Hedge Fund AUM Up $77B In 2015, Doubling 2014 Amount

|

Key highlights for December 2015:

|

2015 did not end with much pomp and circumstance and was a challenging year for managers. Hedge funds ended 2015 on a low note with the Eurekahedge Hedge Fund Index down 0.70% in December, while the MSCI World Index declined 2.23% during the month. Overall for 2015, hedge funds were up 1.45% (their lowest annual return on record since 2011) amid a challenging market environment. Meanwhile underlying markets as represented by the MSCI World Index ended the year in the red, down 0.48%. On the back of ongoing macroeconomic themes, central bank policy has been dominating the news for the year with assurances on achieving the inflation target, yet looking back; the stimulus doled out by central banks worldwide was rather prudent – mildly extending the asset purchase program with its intensity mismatched to that expected by investors such as that in Europe. Disappointing ECB announcement in early December saw several reversals in the equity markets especially i n Europe, making trading conditions somewhat choppy throughout the month – investors have also unwound their German bund holdings, thus seeing a spike in its yield. Losses were also extended throughout European equities as well as in the US and Japan. The long-awaited increase in interest rate in the US finally happened, sending a brief rally in US equity markets before they fell, ending the month in the red. Over in Asia, the equity market in mainland China performed well on the basis of several measures by Chinese regulators to curb the decline of the stock market, however the recovery has been short-lived as the events in early January have shown – the Chinese markets are still not out of the woods.

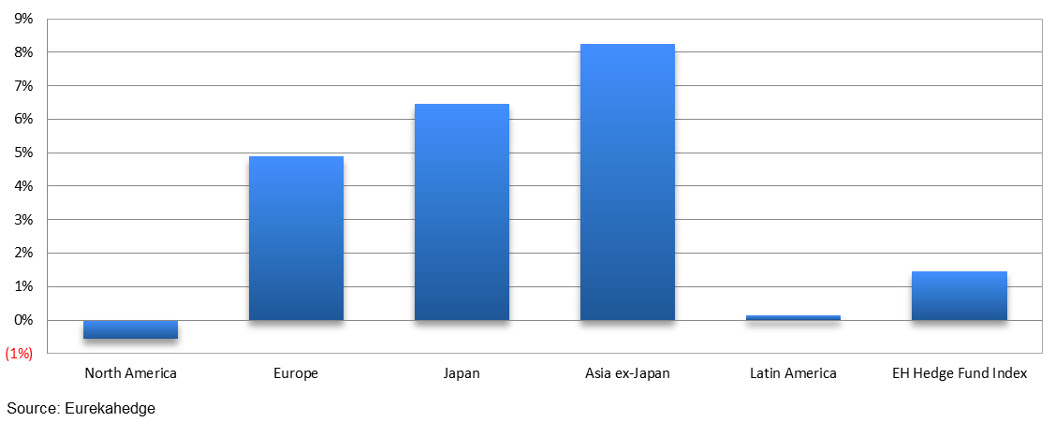

Key trading themes during the month puts a spotlight on currencies, equities and fixed income to which hedge funds saw significant drag on performance. Across regional mandates, Asia ex-Japan hedge funds have also been performing well despite the global market lethargy, with some hedge funds posting gains from arbitraging opportunities present in the Chinese markets. Though Asia ex-Japan hedge funds were up 8.23% year-to-date, on the other hand, the performance of North American hedge funds was rather disappointing – losing 0.55% year-to-date, its worst annual return since 2008. All strategic mandates were down in December with CTA/managed futures hedge funds registering steep declines as hedge funds with exposure to European and North American equity futures as well as the euro/US dollar pair saw heavy losses following what was deemed by the markets as inadequate policy response by the ECB earlier in December.

November and December 2015 returns across regions

The performance of regional mandates was mixed this month with Asia ex-Japan and Japan focused hedge funds leading the table with gains of 1.45% and 0.27% respectively. The performance for European managers was flat in December, while North American and Latin American focused hedge funds fell into negative territory during the month losing 0.94% and 0.56% respectively. Global equity markets performed poorly with the exception of the Mainland China. Losses were registered across all regions except for Mainland China and Australia/New Zealand equity markets. On the back of encouraging data from Australia, hedge funds with an Australia/New Zealand mandates were also one of the better-performing single-country mandated hedge funds for the year. On a year-to-date basis, gains made earlier in 2015 saw Asia ex Japan managers leading the tables, up 8.23% followed by Japanese and European managers up 6.47% and 4.89% respectively. Latin American hedge fund managers, whi le also in positive territory, had to contend with a year-to-date gains of 0.14% while North American managers languished with losses of 0.55% over the same period, also the region’s worst performing annual return since 2008.

2015 year-to-date returns across regions

Mizuho-Eurekahedge Asset Weighted Index

The asset weighted Mizuho-Eurekahedge Index gained 0.11% in December. It should also be noted that the Mizuho-Eurekahedge Index is US dollar dominated, and during months of strong US dollar gains, the index results include the currency conversion loss for funds that are denominated in other currencies. The US Dollar Index declined 1.54% in December.

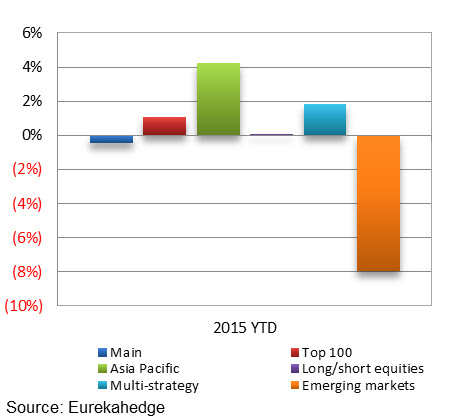

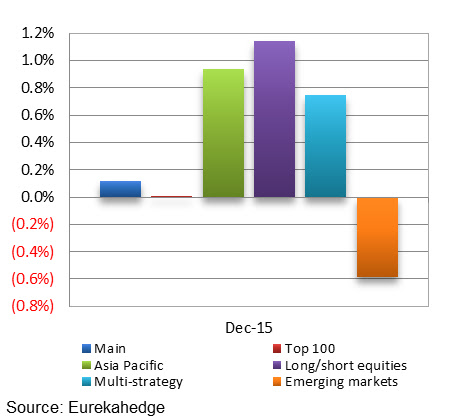

Performance was mixed across the board among the suite of Mizuho-Eurekahedge Indices; the Mizuho-Eurekahedge Long Short Equities Index led the table during the month with gains of 1.14%, followed by the Mizuho-Eurekahedge Asia Pacific Index with gains of 0.94% over the same period. On a year-to-date basis, the Mizuho-Eurekahedge Asia Pacific Index gained 4.22% followed by the Mizuho-Eurekahedge Multi-Strategy Index which was up 1.81%. The Mizuho-Eurekahedge Emerging Market Index however, performed the worst with losses of 7.92%. The USD Index has gained 9.26% on a year-to-date basis.

|

Mizuho-Eurekahedge Indices  |

Mizuho-Eurekahedge Indices |

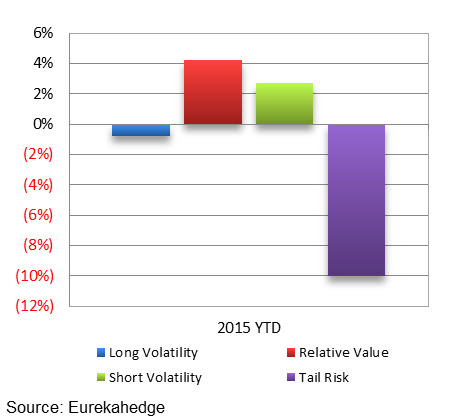

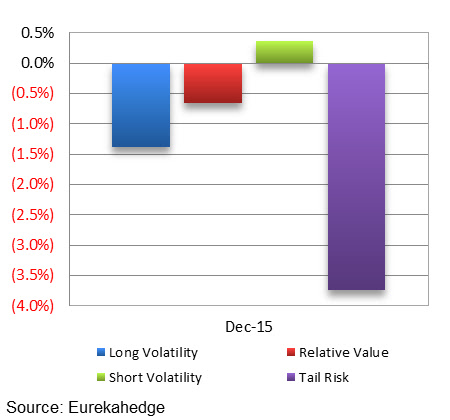

CBOE Eurekahedge Volatility Indexes

The CBOE Eurekahedge Volatility Indexes comprises four equally-weighted volatility indices – long volatility, short volatility, relative value and tail risk. The CBOE Eurekahedge Long Volatility Index is designed to track the performance of underlying hedge fund managers who take a net long view on implied volatility with a goal of positive absolute return. In contrast, the CBOE Eurekahedge Short Volatility Index tracks the performance of underlying hedge fund managers who take a net short view on implied volatility with a goal of positive absolute return. This strategy often involves the selling of options to take advantage of the discrepancies in current implied volatility versus expectations of subsequent implied or realised volatility. The CBOE Eurekahedge Relative Value Volatility Index on the other hand measures the performance of underlying hedge fund managers that trade relative value or opportunistic volatility strategies. Managers utilising this strategy can pursue long, short or neutral views on volatility with a goal of positive absolute return. Meanwhile, the CBOE Eurekahedge Tail Risk Index tracks the performance of underlying hedge fund managers that specifically seek to achieve capital appreciation during periods of extreme market stress.

During the month of December, the CBOE Eurekahedge Short Volatility Index led the tables with gains of 0.36% during the month. The CBOE Eurekahedge Tail Risk Volatility Index declined 3.75% while the CBOE Eurekahedge Long Volatility Index and the CBOE Eurekahedge Relative Value Volatility Index lost 1.38% and 0.66% respectively. On a year-to-date basis, the CBOE Eurekahedge Relative Value Volatility Index is up 4.26% followed by the CBOE Eurekahedge Short Volatility Index which has gained 2.72%. The CBOE Eurekahedge Long Volatility Index dipped 0.80% on a year-to-date basis while the CBOE Eurekahedge Tail Risk Volatility Index posted year-to-date losses of 10.00%.

|

CBOE Eurekahedge Volatility Indexes  |

CBOE Eurekahedge Volatility Indexes |

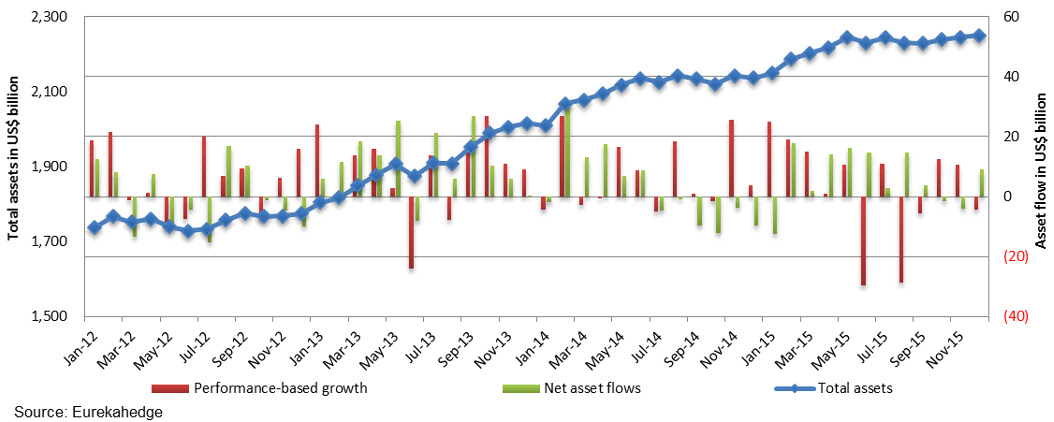

Summary monthly asset flow data since January 2012