Earlier this week, we wrote a story titled Apple’s Original Investors Are Now Among the 1%. As the headline suggests, we discussed stories of people who were early investors in what is now America’s largest company by market capitalization. Many regular people became millionaries due to this one investment.

We were contacted by a reader who wanted to tell his story. He wanted to remain anonymous, but we verified his details. The man was a Peace officer with an average income, who now is worth $6 million, due entirely to Apple Inc. (NASDAQ:AAPL) investment. We also asked some questions about why he decided to invest in Apple:

For the next 10 years, in CALPERS, nothing much happened. Either up or down, a total of $2000/ year. Basically, not much happened. When I was 50, a new plan was available, if we chose to contribute. It was called a PCRA (Personal Choice Retirement Account). I got in on the Dot Com thing, and staying only in mutual funds, rode it up ($933,000), and rode it down ($110,000 at the end). Each time I made a mistake, like riding the market down, I made a mental note to not make that particular mistake again. Keep this in mind for later…. early December, 2008, at the end of the worst financial year the World has known in my lifetime.

At the beginning of 2003, when I had hit my $110,000 bottom, it was an early day in January 2003. So, I searched to find the 10 best stocks from 2002. Chinese company Net Ease, NTES, was one of them. 15 minutes after my due diligence, putting most of the money into it, a young friend called to tell me about another company, which I began tracking, until mid-October. By that time, NTES had tripled, and this other company was the only one to keep pace with it. One day, the Chinese government cracked down on NTES, it dropped from a triple to a double, and I immediately got out. Foreign country, couldn’t trust it, and put everything into the other company…..Taser, TASR. I loaded up, and over the next 13 1/2 months it went from $200,000m through three splits, to $2.2 million. I’d been dragging my feet for a couple of months, about putting a protective stop on it. I’d never done that before. Finally put in the stop, January, 2005, and the next morning, the bottom dropped out. (Sheer coincidence or Act of God.) Bear in mind, I’d been watching it now, practically every day, for two years. I had accumulated 101,663 shares for myself, and 10,000 shares for my daughter.

I’d dodged a bullet, and my legs literally were shaking. (By this time, I hadbecome the single parent of my daughter, who was given to me in 1987). So, I was investing for her and for me. What I am in, she’s in, too. I decided to see what looked really interesting, and after a couple of days, looking at a handful of companies any way I could think of, I decided on good old Apple.

During this time, I’d talked other officers into getting into the Personal Choice accounts, and they got into Apple. In ’08, Apple went from about $198.50 a share in December, to a low of about $79.35 late November, ’08. I was losing about 200k a day for weeks at a time. Remembering way back to the Dot Com days, I sold everything I had, because I would not go below $1.5 million. It was like a real life game of Deal or No Deal, with Howie Mandel hosting. I tried a couple of tepid re-entries into Apple, finally thinking it was good to go, on April 9, 2009. Did it for my daughter, for whom there is a Roth IRA and a brokerage account. (She worked at a flower kiosk as a teen, got her first W-2 form. So I matched that, and she now had a Roth IRA. Today she is 31, and her “Apple” Roth IRA is worth $78,275.) As of close of business today, I have accumulated 10,501 shares in my own account, and it’s net worth is $5,963,029.

By this time, I have gotten a number of other officers, perhaps 20, to invest, and I buy Apple for five of them. The others buy Apple for themselves. Over it’s lifetime, Apple has averaged about 24% a year, which means that it doubles every 3 years, according to the Rule of 72. I have dedicated my own account to become a charitable organization for the purpose of contributing to the Navy Seal/Special Warrior Foundation, and to the CHP 11-99 Foundation, which aids the families of Officers killed in the line of duty. I believe in the guidelines espoused in The Millionaire Next Door, by Dr. Tom Stanley: Live below your means, re-invest your money, and do good deeds to help others out.

Here are two of the officers I’ve been helping. The first officer put $60,000, at my suggestion, into Apple in late 2007. He held on through the bad times, and his account now is about $305,000. The second officer has basically no knowledge about computers or investing. She just happens to be a really good person. We started off small, in mid-2009. I only put in a couple thousand of her money in her PCRA, (Always start off small.) which I had convinced her to start, and it went into Apple. In October, 2009, I called her up, and told her she ought to be happy. She said, “No, you only put a little teeny bit in. I trust you, so do what you have to do.” So, I put in $148,000 into Apple in October, 2009. Admittedly, she does her part, and takes out of her pay check a good amount each month. But, I put it all into Apple (tried a couple other companies in small amounts, but I just couldn’t trust them.) Today, her account is worth $347,000 and change. And it’s all Apple.

Apple has averaged around 41% for the last four years, about 46% in the 11 weeks of this year, and basically has blown out earnings for the last 10 years, even when the media said that two quarters ago it was a “miss” (Sure, only the second largest earnings in company history to that point. That’s a “miss”?)

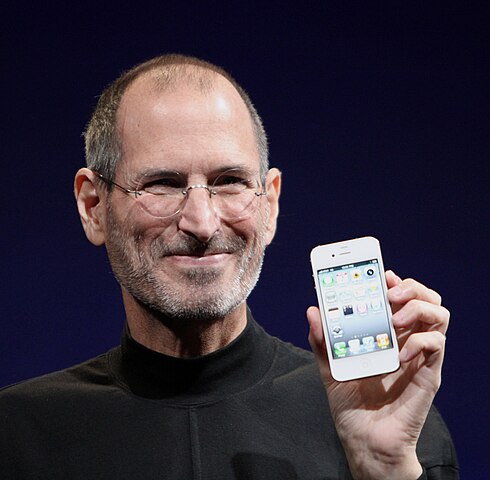

So, Apple now has a dividend, bringing in value investors, schools are beginning to download school books on the New iPad, the G5 iPhone is waiting in the wings, China is barely scratched, and there are at least nine other new countries Apple is just getting into. There’s the imminent iTV big screen, and everything will have Siri verbal communications by the end of the year. Billions will now be coming in from value investors, whose mutual funds are now allowed to buy Apple for the first time, because of the dividend. Tim Cook has shown his skills in being the acting and then the official CEO. Jony Ive is the best industrial designer around, and was knighted by Queen Elizabeth. And Exon Mobile has fallen to a distant second. I could go on and on, so I ask the simple question: What’s not to like about Apple. Even the people I help….. well, I charge them zero. Nada. We’re not looking for “stuff”. We’re looking for financial security on a personal level, and for our families, since the federal government doesn’t seem to be doing so well of late.

I do this to honor my father, the computer geek before there were geeks. He seemed gruff, but helped out others without bringing attention to himself. So, now, when I do this, to help others, my Mom and Dad get to watch me, to see if they raised a good kid. They’re both in Heaven, so the view is pretty good.

I do all my own investing, rather than have a broker do it for me. I sit at my old computer, and read the message boards on yahoofinance.com, and check stocks on barchart.com. Both are free. There’s a lot of superfluous junk on the message boards, but occasionally I find a good article, or insight into why something happened that day. (Like recently, when a single block of a million shares was sold….. I figure that was hedge funds trying to manipulate the market, to get in at a lower price.) My plan is to keep 10,000 shares, so the account is self-sustaining. Heck, the dividend alone will be about $110,000 a year, more than I ever made on the job (My first full year, 1974, I was elated to be making $946 a month. Wow!)

My daughter got me a Kindle for Christmas a couple of years ago, I read Steve Jobs, by Walter Isaacson. Really liked the book and it gave me even more insight into the company.

Note: as always this is the rule; however, we want to specifically mention it here due to the nature of this article:

VALUEWALK LLC is a limited liability corporation, based in New Jersey.

Any content on this site is NOT investment, trading, legal, or tax advisers, and none of the information available through this blog is intended to provide tax, legal, investment or trading advice. Nothing provided through these posts whether by the owner or posted by other writers constitutes a solicitation of the purchase or sale of securities/futures. THE DATA AND INFORMATION PRESENTED ON THIS WEB SITE IS BELIEVED TO BE ACCURATE BUT SHOULD NOT BE RELIED UPON BY THE USER FOR ANY PURPOSE. ANY AND ALL LIABILITY FOR THE CONTENT OR ANY OMISSIONS FROM THIS WEB SITE, INCLUDING ANY INACCURACIES, ERRORS, OR MISSTATEMENTS IN SUCH DATA OR INFORMATION IS EXPRESSLY DISCLAIMED.

The author of this article has no position in Apple, Inc.