Despite policymakers’ best efforts, it looks as if China‘s economy is currently experiencing one of the worst slowdowns in recent memory.

China has already adopted a series of economic stimulus measures, to try and offset some of the impact of US tariffs, including accelerated spending on infrastructure and multiple cuts to bank reserve requirements. However, these measures may be too little too late.

The impact of US tariffs has yet to appear in trade data, but sections of the economy are already showing strain. The government’s manufacturing purchasing managers’ index, a gauge of Chinese factory output, declined to 50.2 in October, that’s the weakest since July 2016, although it still signals expansion.

Q3 hedge fund letters, conference, scoops etc

If you’re looking for value stocks, and exclusive access to value-focused hedge fund managers, check out ValueWalk’s exclusive value newsletter, Hidden Value Stocks.

Elsewhere, a PMI sub-index that tracks new orders fell from 48.0 to 46.9 in October, once again, its lowest level since 2016. Economists widely believe economic indicators will only deteriorate further in the months ahead.

The weakening economy is already putting pressure on the Chinese currency. The renminbi closed at a fresh 10-year low against the dollar on at the end of October.

Can’t stop the slowdown

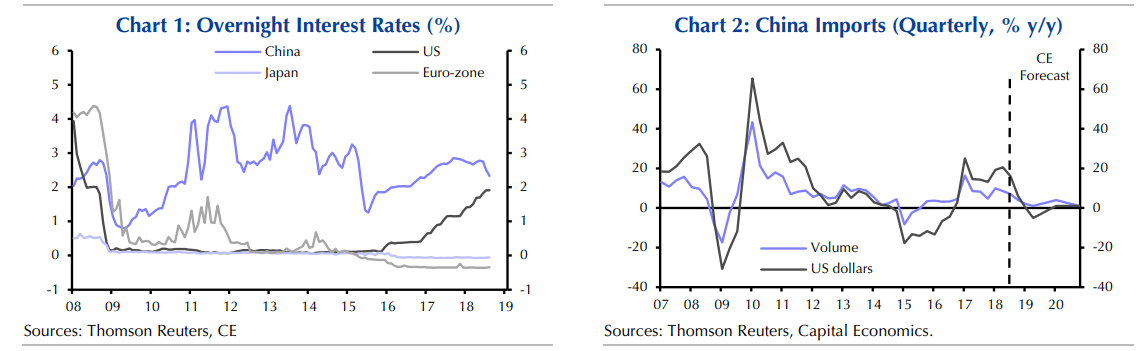

The big unknown is how China’s slowdown will impact the rest of the global economy. Analysts at Capital Economics believe China will pull out all the stops to try and reignite its economic growth, but these efforts will not stop the global economy from slowing next year.

Exclusive access to under the radar value hedge fund managers

Chief Global Economist Andrew Kenningham and team are expecting the country to unleash a fiscal stimulus next year equivalent to around 2% of China’s GDP. While this will be a sizable sum it is “simply not big enough to have a major impact on the world economy.” In fact, they estimate it would have a similar effect to Trump’s $250 billion stimulus, which is around 0.3% of GDP. What’s more, the team at CapEcon believe that Chinese policymakers will concentrate their stimulus efforts on tax cuts, rather than infrastructure investment as they did a decade ago (China’s 2008–2009 stimulus was around 1.5% of world GDP).

All in all, the global economics team believe China’s efforts will be enough to halt, “but not reverse” the country’s economic slowdown, and they will have a limited impact on the rest of the global economy. CapEcon is expecting China’s GDP growth rate to stabilize at 4.5% by mid-2019.

This article first appeared on ValueWalk Premium