By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

As a “Tex-Can”—born in Canada, lived in Texas the past 26 years—I’m so blessed to call Texas my home. I can’t wait to tell you all the fascinating things I’ve learned that makes the state a truly remarkable place.

But first, you probably heard about the big gold selloff on Wednesday. I just flew in from meeting with gold fund analysts in Toronto, Vancouver and New York, and a lot of our conservations touched on this subject.

Gold has been on a tear so far this year, so what’s the cause of this selloff? Turns out, most of the gold stock buying can be traced back to macro hedge funds like Bridgewater and quant funds. The generalists, in fact, have not been buying. I might have mentioned before that the S&P 500 Index is only 1 percent gold—Newmont Mining being the only name in the high-cap index—so there’s not much general investment in the yellow metal. The Toronto Stock Exchange (TSE) is closer to 8 percent, but most Canadian institutions are substantially underweight. This has been a big drag on performance.

Some of these hedge funds and quantitative-based investment platforms use leverage in their strategies—some are even triple or quadruple leveraged—which can cause the price of gold to react with big fluctuations. Many quant-based traders also track moving averages like the 50-day, and when gold falls below this mark, they quickly sell enough to lower their risk. So the selloff this week—which came ahead of Federal Reserve Chair Janet Yellen’s hawkish remarks from Jackson Hole, Wyoming—has seen gold and gold stocks fall even more.

In the first quarter this year, the top 10 performing gold stocks—selected based on low SG&A (selling, general and administrative costs)-to-revenue—surged 88 percent. Compare that to the Philadelphia Gold and Silver Index (XAU), which jumped 53 percent during the same period. It appears, then, that one of the key factors triggering quant-buying was low SG&A-to-revenue. Quants didn’t care about the mining properties and future gold production, which has historically been the case.

When selloffs such as these occur, it’s often hard not to get emotional. That’s why it’s important to keep in mind Sgt. Joe Friday’s famous saying: “Just the facts, ma’am.”

I still maintain that the gold drivers are in place and am optimistic for the metals’ outlook. Stay tuned!

Having said all that, let’s talk about Texas, home to U.S. Global Investors!

1. Check out Our Mettle

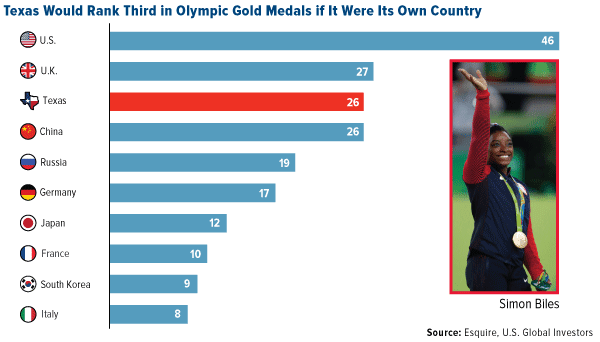

The 2016 Olympics Games in Rio de Janeiro now belongs to history, and by a very wide margin, American competitors walked away with the most medals: 121 altogether. Looking at gold medals, the U.S. still ranked first, with 46 won. But if we took away what Texas collected, the Land of the Free would have fallen to thirdplace, behind the U.K. and China.

Houston was the winningest Texas city. Home to Olympic medalists Simone Biles, Simone Manuel, Kerron Clement and more, H-Town is now 10 gold medals richer.

2. Moneybags

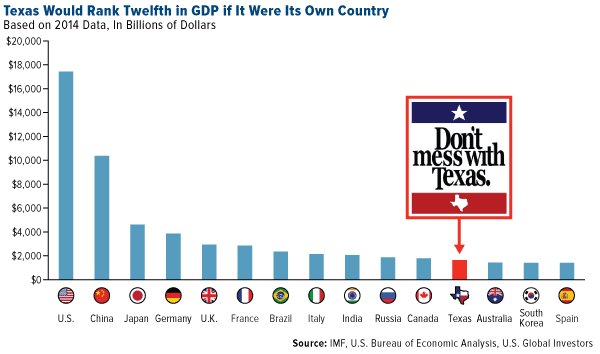

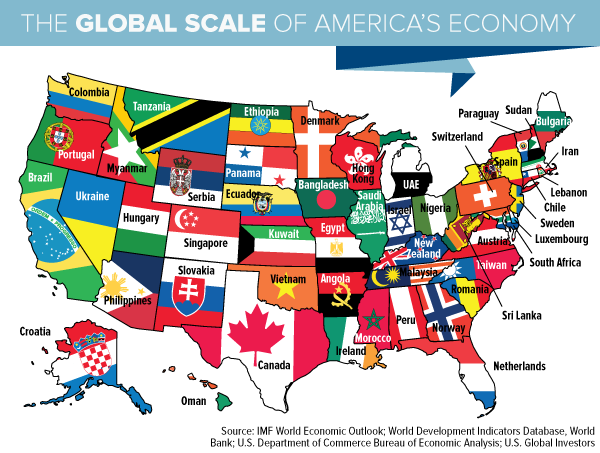

Texas is competitive in more than just Olympic events, of course. The state has the second-largest gross domestic product (GDP) in the Union, following California. If it were its own country, Texas would clock in at number 12 in the world, snuggled in between Canada and Australia.

3. Tex-Can

If Texas were its own nation, in fact, its economy would be about the same size as Canada’s.

4. This Is Oil Country

Another thing Texas has in common with Canada? Black gold. Barrelsful of it.

Last month, Oslo-based Rystad Energy shared a report that shows the U.S. as now having the world’s largest reserve of recoverable oil, with 264 billion barrels in existing fields, unconventional shale and as-yet undiscovered areas. This is the first time such a report has moved the country ahead of both Saudi Arabia and Russia.

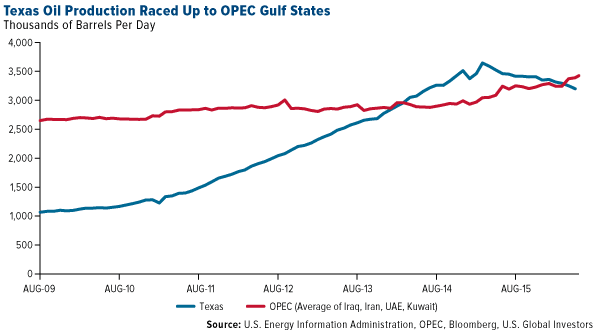

Were it not for the contributions of oil-rich Texas, however, this might not be the case. Thanks in large part to fracking in prolific fields such as the Eagle Ford Formation and Sprayberry Trend, the state leads all others in crude production, annually gushing out more than a third of total U.S. output.

You can see how the fracking boom helped propel the state into the same league as major OPEC nations Iraq, Iran, United Arab Emirates and Kuwait.

5. A Mighty Wind

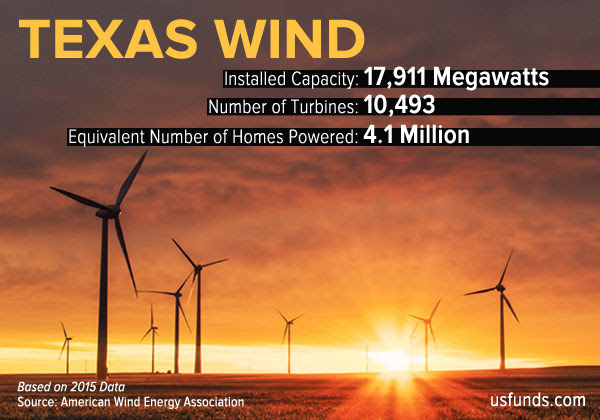

Texas is more than oil, of course. The natural-resource-rich state is also known for its natural gas production (it leads the nation), coal, electricity (again, number one in the States) and renewable energy—specifically, wind energy.

Thanks to Competitive Renewable Energy Zones (CREZ) and $33 billion in invested capital, Texas ranks first in the nation for installed wind capacity and the number of megawatts generated by wind. In 2015, close to 10 percent of the state’s electricity production came from wind, according to the American Wind Energy Association.

With an estimated 17,000 Texans already employed in the state’s wind energy industry, Texas is in the process of installing an additional 5,200 megawatts.

6. Men at Work

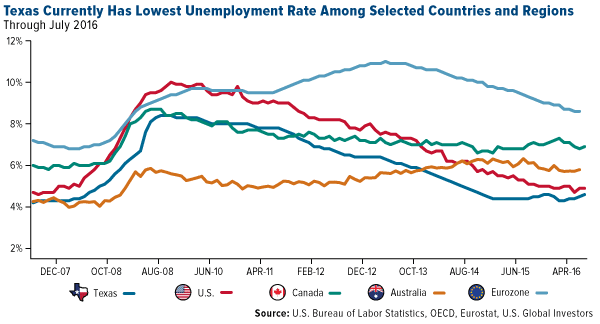

Speaking of employment, that’s something else you can find a lot of in the Lone Star State. The oil industry might have taken a hit from falling crude prices, but the Texas economy has proven resilient. As you can see, the 2007-2008 global financial crisis had much less of an impact on state unemployment rates compared to other major countries and regions such as Canada, Australia, the European Union and United States.

7. All Roads Lead to Texas

Important to keeping business and commerce flowing, as well as helping commuters travel to and from their work, are roads. Texas has them in spades. According to the U.S. Department of Transportation, the state is connected by 313,596 miles of public road, the most of any state. With 18 numbered interstate highways, it also has more interstate miles than any other does.

If it were its own country, Texas would rank 13th by road network size, somewhere between Germany and Sweden.

At only $0.20 per gallon, the Texas gas tax is among the most reasonable in the nation. And because almost that entire amount goes to public transportation—$0.05 is devoted to public education—Texas has some of the best roads in the U.S.

While we’re on the topic of transportation, Texas also boasts the most airports of any state—1,415, according to StateMaster. Two of the four major U.S. carriers, American Airlines and Southwest Airlines, are headquartered in the Lone Star State.

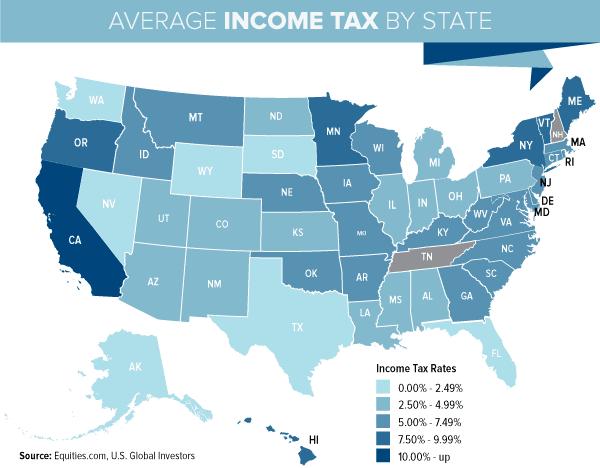

8. No Income Tax

There are only seven states without an income tax, Texas among them. (Alaska, Florida, Nevada, South Dakota, Washington and Wyoming round out the list.)

Neither does the state impose a corporate income tax, and last summer, Governor Gregg Abbott approved $4 billion in tax cuts for businesses and homeowners.

9. Gold Star State

Governor Abbott is also reponsible for what will be a first in the United States. More than a year after he signed a law to repatriate $1 billion in Texas gold bullion from the Federal Reserve, construction will soon begin on the Texas Bullion Depository. Such a state-run gold depository doesn’t currently exist anywhere else in the U.S. It’s hoped that it will help turn Texas into a “financial Mecca,” in the words of one state senator.

10. Population Destination

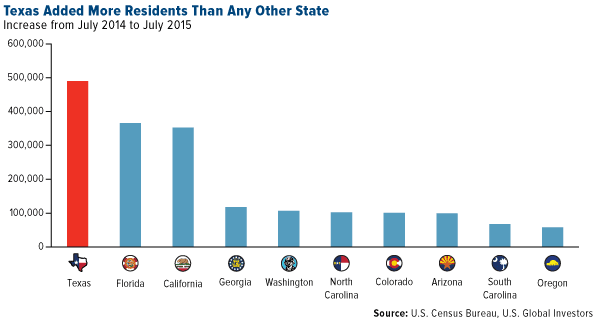

Low taxes are one of the main appeals driving Texas’ rapid population growth. According to the Census Bureau, five of the 11 fastest-growing U.S. cities by population can be found in Texas. Ranking number two in the nation is New Braunfels, a lovely town originally settled by Germans that lies midway between San Antonio and Austin.

Between July 2014 and July 2015, the Lone Star State added 490,036 new residents, the most of any state by a wide margin.

To put this in perspective, the number of new Texas arrivals alone between 2014 and 2015 exceeds the total populations of several countries, including Malta (population: 429,366, as of December 2014), Brunei (411,900, as of July 2014) and Iceland (336,060, as of June 2016).

11. Bet on Tech

It’s not just people moving to Texas, though. Companies are as well—specifically tech companies, and, to get even more granular, Silicon Valley tech companies. The San Francisco Chronicle reports that, in recent years, more than $1 billion in taxable income has flowed from the Bay Area to Texas, as tech firms have sought not just lower taxes but also simpler regulation.

Indeed, the Lone Star State has emerged as a formidable tech hub to rival Silicon Valley. Employing more than 270,000 people, the state’s tech industry supports firms ranging in size from hip Austin startups to massive Fortune 500 companies such as Dell, Texas Instruments and Rackspace Hosting (which just agreed to a $4.3 billion acquisition deal by private equity firm Apollo Global Management).

For the last three years, Texas has led the nation in high-tech exports—everything from semiconductors to communications equipment. Last year, in fact, the state’s total sales amount exceeded California’s by a whopping $6.3 billion.

No wonder so many people are choosing Texas as the place to hang their hat!