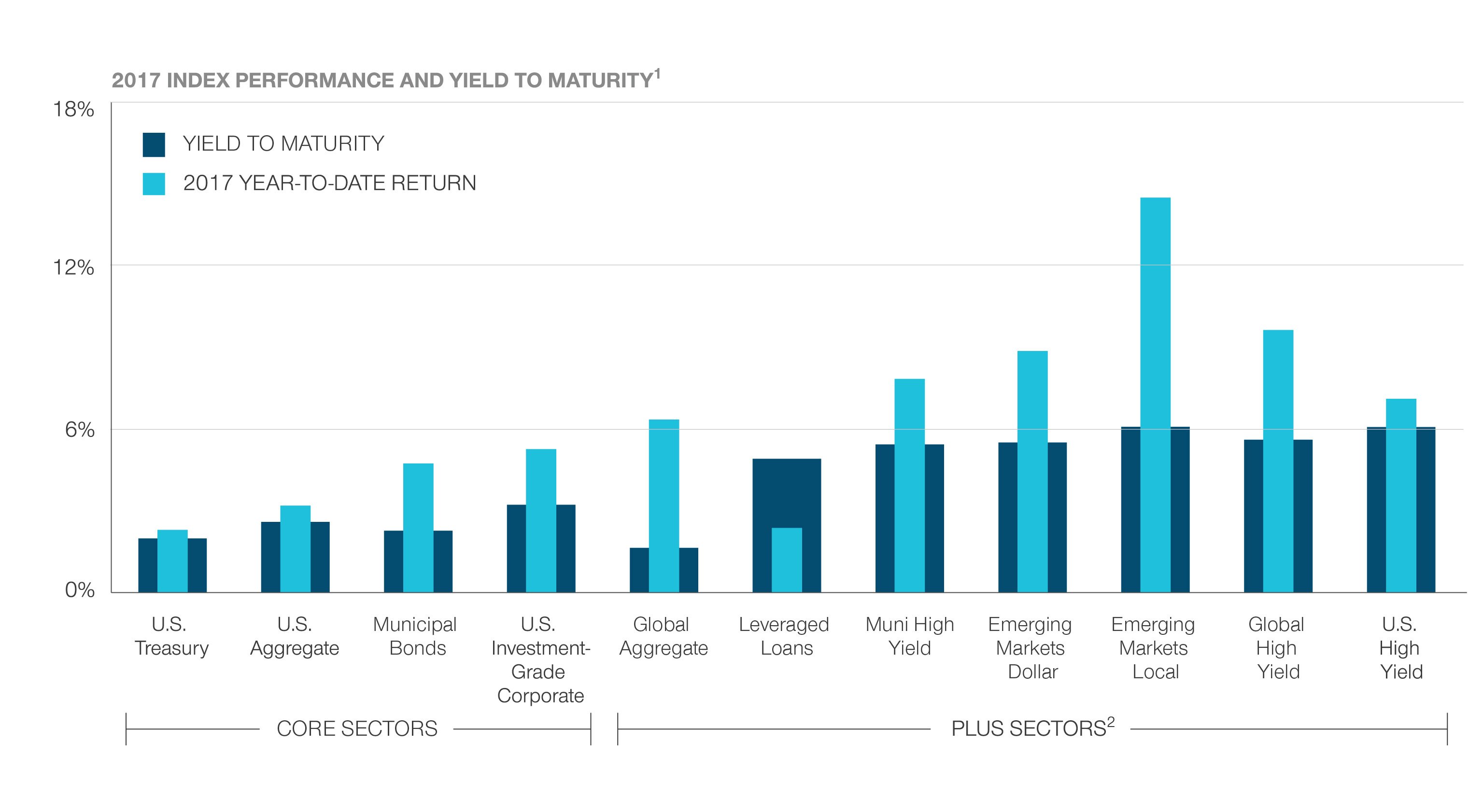

SEARCH FOR YIELD DROVE GAINS.

The performance of fixed income plus sectors in 2017 highlights strong demand for yield.

Interest rates remain low by historical standards and have pushed investors beyond core fixed income sectors in search of yield. While core sectors have performed well so far in 2017, the increased diversification across (1) geography and (2) sectors drove stronger gains in core-plus sectors such as high yield and emerging markets.

As of September 30, 2017

Sources: Bloomberg Barclays, FactSet, JPMorgan, and S&P/LSTA.

1 Asset classes are represented by Bloomberg Barclays, JP Morgan, and S&P indices.

2 "Plus" sectors represent more aggressive, higher-risk sectors versus "Core" sectors.

Past performance cannot guarantee future results.

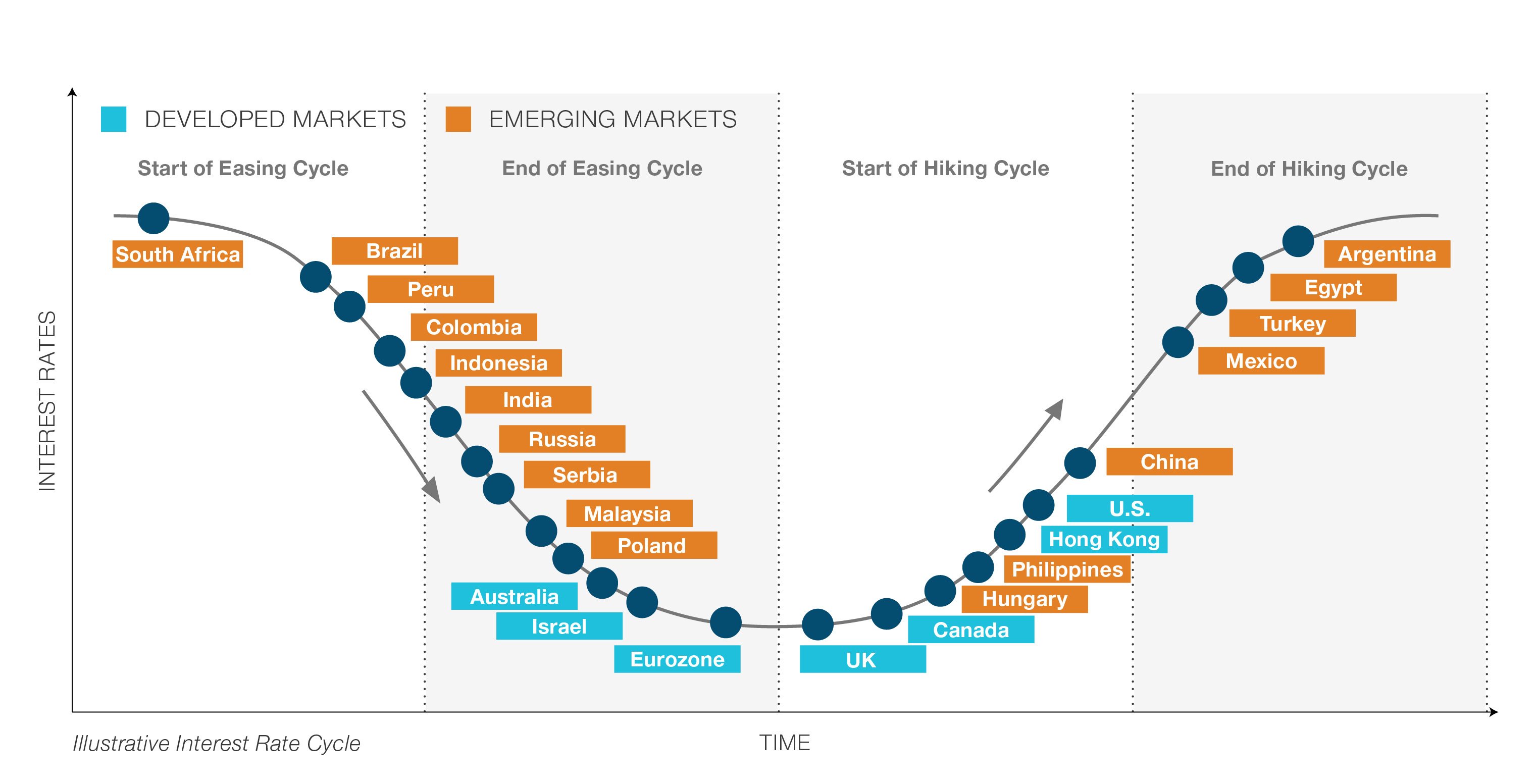

DIVERGENCE BRINGS OPPORTUNITIES...

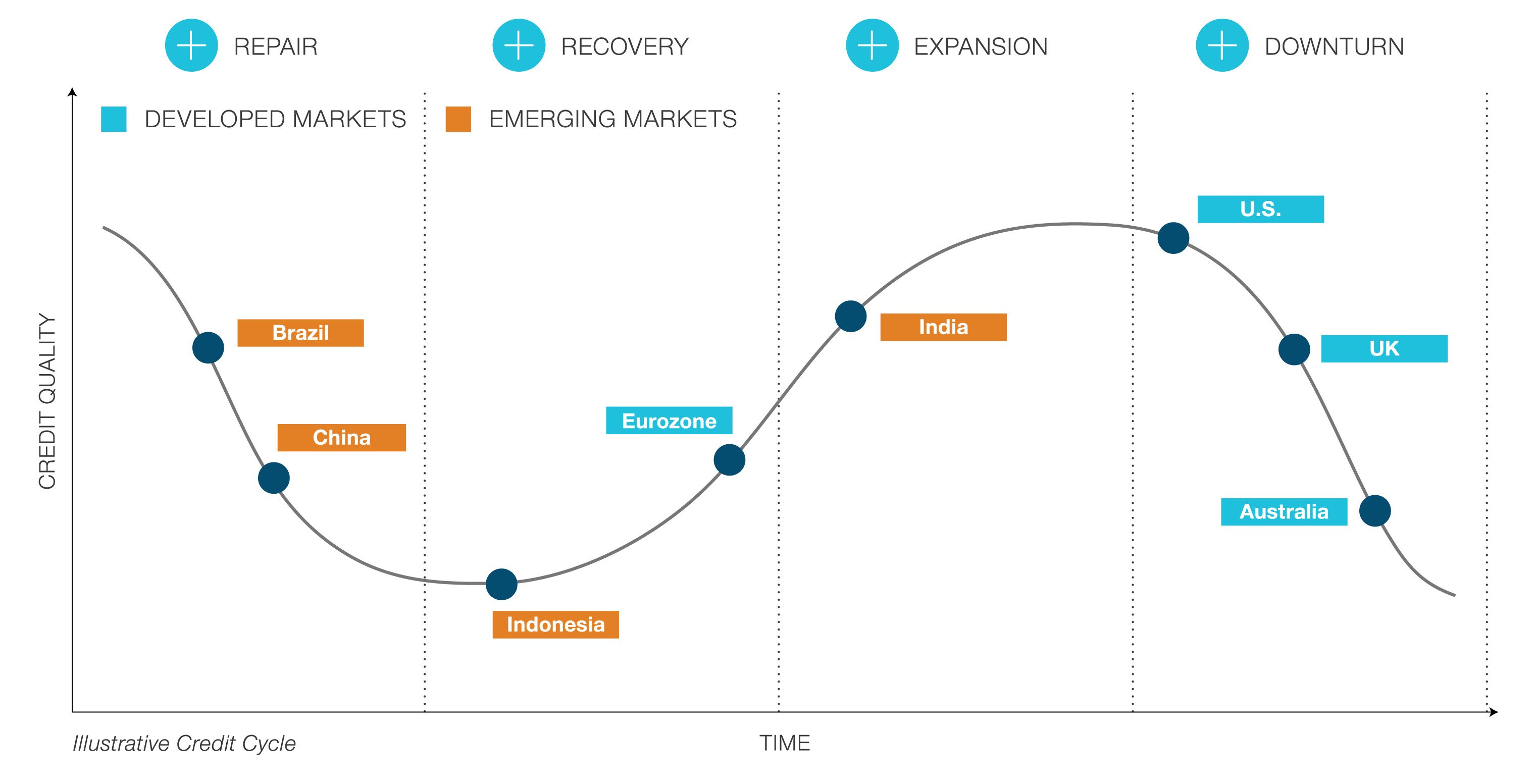

Variations in interest rate and credit cycles offer diversification opportunities.

Interest rates are expected to rise in the U.S., fall in India, and stabilize in the eurozone. At the same time, overall credit quality has fallen in the UK, plateaued in the U.S., and recovered in the eurozone. The growing breadth, depth, and complexity of the fixed income market highlight the importance of broad diversification, in-depth research, and active management.

Interest Rate Cycle

As of September 30, 2017

Source: T. Rowe Price

Past performance cannot guarantee future results.

Credit Cycle

As of September 30, 2017

Source: T. Rowe Price

Past performance cannot guarantee future results.

...BUT MIND YOUR STEP.

A broader opportunity set carries benefits and risks and calls for a balanced approach.

A portfolio that includes plus sectors–such as high yield, emerging markets, and leveraged loans–could benefit yield-hungry investors. However, many of these enhanced-yield assets are highly correlated with equities, which could alter a portfolio’s broader risk profile. It’s important to be mindful of these risks and maintain a balanced approach to portfolio construction.

Read the full article by Investments Team of T. Rowe Price, Advisor Perspectives