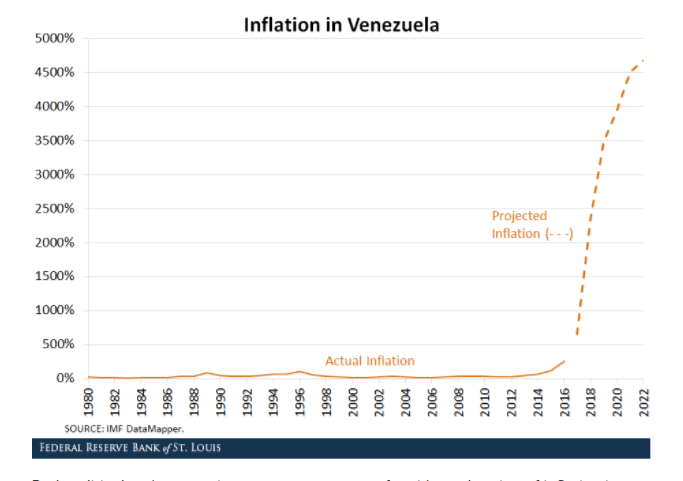

The situation in Venezuela is ugly and getting more so by the day. Looking on the bright side, however, the oil-rich nation’s abundance of misery might provide an example of how not to manage and economy. With inflation now spiraling out of control, projected to hit 2349.3% in 2018 by two Federal Reserve economists (and Bloomberg going much further stating today that inflation has hit 440,000% levels akin to Hungary in 1946, Weimar in 1923 and Zimbabewe more recently), these same two central bankers think they have the solution: a virtual currency.

Socialist thinking the government is more powerful than market supply and demand leads to chaos

In the last 12 weeks, the cost of a cup of coffee has skyrocketed 718% from 5,500 bolivars to 45,000 bolivars. As Bloomberg points out, if this were annualized it would mean 448,025% inflation.

At its core, Venezuela is the story of a socialist government that mismanaged significant wealth and then thought it had the power to control the economy and ignore forces of market supply and demand. In one instance, the government of President Nicolas Maduro attempted to force a private company to produce goods at a loss to stop price increases. The country started “expanding its monetary base,” a euphemism for recklessly printing more money to pay their debts.

The result of such heavy-handed economic control has been horrific. “On the political front, shortages of food, medicine, electricity and other necessities are causing riots and political instability,” write St Louis Federal Reserve Economist Ana Maria Santacreu and Research Associate Heting Zhu. “On the economic front, the drop in oil prices has implied a significant reduction in Venezuela’s revenues from oil’s exports.”

As a result of economic incongruity, violence and unrest has subsumed the populace with starving residents raiding the local zoo at one point to find their next dinner.

The problem is very real and the solution could be very virtual.

US Central Bankers recommend Venezuela adopt world's first sovereign backed virtual currency

Since the 1940s there have been 57 instances of hyperinflation, where monthly inflation rates top 50%.

During such episodes, a virtuous cycle occurs, where the currency rapidly devalues, unemployment increases while tax revenues drop and the cost of living becomes dramatically higher.

Santacreu and Zhu note the worst example of hyperinflation was not the famed Weimar Republic, where the German government produced so much of its currency it became worthless.

The worst example occurred in 1945 Hungry where prices were doubling every 15 hours as World War II raged. War is one of the causes of hyperinflation, as the St. Louis Federal Reserve observes:

Among other causes, hyperinflation occurs due to episodes of war, political mismanagement or the transition from a command economy in which the government owns the factors of production to a market-based economy. Usually, countries that undergo hyperinflation are characterized by high levels of government debt, which induces governments to start printing money to meet such debts. As a result, the value of the currency decreases, and a spiral effect takes hold, resulting in lost credibility on the currency and demands for higher wages, triggering even higher inflation.

While the present looks troubling, Venezuela’s future looks even worse. The International Monetary Fund projects that inflation might reach 4684% in 2022.

But there is hope.

Brazil was in this position during the 20th century, when their inflation rate topped 2000%, but they eventually got it under control.

“To stabilize the economy, the Brazilian government created a virtual currency called a unit of real value (URV),” the pair of central bankers noted. “URV’s intangibility and transparency made it much more trustworthy and dependable than the previously issued paper money.”

With all the haranguing over virtual currencies, could economically challenge Venezuela be the first to create a national digital currency? This just might work, say Santacreu and Zhu. “If Venezuela can adjust its large imbalances and establish some fiscal disciplines to restore people’s trust in the financial system, its hyperinflation could be tamed down eventually."