ZNTL stock’s biggest holder just boosted its stake

Shares of Zentalis Pharmaceuticals Inc (NASDAQ:ZNTL) are cooling off a bit Thursday after yesterday’s 4% rise capped a five-day rally of 17.8%. This bullish run in the market came as the news of Matrix Capital Management’s substantial commitment of $107.9 million to Zentalis’ recent capital-raising operation started to circulate among investors.

The transaction was first spotted on Fintel’s Daily Brief page which displays significant market trades and unusual options activity.

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

According to the 13D/A SEC filing, Matrix Capital Management, already a significant shareholder owning around 15% of ZNTL before the stock, bought an additional 4.76 million shares on June 20. The transaction boosted Matrix’s total share count to 13.96 million, signaling strong confidence and a large backing to the pharmaceutical company’s long-term prospects.

Zentalis is at the vanguard of developing small-molecule therapeutics designed to combat various forms of cancer. The company recently announced a promising update regarding the phase 1b trial of azenosertib, part of a combination therapy used in the treatment of patients with platinum-resistant ovarian cancer.

This news, along with a collaboration with industry giants Roche and Foundation Medicine for the advancement of azenosertib’s phase 3 trial, are positive signals that management is tracking along on the New York City-based biopharma’s long-term growth plans.

Is today’s pull-back the end, or is there more boost to be had in the biggest shareholder’s move?

Institutions Slow

The institutional activity in ZNTL has slowed a bit in the most recent quarter after a significant step up over the last year. The number of institutions on the register has grown by 1.5% over the last quarter while the average portfolio allocation has declined by around 3%.

There are 348 hedge funds and institutions on the register that collectively own 77.95 million shares of the float. Fintel’s Fund Sentiment Score of 46.05 ranks Zentalis in the bottom half when screened against 36,054 other securities. You can find a list of higher ranking stocks here on the leaderboard.

The company’s shares have enjoyed a 44% boost so far in 2023, but continue to to trade more than 60% below their peak above $80 at the close of 2021.

Interesting Options Activity

Fintel’s options data on ZNTL highlighted a swing in sentiment on Wednesday in a trend against the share price movement. As shown in the table below, the swing to net premium sold over course of trading yesterday was driven by put option purchases.

Matrix Capital’s latest investment was part of Zentalis’ recent share offering of over 11 million shares at $22.66 per share. The company plans to leverage the proceeds from this capital raise to fund ongoing and planned clinical trials and support general corporate purposes.

Notably, the fresh influx of capital has put Zentalis on secure financial footing, ensuring it has sufficient funds to cover its operating expenses and capital expenditure needs through 2026.

Zentalis has recently showcased compelling efficacy data for azenosertib in the treatment of solid tumors, addressing some of the pressing concerns surrounding the commercial, fundamental, and strategic value of the program.

Although there are lingering questions about the efficacy and safety/tolerability of the drug, Zentalis is poised to provide further clarity in the forthcoming update from this monotherapy trial in Q4.

As the company navigates this pivotal stage, the collective investor gaze is focused on whether there exists a viable accelerated pathway for monotherapy azenosertib in treating platinum-resistant ovarian cancer. Additionally, the company’s broad investment thesis, centered on developing potentially differentiated small molecules assets, serves to keep investor sentiment engaged.

Analyst Thoughts

Morgan Stanley analyst Michael Ulz said that the recent investor event provided much needed clarity on the chemo-combo strategy and that the monotherapy dose optimization confirmed an improved profile.

Morgan Stanley has an ‘overweight’ call and $55 target price on the stock.

Fintel’s consensus target price of $47.53 suggests the market thinks shares could rise more than 60% over the next year if current momentum persists.

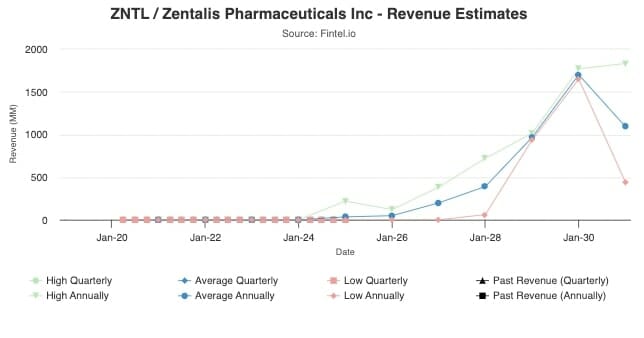

The chart below shows the forward revenue forecasts from analysts in the market through to 2023.

Matrix Capital’s recent financial vote of confidence in Zentalis gives it a brighter future align side its ambitious agenda. The saga of Zentalis’ journey in revolutionizing cancer treatment through small molecule therapeutics will continue to unfold in the coming quarters.

The post Matrix Capital Infuses $108 Million Into Zentalis Toward Promising Cancer Therapeutics appeared first on Fintel.