This content is NOT a recommendation to buy, sell, or trade Digital Assets. This is ONLY meant to provide an educational overview.

What is Our Mission with this Content?

- Most of the content produced thus far on Digital Assets state that Bitcoin has speculative characteristics and will show a chart illustrating that it has surpassed other bubbles. That’s interesting, but it doesn’t advance the conversation. What’s missing is more investor education. Knowledge = Power.

- Our goal in this 5-minute read is to educate investors so that they can be more informative should they decide to utilize Digital Assets.

Conclusion

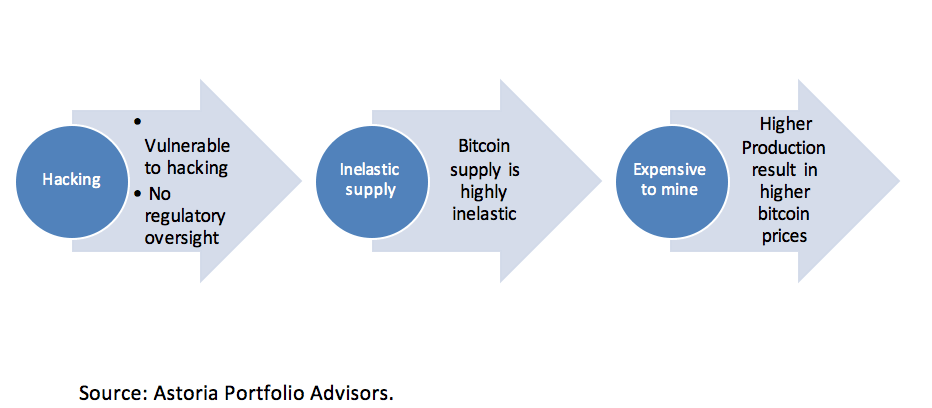

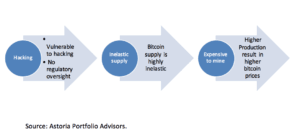

- Investors are seemingly surprised by Bitcoin’s price volatility. They shouldn’t Price volatility is extremely high due to 3 reasons.

Source: Astoria Portfolio Advisors.

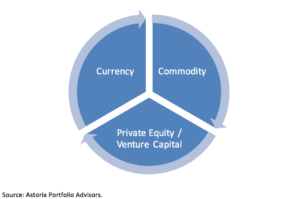

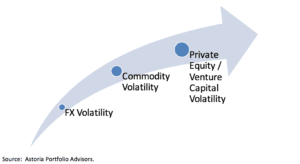

- Bitcoin contains characteristics of FX, Commodities, and Private Equity/Venture Capital companies. Given the significant volatility premium in Digital Assets, investors need to become more educated to determine if it’s a viable asset for their portfolios or if they just want a quick trade.

- Given there is no centralized exchange and a limited amount of exchange traded instruments to hedge, prices across the world can vary dramatically which makes is an interesting opportunity for arbitrageurs.

- The pricing of Digital Assets resembles stock trading in the early 1900s or Emerging equities 15-20 years ago where spreads were wide, volatility was sky high, and information flow was low. More knowledge + more education + more technology + more hedging solutions should temper price volatility. This will all take time, however.

- Bitcoin fanatics shouldn’t fear more government or regulatory oversight. This will bring more credibility and elevate Bitcoin’s stature.

- Arguing that criminals use Bitcoin and that tarnishes its image is pointless. Those same criminals also use dollars, yen, swiss francs, euros, and gold to facilitate illegal activity – and they have for thousands of years.

- Volatility being sucked out of the traditional financial assets (stocks, bonds) along with the shrinking capital market system have undoubtedly enticed volatility seeking investors into the Digital Asset space. In a world with no volatility, Digital Assets have tons of it!

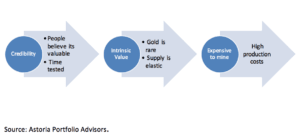

- Gold has relatively higher intrinsic value compared to Digital Assets. Gold’s supply is elastic whereas Bitcoin is highly inelastic. Gold has more inventory as Bitcoin’s inventory is fixed. These are important differences along with the fact that Gold a multiple century head start compared to Digital Assets.

- Ultimately, Bitcoin’s value will largely depend on what people determine its market clearing price to be worth – this is how the price of gold is determined. Both are storage of values and neither produce cash flows so traditional stock/bond valuation models (i.e. discounting future cash flows) cannot be used. More Bitcoin users + more knowledge + more hedging solutions will empower investors to determine its value in society.

- Nobody knows where Bitcoin’s price will settle. If we knew its forward price, it would be there. Showing a chart that it has surpassed the Tulip bubble is interesting, but it doesn’t help determine the efficacy of Digital Assets. A tulip is a damn tulip! There is some intrinsic value in Bitcoins if enough people say there is.

- Just because an asset went up a lot, doesn’t mean it can’t go up more. Again, we focus our effort on educating the reader so that they can make a more informed decision should they decide to use Digital Assets. Always remember, Knowledge = Power.

What is Bitcoin?

- Bitcoin exhibits characteristics of 3 distinct asset classes:

- Currency: Bitcoin can be used to purchase goods and services – hence, it has characteristics of a currency. There is no physical form why it is known as a Digital Asset.

- Commodity: There are production costs to create bitcoin which influences its price. Miners are paid for their efforts. Hence, bitcoin exhibits commodity-like characteristics.

- Private Equity / Venture Capital: Purely from a price volatility perspective, bitcoin resembles a private equity, venture capital start-up where risk of failure is sky high. There is no cash flow generated from owning bitcoins – which is very similar to private equity and venture capital where future growth is significantly more important than generating cash flows.

Why did Bitcoin start?

- Bitcoin was born out of the 2009 Credit Crisis that saw stocks, bonds, and real estate fall as much as 50%-80% and some currencies weaken as much as 25-35%. In the years following the 2008 Great Recession, several central banks deliberately weakened their currencies (i.e. print money) to spur economic growth.

- Bitcoin was born to provide investors with a new type of Digital Asset where encryption techniques were used to regulate the creation of new units and to verify the transfer of funds – all operating independently from a central bank or a government agency.

- Given the inherent 3 combined asset classes implied within Bitcoin, its price action should be more volatile than traditional capital markets. However, there is no doubt that volatility being sucked out of traditional capital markets have forced some volatility seeking investors into this asset class.

How Big are Digital Assets Relative to Stocks, Bonds, and Commodities?

- Digital Assets make up less than 1% of traditional capital markets.

How does Blockchain fit into the equation?

- Blockchain is a digital, decentralized ledger. There is no central point of control and this digital record is stored partially or fully on each participant’s software. The Blockchain is a fully auditable record of every bitcoin and every Bitcoin transaction.

- Blockchain memorializes every bitcoin transaction. Each transaction is publicly accessible and transparent to each participant.

- Bitcoins are created using a process known as mining. Miners are important to the echo system as they group unconfirmed transactions into blocks and add them to the blockchain. Anybody can become a Bitcoin miner by running software with specialized hardware.

- Bitcoin mining can be a competitive process as individuals are awarded for their services. As more miners step into the mining process, it can get more difficult to profit so miners look for efficiency to cut their operating costs. This is the element that closely resembles the commodity production field.

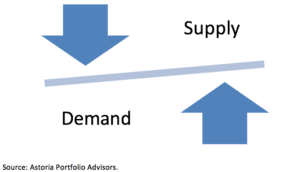

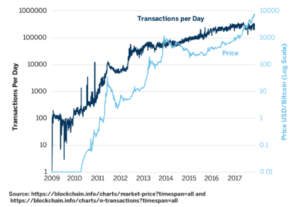

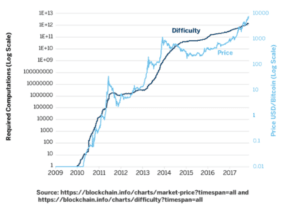

- There is a significant supply and demand imbalance with bitcoins. See picture below. This is a key reason behind its parabolic move.

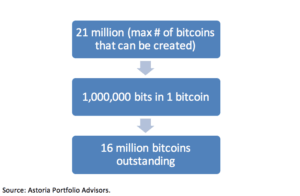

This is how the price is set for Bitcoin.

- Like any financial asset, the price of bitcoin is determined by supply and demand:

- As mentioned above, Bitcoin’s supply is highly inelastic – this is critical to understand.

- Bitcoin trades on different exchanges and each exchange sets their own average price based on the trades being made by the exchange at any one time. The price between different exchanges can vary quite a bit. There are at least 40 exchanges that can facilitate Bitcoin transactions. Each of them have their own pros and cons.

- Bitcoin indexes gather together prices from several exchanges and average them out, but not all the indexes use the same exchanges for their data. This makes arbitrage opportunities available which is why some Hedge Funds are starting to look at Digital Assets.

How Volatile is Bitcoin?

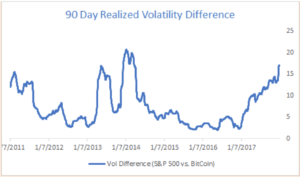

- In the past 6 years, Bitcoins have experienced on average 7x the volatility of the US broad market – we think that makes sense as you are essentially buying 3 highly volatile assets.

- However, there have been times when it was as high as 20x more volatile than the S&P 500. See chart below.

Source: Bloomberg, Astoria Portfolio Advisors. We use rolling, weekly return data between S&P 500 and XBTUSD Currency Index on Bloomberg.

- We would argue that Bitcoin’s volatility has convexity so it’s not necessarily a function of summing FX + Commodity + Private Equity to derive Bitcoin’s volatility. Plus, there is an enormous element of gap risk as there are many exchanges throughout the world.

- This volatility premium is justifiable in Astoria’s view.

- Knowledge of Digital Assets is still in its infancy stages and markets are inefficient – so price action is highly volatile and arbitrage opportunities are robust for those that can properly establish risk management and can stomach it.

- I started my career in Equity Derivatives Research in 2000 and saw first-hand how difficult it was for traditional asset managers to embrace a simple call overwriting or put selling strategy. Less than a decade later, the adoption of equity derivatives by these same clients was rampant.

- As the chart below shows, the number of Bitcoin transactions has been steadily rising but the overall number of users is still quite small (we discuss this in our appendix).

Is Bitcoin the Modern-Day Gold?

- What makes gold valuable?

- Does Bitcoin equally carry the same attributes as Gold? No.

- Bitcoin’s supply is highly inelastic and as production costs rise, Bitcoin’s price has risen accordingly. See chart below.

Appendix

Where Can I Buy Bitcoin?

- You buy Bitcoins on exchanges such as Coincase, Bitstamp, and Bitfinex. There is no middle man. It is known to be a peer to peer network where transactions take place directly between users. You can send bitcoins to people via mobile apps and a computer.

- Each transaction is recorded in a public ledger, known as Blockchain although the names of the buyers and sellers are kept private. This is one of the reasons why Bitcoin is often suggested as the transaction of choice for those trafficking in illegal activities. However, you should be mindful that physical currencies have always been used to engage in illegal activity. The value of bitcoin shouldn’t be marginalized because of illegal use.

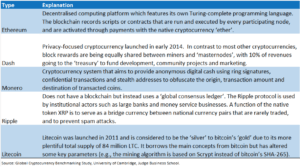

Are There Other Digital Assets Besides Bitcoin?

- The University of Cambridge estimates that in 2017, there are 9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin. https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/2017-global-cryptocurrency-benchmarking-study.pdf

- Other popular Digital Assets are Ethereum, Dash, Monero, and Ripple. What are some of the key differences between these Digital Assets vs. Bitcoins? See table below.

Where can I use Bitcoins?

- Bitcoin can be used to purchase goods and services (Overstock, Expedia, Cheapair, Ships & Trip Travel, Microsoft, Dell). In northern California, a person purchased a Lamborghini with Bitcoin https://www.ccn.com/buying-cars-bitcoin-lamborghini-jeep-everything/

- As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment. http://www.ibtimes.co.uk/bitcoin-now-accepted-by-100000-merchants-worldwide-1486613

You Can Trade Bitcoin Futures.

- CBOE and CME have listed futures contracts on Bitcoin. There are several exchanges that facilitate trading Bitcoin.

- Advantage Futures

- ED&F Man Capital Markets

- E*trade

- Interactive Brokers

- Phillip Capital

- RJO Futures

- Straits Financial

- TD Ameritrade

- Trade Station

- Wedbush Futures

Source: CBOE

- CBOE:

- XBT futures is a cash-settled contract that settles to a single, tradeable auction price. Investors can buy, sell, bitcoin futures nearly 24 hours a day, 5 days a week.

- Contract specification for futures can be found here. http://cfe.cboe.com/cfe-products/xbt-cboe-bitcoin-futures/contract-specifications

- CBOE futures are determined from Gemini exchange. 1 CBOE Bitcoin future currently costs approx. $16,000.

- You will have to check with your futures broker how much collateral you will need to put down. There are estimates that as much as 50% margin needs to be posted so that’s currently $8k if you are trading the CBOE future.

- Gemini currently hosts two daily auctions (4:00 p.m. ET and 7:00 p.m. HKT) for USD/BTC trading, as well as one daily auction (4:00 p.m. ET) for USD/ETH trading.

- CME

- BTC futures are higher in notional value (currently about $86,000). They also trade nearly 24 hours a day.

- All contract months settle to the volume-weighted average price (VWAP) of outright trades between 14:59:00 and 15:00:00 Central Time, the settlement period, rounded to the nearest tradable tick. If the VWAP is equidistant between two ticks it will be rounded towards the prior day settlement price.

- You can find the contract specifications at this site: http://www.cmegroup.com/trading/equity-index/us-index/bitcoin_contract_specifications.html

Are There Bitcoin ETFs?

- Several issuers have filed to launch ETFs on bitcoins. GBTC is a trust offered on the stock exchange that holds bitcoin as its primary asset. Given its early entrance, investors have flocked to it and have pushed its price to be, on average, 50% above its Net Asset Value. Assets in GBTC grew $3 bln in 2017 alone!

- Bitcoin ETFs should bring significant amounts of interest from investors that can’t trade futures, don’t want to pay high margin rates, or are seeking a smaller notional amount to invest. It is customary for ETF notionals to be less than $100 per share.

- In Astoria’s view, ETF solutions in non-US markets is the biggest opportunity given the larger number of Digital Asset users abroad.

Best, John Davi

Founder & CIO of Astoria

This content is NOT a recommendation to buy, sell, or trade Digital assets. This is ONLY meant to provide an educational overview. For full disclosure, please refer to this portion of our website: https://www.astoriaadvisors.com/disclaimer