Article by RCM Alterrnatives

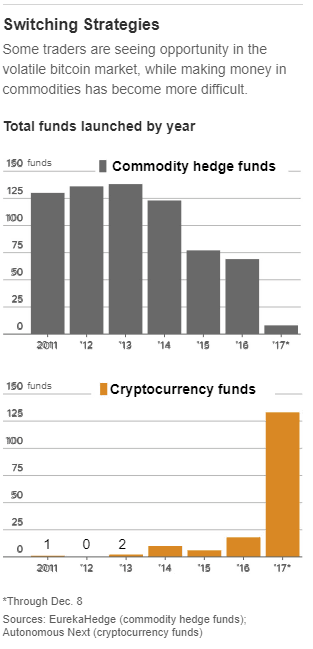

Call it Cypto-mania, call it a new sector to trade, or call it legit, hedge fund managers are buying into the narrative. Even though the leader of the cyptomania (Bitcoin) is off from its late 2017 highs, this isn’t much of a bother to hedge fund managers looking for returns when bitcoin moves *up and down*. Many warn of it’s volatile nature, which again hedge funds managers welcome (as long as they have the right risk parameters in place). Put that all together and there were more than 100 cyptocurrency funds launched in 2017, compared to only 8 new commodity funds. Here’s The WSJ:

Meanwhile, out of 171 cryptocurrency funds tracked by research firm Autonomous Next, 123 launched in 2017. While the market is growing, the $2 billion in assets under management is still dwarfed by investments in traditional assets.

Will we see just as many launches in 18? Will all these funds have the right right paramaters to avoid large loses? Which funds will become the bitcoin futures bellweather? Will Bitcoin be return bang many as speculating? Will we see a flood of funds into cryptocurrency funds? 2018 is going to be an interesting year!

P. S. – Check out this idea we have for gaining exposure to some of Bitcoin’s upside while trying to eliminate most of its downside.