fall less than expensive ones.

So which markets in the world are considered cheap now? One of the best ways to get an answer to this is to look at the CAPE ratio.

CAPE: A better measure of value

There are many ways to value a stock or market.

Earnings of a company – or a market – can rise or fall a lot from one year to the next. The best way to take this into account is to adjust earnings for economic cycles by looking at long-term earnings trends, rather than the snapshot of a single year. The cyclically adjusted price-to-earnings ratio (CAPE) uses the average for ten years of earnings, and adjust them for inflation. This smoothens the cyclicality of a single year P/E. It’s more difficult to calculate, but it’s a more complete valuation measure than the normal P/E ratio.

As I explained recently, investing in markets that have a low CAPE, on average, results in much better returns than buying stock markets with high CAPEs.

For example, the 10 cheapest stock markets in the world at the end of 2016 returned an average of 29.5 percent in 2017. Meanwhile, the 10 most expensive markets returned an average of 23.4 percent over the same time period. (By comparison, the MSCI World Index was up 24 percent and the S&P 500 rose 21 percent..)

Cheap outperformed expensive the year before, too. The 10 cheapest stock markets at the end of 2015 returned 19 percent while returns from the 10 most expensive markets declined, on average, by 1 percent.

Of course, just because a market is cheap (low CAPE) doesn’t mean that it won’t stay cheap, or get even cheaper, or perform well. Similarly, just because a market is expensive (high CAPE), it doesn’t mean it won’t get more expensive, or that shares won’t appreciate.

But as a rule of thumb, finding cheap stocks and markets on a CAPE basis is a straightforward way to value assets, and it has a solid track record.

So what are the cheapest stock markets now – which, if history is any guide, will on average outperform more expensive markets this year?

———-Recommended Link———–

Continue reading here.

————————————————

The cheapest markets now

Right now, the world’s cheapest emerging markets on a CAPE basis are Russia, with a CAPE of 5.8, the Czech Republic (at 9.8) and Turkey (11.9). Notably, last year both the Czech stock market (up 39 percent) and Turkey’s market (up 48 percent) were substantial outperformers. Russia’s market rose only 3 percent in U.S. dollar terms.

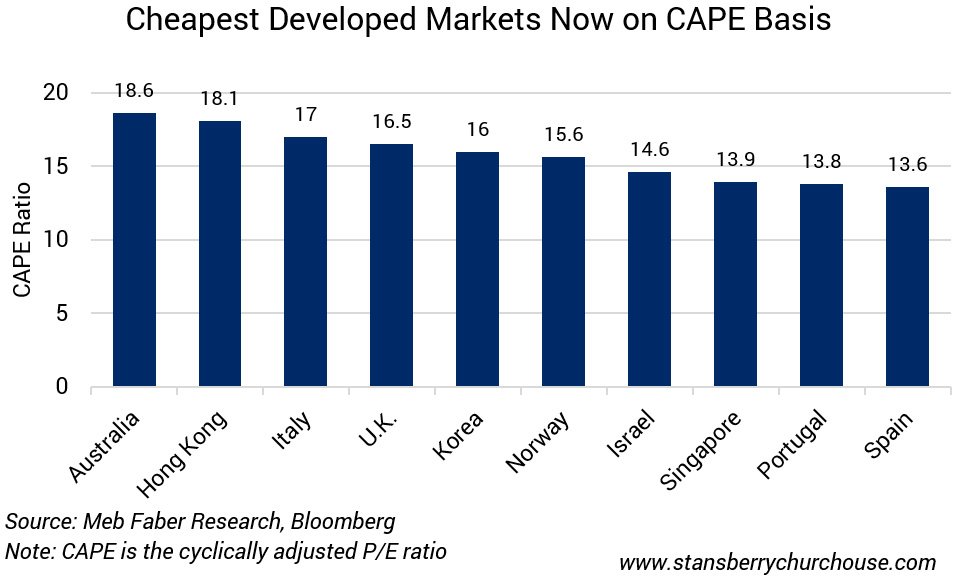

The graph below shows the cheapest developed markets, which are Spain, Portugal and Singapore pulling up the rear, all with a CAPE of just under 14. All three markets performed strongly in 2017, with Singapore up 31 percent, Portugal up 34 percent and Spain up 26 percent.

If the past two years are any guide, these cheap stock markets – both emerging and developed – should outperform their more expensive counterparts.

You can get exposure to Turkey through the iShares MSCI Turkey ETF (Nasdaq; ticker: TUR)… to Singapore through the iShares MSCI Singapore ETF (New York Stock Exchange; Ticker: EWS)… to Portugal through the Global X MSCI Portugal ETF (New York Stock Exchange; Ticker: PGAL)… and to Spain through the iShares MSCI Spain ETF (New York Stock Exchange; Ticker: EWP). ETFs for the Russian market are traded under the symbol RSX in New York, 3027 in Hong Kong and RUS in Singapore. (Note that ETFs don’t necessarily directly replicate the index.)

But if you want an easy way to buy the world’s cheapest stock markets all at once is by using the Cambria Global Value ETF (NYSE; ticker: GVAL).

This ETF aims to follow the price and yield performance of the Cambria Global Value Index, which focuses on the 100 companies with the best valuation metrics from 45 different countries. The ETF’s top holdings include companies in Portugal, the Czech Republic, Russia, Austria, Brazil and Greece.